add

+

INREV Guidelines Introduction

add

+

Introduction to INREV Guidelines

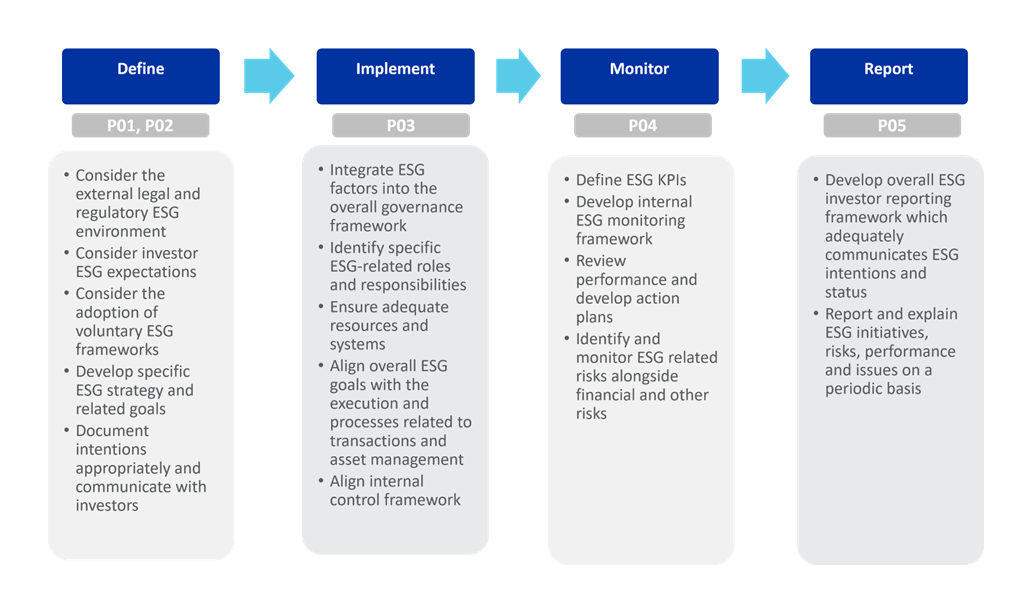

INREV aims to improve transparency and promote best practice and professionalism in the sector. INREV members have encouraged and strongly supported the establishment of industry guidelines over the past few years and developed an integrated set of principles and recommendations including tools and examples and standardised templates for investors and investment managers of non-listed real estate vehicles. The objectives of the INREV Guidelines are:

- to ensure that investors in non-listed real estate vehicles obtain consistent, understandable, easily accessible and reliable information that can be compared across investments and between different periods;

- to establish requirements and best practices within the industry and to help investment managers implement them in practice.

The INREV Guidelines are presented in an online format, allowing visitors to easily navigate and search through and view tailored guidelines for example for open end funds.

It is possible to download a full version of the Guidelines or to create a custom version module by module in a PDF format in our Guidelines section.

The INREV Guidelines are organised into ten modules.

.png)

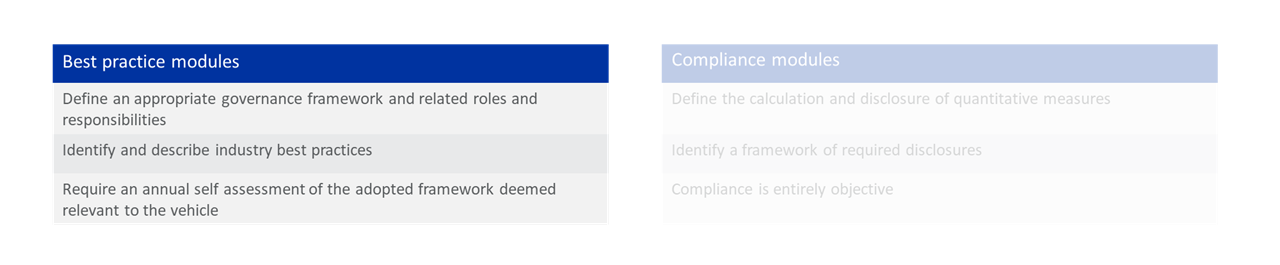

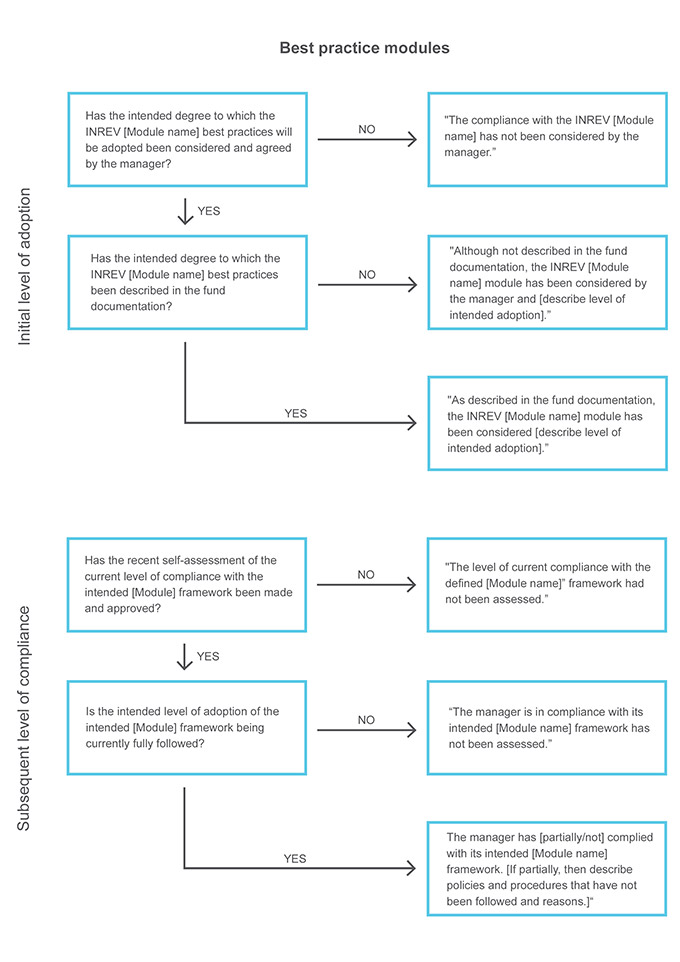

The Guidelines are embedded in an Adoption and Compliance Framework which allows investment managers and investors to evaluate their implementation of the INREV Guidelines, module by module. To determine ways of implementation and add a hierarchy to the guidelines’ requirements and best practices it is important to understand the underlying terminology:

Principles

Principles serve as a basis for the requirements and best practices.

Best practices

Best practices have been developed by INREV to enable investors and investment managers to design vehicle products with an effective governance framework aligned with industry best practices and relevant to their specific needs. Investment managers should evaluate themselves, using the self assessment tool against such best practice frameworks and disclose their level of adoption.

Standardised templates

The Due Diligence Questionnaires (DDQs) and the Standard Data Delivery Sheet (SDDS) are standardised templates that complement the INREV Guidelines but they are not part of its formal structure. These are used for information exchange between industry participants.

Tools and Examples

Tools and examples are meant to assist in the application of the INREV Guidelines. Tools support market participants in assessing specific situations and in complying efficiently with the INREV Guidelines. Examples serve as a pattern to be followed by market participants to illustrate a certain standard.

Definitions

INREV definitions (‘Global Definitions’) were developed to achieve consistency of meaning and terminology within the non-listed real estate industry. Global definitions are being created via the collaboration with the NCREIF PREA Reporting Standards and can be found in the Global Definitions Database. They are gradually replacing the INREV Definitions.

add

+

Adoption and Compliance Framework

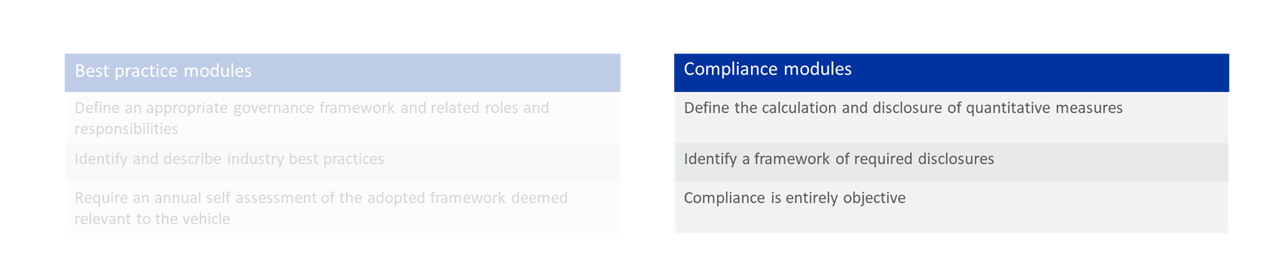

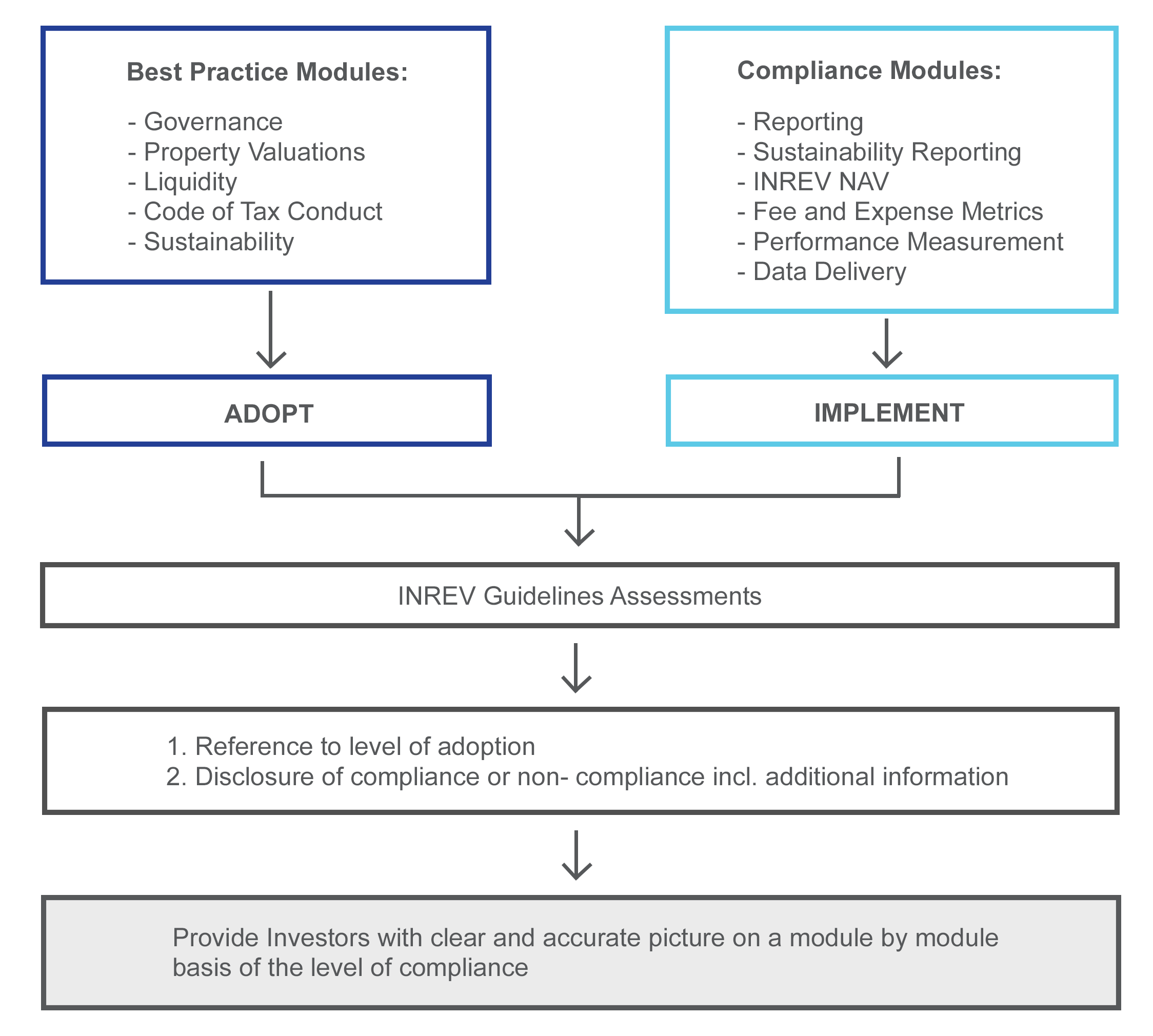

The INREV Guidelines are designed for non-listed real estate vehicles for institutional investors. Since non-listed vehicles can differ considerably, INREV provides a modular approach for investors and managers to agree on an appropriate level of adoption of INREV best practices and in deciding on the level of compliance with INREV requirements for individual modules.

INREV’s best practice frameworks developed for the modules of Governance, Liquidity, Property Valuation, Tax Conduct and Sustainability, are qualitative in nature and individual vehicles will adopt them in different ways. INREV’s objective is to ensure that investors are provided with a clear and accurate description of these modules.

In contrast to best practices, INREV’s requirements in the modules covering Reporting, including Sustainability reporting, Performance Measurement, INREV NAV, Fee and Expense Metrics and INREV Data Delivery, are more technical in nature. These requirements leave no room for different interpretation: the requirements are either followed, or not. Additionally, in the Reporting module, Performance Measurement module and Fee and Expense module, some of the INREV Guidelines are recommendations rather than requirements. Although INREV would encourage members to follow such recommendations, they are not mandatory to claim full compliance with the respective modules.

The INREV Guidelines Assessments have been developed to assess the level of compliance with the INREV Guidelines. If all of the requirements for an individual module are fully implemented, the manager can disclose full compliance with the relevant module. If the requirements of a module are not fully met, the manager should disclose that the vehicle does not fully comply with that module of the INREV Guidelines and state the reasons for deviation including any additional information relevant to investors.

In all cases, investment managers should present investors with a clear and accurate picture of the level of compliance with the INREV Guidelines. The level of adoption and compliance with the INREV Guidelines is a matter to be discussed during the launch process of the vehicle. The vehicle documentation should describe, on a module by module basis, the extent to which the vehicle aims to be in compliance with INREV Guidelines.

INREV does not provide any assurance on the degree of adoption of best practices or on the level of compliance with requirements for individual vehicles.

The legal framework applicable to individual vehicles may require third party assurance on elements of compliance with INREV Guidelines, for instance where the legal NAV of the vehicle is the INREV NAV. We recommend that investors and managers discuss and agree the nature of such assurance as part of the launch process.

The INREV adoption and compliance framework is summarised below. The framework includes references to tools which can be used to assist in the application of the guidelines.

add

+

Best Practice Modules

| COMPLIANCE OBJECTIVE |

SELF-ASSESSMENT PROCESS |

DISCLOSURE | OVERSIGHT AND ASSURANCE |

| Module 1. Governance | |||

| Managers should evaluate the level of adoption of INREV best practices using the Governance INREV Assessment Tool. | Managers and investors should refer to and consider adopting INREV Governance best practices when designing and implementing an oversight framework for a specific vehicle. | Managers should describe in their annual report and vehicle documentation their governance practices and the degree to which they adopt INREV best practices. | Management and non-executive officers should review the adequacy of the description of the governance framework. |

| Module 3. Property valuation | |||

| Managers should follow the valuation best practices when determining the fair value of the property portfolio and prepare required disclosures to investors. | Managers should evaluate the level of adoption of INREV property valuation best practices. | Managers should describe their property valuation policies and the degree to which they have adopted INREV valuation best practices in their annual report and vehicle documentation. | Management and non-executive officers should review the basis and adequacy of disclosure to investors summarising the level of adoption with the property valuation best practices. |

| Module 7. Liquidity | |||

| Managers and investors should refer to and consider adopting INREV liquidity best practices when designing non-listed vehicle products. | Managers should evaluate, using the Liquidity Guidelines Assessment, the level of adoption of INREV liquidity best practices. | Managers should describe their liquidity policies and the degree to which they have adopted INREV best practices in their annual report and vehicle documentation. | Management and non-executive officers should review the basis and adequacy of disclosure to investors summarising the level of adoption with the liquidity best practices. |

| Module 9. Code of Tax Conduct | |||

| Managers should evaluate their level of adoption of Code of Tax Conduct best practices when examining their own tax policies and practices. | Managers and investors should refer to and consider adopting Code of Tax Conduct best practices when designing and implementing an oversight framework for a specific vehicle. | Managers should describe in their annual report and vehicle documentation their practices referred to in the Code of Tax Conduct and the degree to which they adopt INREV best practices. | Management and non-executive officers should review the adequacy of the description of the Code of Tax Conduct framework. |

| Module 10. Sustainability | |||

| Managers should evaluate the level of adoption of INREV best practices using the Sustainability INREV Assessment Tool. | Managers and investors should refer to and consider adopting INREV Sustainability best practices when designing and implementing an oversight framework for a specific vehicle. | Managers should describe in their annual report and vehicle documentation their sustainability practices and the degree to which they adopt INREV best practices. | Management and non-executive officers should review the adequacy of the description of the sustainability framework. |

add

+

Compliance Framework

| COMPLIANCE OBJECTIVE |

SELF-ASSESSMENT PROCESS |

DISCLOSURE | OVERSIGHT AND ASSURANCE |

| Module 2. Reporting | |||

| Managers should make disclosure corresponding to all relevant INREV reporting requirements and recommendations as a component of their annual or interim reports to investors. | Managers should evaluate the level of compliance with INREV requirements and recommendations, using the Reporting Guidelines Assessment. | Managers should include all information corresponding to applicable INREV reporting requirements and recommendations in their annual and interim reports. | Management and non-executive officers should review the adequacy of the compliance disclosure to investors summarising the level of compliance with reporting requirements. Auditors could give negative assurance on the degree to which INREV reporting requirements and recommendations are complied with. |

| 2.1 Sustainability Reporting | |||

| Managers should make disclosure corresponding to all relevant INREV sustainability reporting requirements and recommendations as a component of their annual or interim reports to investors. | Managers should evaluate the level of compliance with INREV requirements and recommendations, using the Reporting Guidelines Assessment. | Managers should include all information corresponding to applicable INREV sustainability reporting requirements and recommendations in their annual and interim reports. | Management and non-executive officers should review the adequacy of the compliance disclosure to investors summarising the level of compliance with sustainability reporting requirements. Auditors could give negative assurance on the degree to which INREV sustainability reporting requirements and recommendations are complied with. |

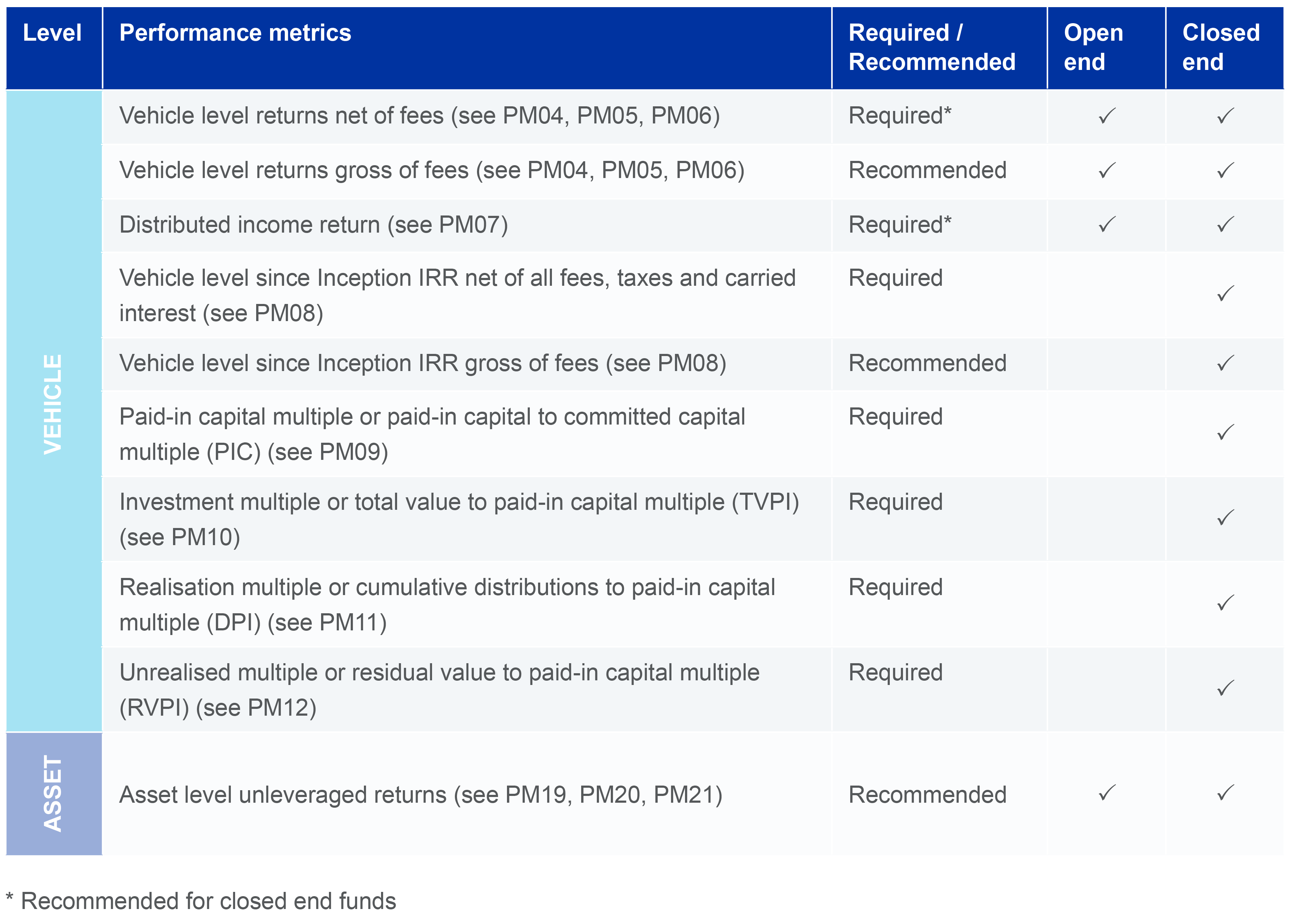

| Module 4. Performance Measurement | |||

| Managers should disclose all relevant INREV performance measures in accordance with performance measurement requirements. | Managers should evaluate the level of compliance with INREV requirements and recommendations. | Managers should include all information corresponding to applicable INREV performance measurement requirements and recommendations in their annual and interim reports. | Management and non-executive officers should review the adequacy of the compliance disclosure to investors summarising the level of compliance with performance measurement requirements. Auditors could give negative assurance on the degree to which INREV performance measurement requirements and recommendations are complied with. |

| Module 5. INREV NAV | |||

| Managers should calculate and disclose an INREV NAV in accordance with INREV requirements. | Managers should evaluate the level of compliance with INREV NAV requirements, using the INREV NAV Guidelines Assessment. | Managers should include the INREV NAV in their annual and interim reports along with required disclosures. Vehicle documentation should include the required information. | Management and non-executive officers should review the basis and adequacy of disclosure to investors summarising the level of compliance with INREV NAV requirements. Depending on circumstances, auditors can give assurance or negative assurance on the INREV NAV and level of compliance with related disclosure requirements. |

| Module 6. Fee and expense metrics | |||

| Managers should calculate and disclose fee and expense metrics in accordance with fee and expense metrics requirements. | Managers should evaluate the level of compliance with INREV fee and expense metrics requirements using the INREV Fee and Expense Metrics Guidelines Assessment. | Managers should include information corresponding to INREV fee and expense metrics requirements in their annual reports and in the vehicle documentation. | Management and non-executive officers should review the basis and adequacy of disclosure to investors summarising the level of compliance with fee and expense metrics requirements. Auditors could give negative assurance on the level of compliance with fee and expense metrics requirements. |

| Module 8. INREV data delivery | |||

| Managers should provide information to INREV in accordance with INREV data delivery requirements. | Managers should evaluate the level of compliance with INREV data delivery requirements. | Managers should provide INREV with all relevant information corresponding to INREV data delivery requirements. | Management and non-executive officers should review the basis and appropriateness of the compliance with INREV data delivery requirement disclosure to INREV. |

add

+

Revision and Change Procedure

Since the launch of the Guidelines, INREV received a growing number of questions and comments from members and non-members regarding their interpretation, adoption and implementation. A document below describes the change procedure for updates to the INREV Guidelines.

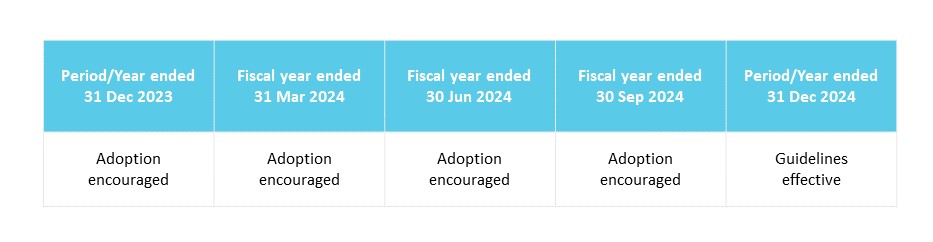

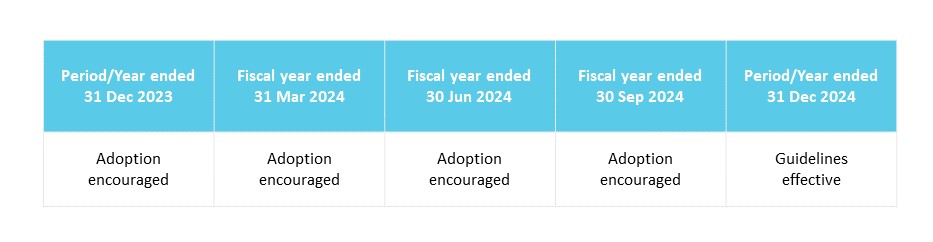

A major revision of the INREV Guidelines was performed during 2021-2022.

Reporting: Update done in January 2023 to reflect the latest developments including regulatory reporting and investor requirements and to align with the updates in other INREV modules INREV Reporting Guidelines Change Log 2023.

Property Valuation: Update done in January 2023 to reflect the latest market practices and regulatory requirements, to enhance the governance and oversight aspects and to ensure further transparency of sustainability inputs in the valuation process INREV Property Valuation Guidelines Change Log 2023.

Sustainability: Added in January 2023.

Governance: Update done in January 2022 to reflect the current functions, organisations and roles within an investment vehicle, in line with the latest regulations in today’s market INREV Governance Guidelines Change Log 2022.

Performance Measurement: Updated done in January 2022 to provide clarifications of the description of assumptions and to enable a more detailed performance analysis INREV Performance Measurement Guidelines Change Log 2022.

Code of Tax Conduct: Added in January 2021

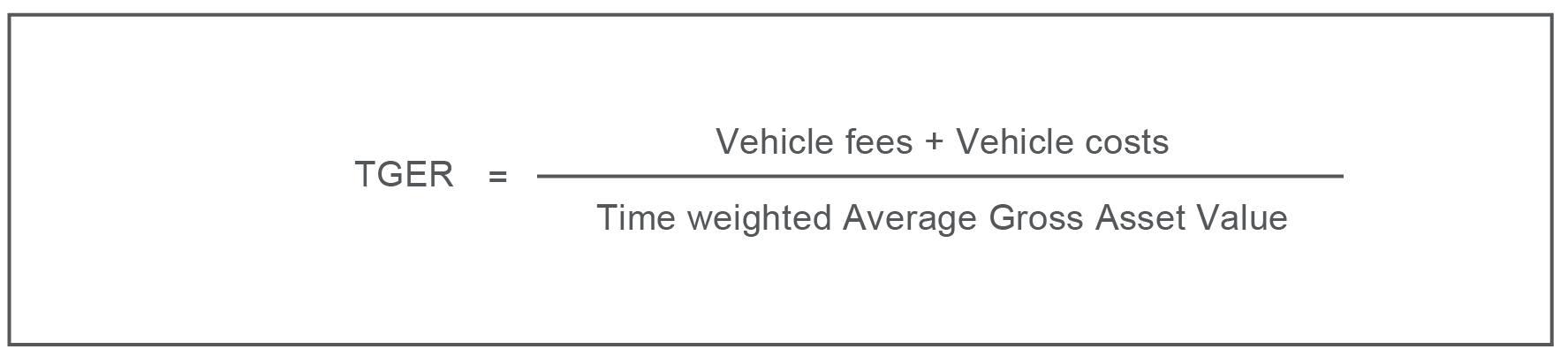

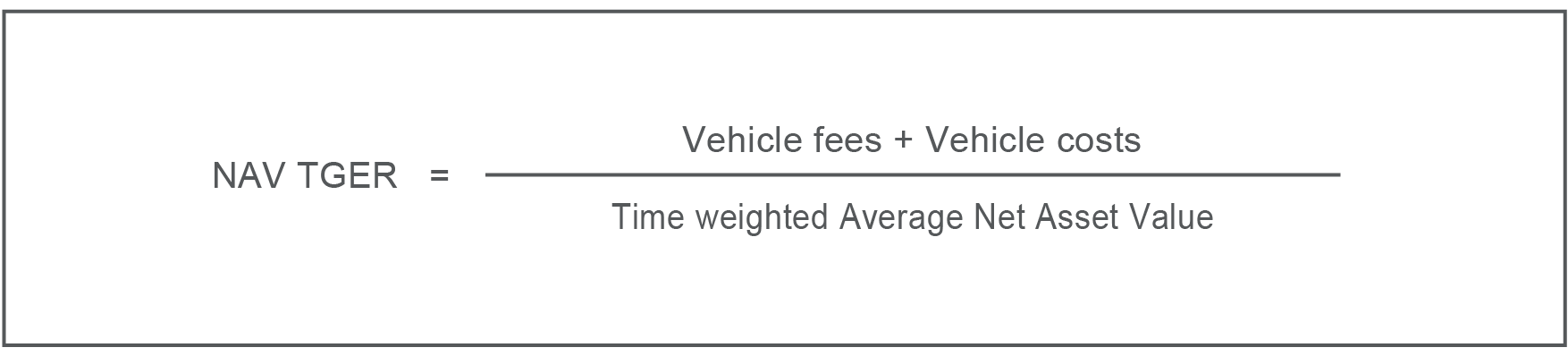

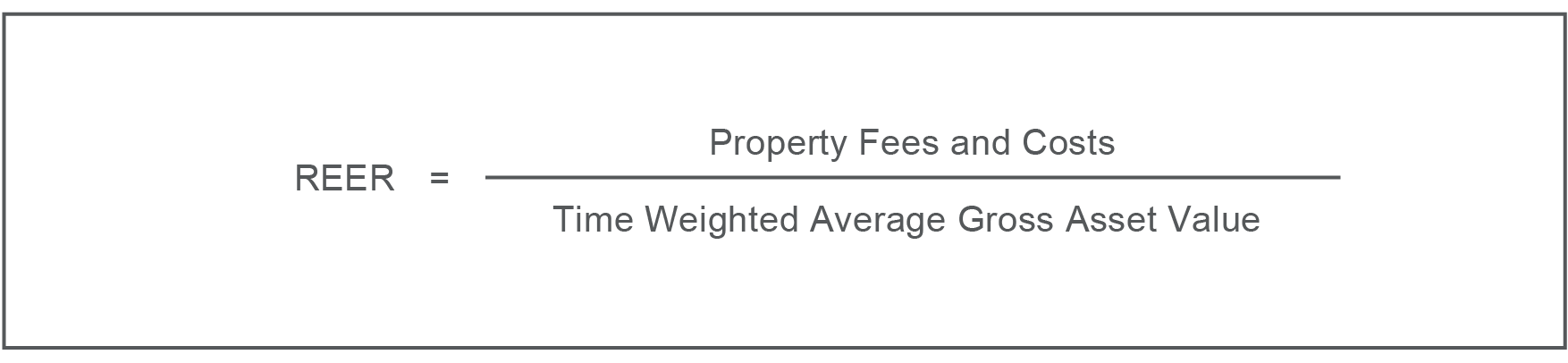

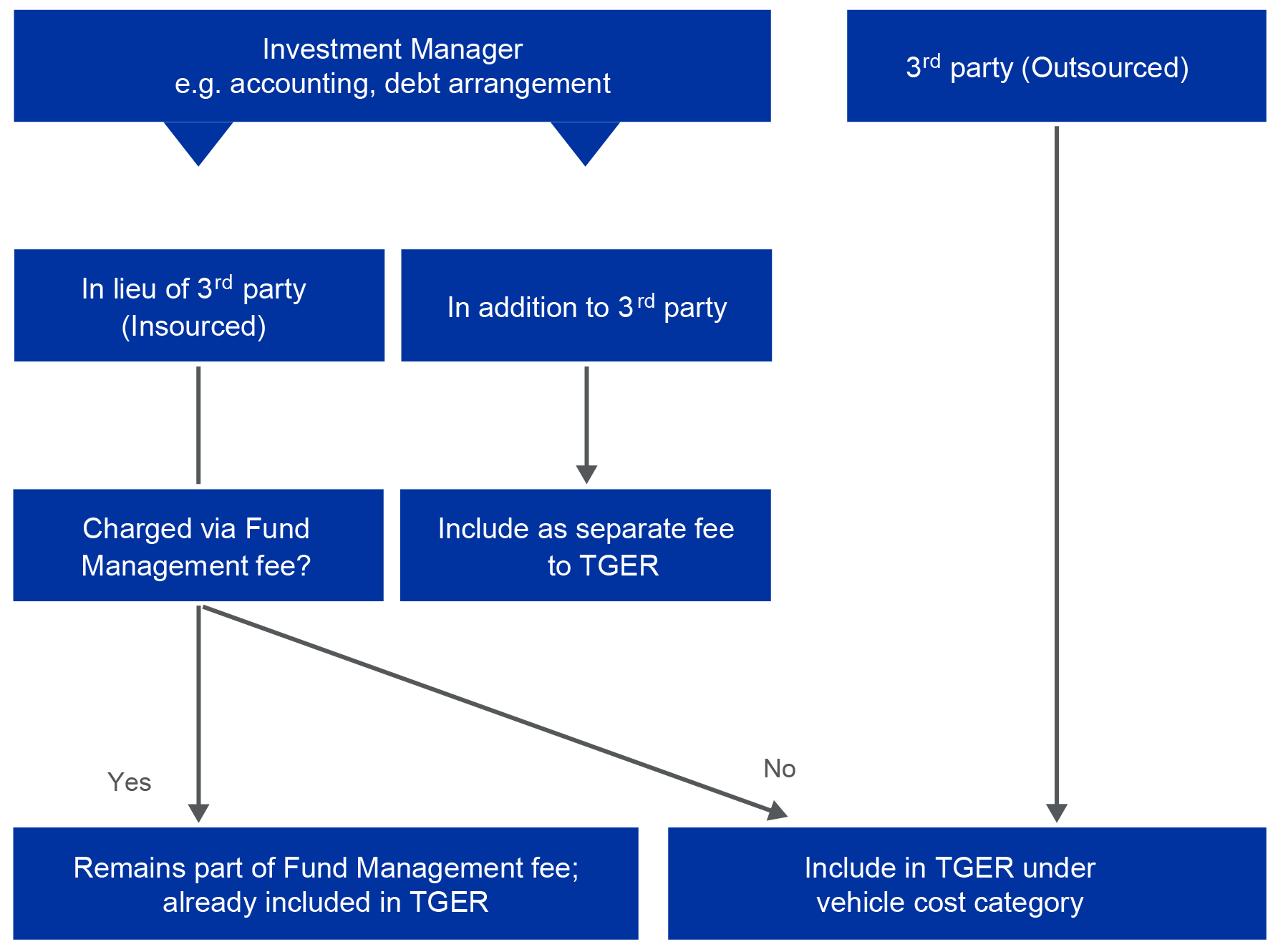

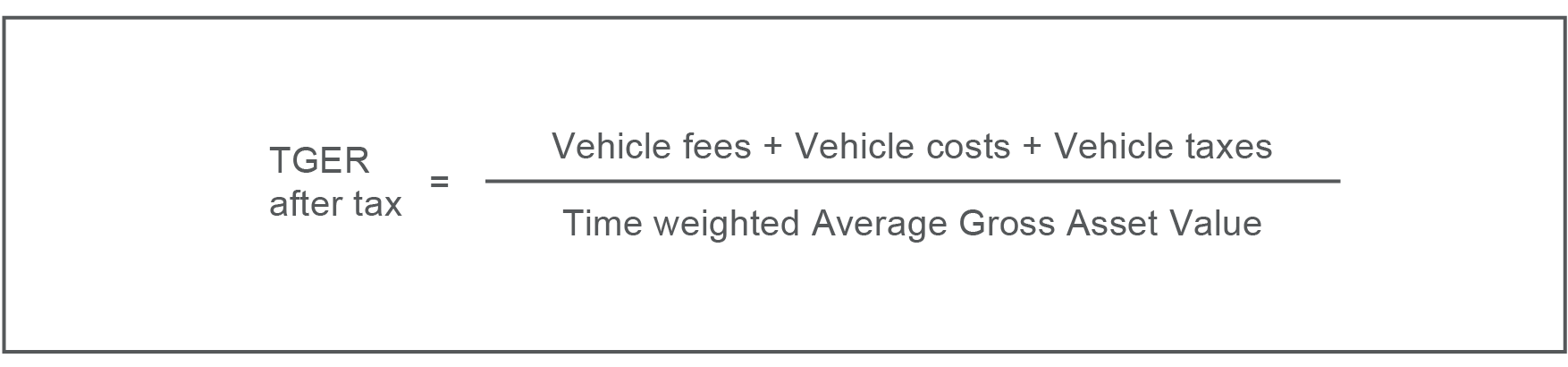

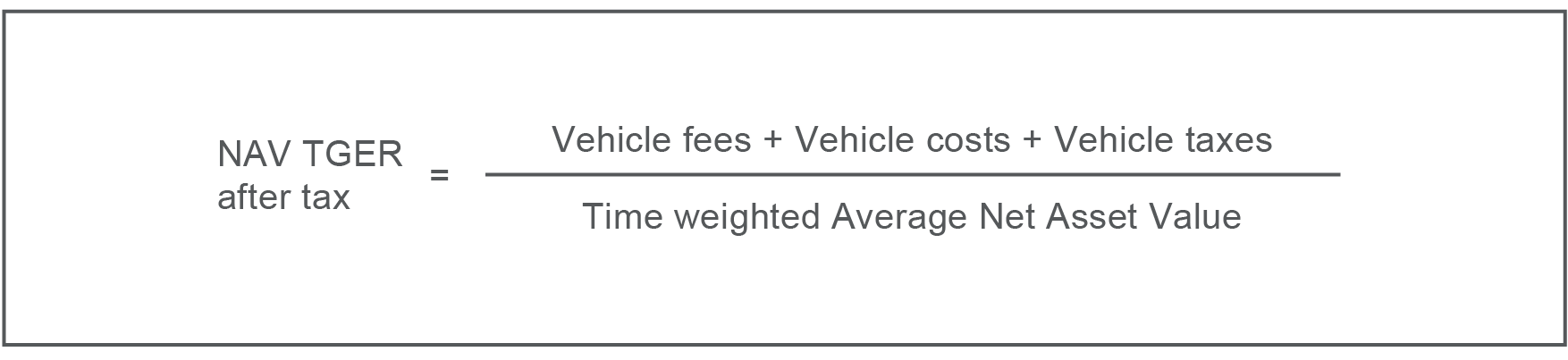

Fee and Expense Metrics: Update done in March 2020 to replace TER by the TGER

add

+

Tools and Examples

Example - Statement of level of adoption of INREV Guidelines

Management has assessed the degree to which the best practices of INREV’s governance, property valuation, liquidity, tax conduct and sustainability frameworks have been adopted and followed by the vehicle. In addition, Management has assessed the level of compliance with INREV’s reporting, sustainability reporting, performance measurement, INREV NAV and fee and expense metrics frameworks. The results of such assessment are summarised below:

| MODULE | GUIDELINES | LEVEL OF ADOPTION OR COMPLIANCE |

|---|---|---|

| 1 | Governance | Although not described in the vehicle documentation, the INREV Governance module has been considered by the manager. The intended framework partially complies with the INREV governance best practices. All best practices have been adopted except for the fact that investors are not able to terminate the contract of the manager without cause. The vehicle formally assessed at the end of the financial year that it is currently following its intended governance framework. |

| 2 | Reporting | Although not detailed in the vehicle documentation, the INREV reporting module has been considered by the manager. The manager has complied with all the requirements of the INREV reporting module. |

| 2.1 | Sustainability Reporting | Although not detailed in the vehicle documentation, the INREV sustainability reporting requirements have been considered by the manager. The results of the INREV Guidelines assessment show that the manager has complied with all the requirements of the INREV sustainability reporting guidelines. |

| 3 | Property valuation | As described in the vehicle documentation, the INREV property valuation framework module has been considered. The manager has defined a valuation framework which fully adopts INREV valuation best practices. The level of current compliance with the defined valuation framework was last formally assessed during the financial year when it was determined that the vehicle was in compliance with all elements of the intended valuation framework. |

| 4 | Performance Measurement |

The manager has disclosed all relevant INREV performance measures in accordance with the requirements of the INREV Performance Measurement module. |

| 5 | INREV NAV | The manager has complied with all the requirements of the INREV NAV module, except for the fact that assumptions used to determine the fair value of deferred taxes are not fully disclosed for confidentiality reasons. |

| 6 | Fee and expense metrics | As described in the vehicle documentation, the INREV fee and expense metrics framework module has been considered The manager has fully complied with the requirements and recommendations of the INREV fee and expense metrics module. |

| 7 | Liquidity | As described in the vehicle documentation, the INREV liquidity framework module has been considered. The manager has defined a liquidity framework which fully adopts INREV liquidity best practices. The manager formally assessed in at the end of the financial year that it currently follows the defined liquidity framework. |

| 8 | INREV data delivery |

The manager is in compliance with the INREV data delivery module. |

| 9 | Code of Tax Conduct | Although not described in the vehicle documentation, the INREV Code of Tax Conduct module has been considered by the manager. The intended framework complies with the INREV Code of Tax Conduct best practices. All best practices have been adopted. The vehicle formally assessed at the end of the financial year that it is currently following its intended Code of Tax Conduct framework. |

| 10 | Sustainability | Although not detailed in the vehicle documentation, the INREV sustainability framework module has been considered by the manager. The intended framework partially complies with the INREV sustainability best practices. All best practices have been adopted except for the fact that the manager has not built a process to manage ESG impact in its supply chain. The manager formally assessed in at the end of the financial year that it currently follows its intended sustainability framework. |

As described in the vehicle documentation the results of the INREV Guidelines Assessments should be disclosed in investor reporting.

Extract "INREV Guidelines Compliance Statement" from results page of the INREV Guidelines Assessments.

Copy + paste the following example statement into your annual and interim reports

INREV Guidelines Compliance Statement - Example purposes only

The European Association for Investors in Non-Listed Real Estate Vehicles (INREV) published the revised INREV Guidelines incorporating industry standards in the fields of Governance, Reporting, Property Valuation, Performance Measurement, INREV NAV, Fees and Expense Metrics, Liquidity and Sustainability. The Assessments follow these guidelines.

INREV provides an Assessment Tool to determine a vehicle's compliance rate with the INREV Guidelines as a whole and its modules in particular.

THE OVERALL INREV GUIDELINES COMPLIANCE RATE OF THE EXAMPLE VEHICLE IS 92.75%, BASED ON 9 OUT OF 9 ASSESSMENTS

The compliance rate for each completed module is:

- Reporting Guidelines is 92.53%, based on 211 / 252 questions applicable.

- Property Valuation Guidelines is 94.35%, based on 48 / 54 questions applicable.

- INREV NAV Guidelines is 97.5%, based on 30 / 42 questions applicable.

- Liquidity Guidelines is 93.67%, based on 31 / 39 questions applicable.

- Sustainability Guidelines is 88.34%, based on 20 / 22 questions applicable.

- Governance Guidelines is 97.44%, based on 84 / 100 questions applicable.

- Fee and Expense Metrics Guidelines is 96.35%, based on 10 / 15 questions applicable.

- Performance Measurement Guidelines is 88.35%, based on 38 / 42 questions applicable.

- Code of Tax Conduct Guidelines is 89.5%, based on 30 / 41 questions applicable.

add

+

Governance

add

+

Introduction Governance

What has changed?

The updated module reflects the current functions and processes within an investment vehicle, in line with the latest regulations in today’s market. It includes clarifications of the roles and responsibilities with an emphasis on the investment manager of the vehicle. The key principles and concepts from the previous version have been retained. In addition, the module introduces a new Sustainability principle and guidelines reflecting the responsibility towards the environment, society and other stakeholders, and incorporates a set of Open end fund pricing best practices.

Effective date

The module is effective for reporting periods ending on or after 31 December 2022.

How do you comply?

The Governance module is a best practice module:

Read more at inrev-guidelines#inrev-guidelines">INREV Adoption and Compliance Framework.

Good governance is a cornerstone of the success of non-listed real estate vehicles. As well as defining and allocating responsibility for key decisions, good governance impacts the structure, processes, and policies that determine how a vehicle is managed and controlled. Governance frameworks work alongside and are complementary to the external legal and regulatory environment at both international and national levels. For instance, the EU’s Alternative Investment Fund Directive (AIFMD) has a significant impact in shaping the structure of management companies and their relationship with the investment vehicles they manage.

INREV's objective is to promote sound governance and to ensure that investors understand and trust the governance frameworks of the non-listed vehicles in which they invest.

The Governance module comprises both Principles and Guidelines. The Principles set out overarching objectives and obligations and are universally applicable for all participants in a vehicle. The Guidelines, which reflect best practices in the industry, provide a practical framework and set forth actionable steps to align with the meaning of the Principles.

The Guidelines provide general best practices which are applicable in most circumstances to the design, operation, and ongoing management of a vehicle. They include various specific components and examples, which guide the user as to how the Principles should be implemented in practice. The Guidelines are illustrative and should not be considered exhaustive.

At vehicle launch, the governing body of the vehicle, in collaboration with the investment manager manager and investors, should design an intended governance framework that is adapted to the respective vehicle structure and style. As part of this process, the principles and best practice guidelines included in this module should be evaluated and adopted to the extent relevant to the vehicle and referred to in the constitutional documents as appropriate.

The governing body of the vehicle, in collaboration with the investment manager, should thereafter, periodically, perform a self-assessment against the intended governance framework and take actions as appropriate. The level of adoption of the best practice guidelines and the annual score representing implementation effectiveness should be disclosed to investors in the annual report. This process is facilitated by using INREV’s self-assessment tool, the use of which is described in more detail in the Adoption and Compliance Framework of the INREV Guidelines.

How should this module be applied?

Investment managers and the vehicles they manage are diverse in nature. They represent a wide variety of forms in terms of structure, operating models, size and complexity. Since most vehicles are managed and/or advised by an investment manager, as a practical matter, many of the governance responsibilities of the governing body of the vehicle are executed through the appointment, supervision, and oversight of the investment manager. As a consequence, many of the detailed guidelines focus on the conduct of the investment manager.

The role of independent non-executive directors, investor representatives which may form various investor advisory committees, and other parties involved in the operation of the vehicle, including investors and service providers, are also considered as part of this module. See Tools and Examples section for more information on the roles of parties involved in vehicle governance.

The diversity of investment models, risk profiles, vehicle sizes, and the different roles played by third parties mean that it would be inappropriate to be overly prescriptive when defining governance guidelines of an investment vehicle. Our objective is to provide a generic framework, which can be applied to the various types of vehicles that make up the non-listed investment universe. At the same time, specific considerations for open end and closed end vehicles as well as joint ventures and club deals, have been included.

add

+

Principles

Act lawfully and ethically

All parties involved in the operation of a vehicle should strive to meet the highest professional standards of ethics and integrity whilst complying with applicable laws. Acting ethically goes well beyond mere compliance with the law and written contracts.

Investment managers operate under a duty of care and should act ethically and with integrity towards investors and other stakeholders. Respect for the law and compliance with constitutional terms of the vehicle provide a basic framework against which the vehicle should operate. Acting ethically entails the investment manager, the governing body of the vehicle, and the other relevant actors understanding and adapting how they conduct themselves to ensure the achievement of desired long-term outcomes.

Act in the best interest of investors and consider other stakeholders

The investment manager should, in its actions, seek to maximise value for investors. Investors should clearly and actively express their expectations of the investment manager so that they can be duly considered and aligned.

The investment manager should also consider the interests of other stakeholders who transact and interact with the vehicle, such as tenants, lenders, and regulators. In addition, there are other categories of stakeholders related to the broader external environment and society that are covered under principle 7.

Identifying and understanding the interests of stakeholders will vary from vehicle to vehicle.

In its actions, the investment manager should constantly strive to achieve alignment of interests with investors, while avoiding conflicts of interest that cannot be effectively managed. Alignment of interests between the investment manager and stakeholders creates shared values, expectations, and objectives and ensures commitment to a common purpose.

When establishing an investment vehicle, main goals such as portfolio strategy, investment horizons, and risk appetite should be clearly identified and understood by all parties. Methods of alignment that are specific to the vehicle structure, such as co-investment, performance and management fee models, as well as protocols around investor consultation and decision-making, should also be considered and implemented. Effective alignment ensures that risks and rewards are appropriately allocated between investors, the investment manager, and other parties, and that investors are treated fairly as a result.

The investment manager has a general duty to act reasonably, fairly, and transparently when balancing the interests of investors. As a general rule, while taking account of the interests of each individual investor, the investment manager should, as a priority, consider the impact of any decision on the interests of all investors collectively. The application of this principle requires judgment and has an ethical dimension as it could have an adverse impact on a minority of investors.

In considering the interests of investors and other stakeholders, the investment manager should take a long-term view regardless of the investment strategy, which may vary considerably from vehicle to vehicle. The culture, strategy, and operational approach of the investment manager should support appropriate long-term outcomes.

Act with skill, care, and diligence

The investment manager should ensure that its activities related to investment vehicles are conducted prudently with diligence and care. It should also ensure that all parties involved, including its own personnel, the members of the governing body, and related service providers, behave with the highest standards of conduct and professionalism.

The investment manager should possess adequate knowledge, skills, and experience. It should constantly strive to apply best practices in arranging and supervising the business operations of the vehicle.

The investment manager should effectively engage with the governing body of the vehicle to enable it to effectively monitor its activities related to the vehicle. Acting with skill, care and diligence also means that the investment manager should refrain from engaging in any activity where it does not have or cannot secure the required expertise or capacity.

Design and operate an adequate oversight and control framework

The investment manager, in collaboration with the governing body of the vehicle, should design and operate an effective supervisory, decision-making, and control framework that adequately addresses the specific risks related to an investment vehicle. Such a framework, which extends to key service providers, needs the involvement of sufficiently qualified persons, who should possess the necessary skills and knowledge. In addition, the rights, obligations, and representation of investors, including their role in decision-making, should be clearly defined in the constitutional documents of the vehicle and respected.

Be transparent while respecting confidentiality considerations

The investment manager should be transparent and disclose information on a timely basis that is accurate, balanced, and clear. The investment manager should not only disclose information when there is a legal obligation to do so, such as when it is defined in the constitutional documents of the vehicle but should also proactively communicate and engage with investors and certain key stakeholders where the matter or information is considered relevant. At the same time, certain information regarding the vehicle and its investors that is not publicly available should be treated confidentially.

Be accountable

The investment manager, together with the governing body of the vehicle and other related service providers, should be accountable to investors for the execution of their responsibilities given their roles and functions. This implies a duty of care, acceptance of scrutiny, and a reasonable level of liability.

Be sustainable: Evaluate and manage sustainability impacts

The investment manager should consider the sustainability aspects, including impacts and risks of the vehicle resulting from its investment or other related activities. An appropriate strategy should be developed to support the management of environmental and social impacts and aspects. This sustainability strategy should be an integral component of the vehicle’s overall strategy. The investment manager should consider abstaining from making investments related to the vehicle that, on balance, are likely to adversely affect desired sustainable outcomes.

add

+

Guidelines

add

+

G-P01 Act lawfully and ethically

The investment manager should ensure that the vehicle complies with applicable laws and regulations.

Vehicles must comply with applicable laws and regulations. The investment manager should comply with, and act in the spirit of, (i) the applicable laws and regulations and (ii) the constitutional documents of the vehicle. The investment manager should have appropriate systems in place to monitor compliance with them.

The investment manager should behave with integrity, trustworthiness and abstain from participating in unlawful transactions.

When entering into contractual arrangements, including the drafting and implementation of the constitutional documents of the vehicle, the investment manager should ensure that outcomes intended by the investors are protected. Documentation should be clear, comprehensible and not misleading.

The investment manager should identify and formally document its core values and principles.

The core values, principles and code of ethics of the investment manager concerning how it acts toward the vehicle should be documented and communicated to investors and stakeholders. The governing body of the vehicle should oversee adherence to these values and principles. The investment manager should promote such values and principles on an ongoing basis and establish appropriate systems to enable individuals to report unethical behaviour. These systems should be designed to ensure any whistle-blower can act anonymously and without fear of reprisal.

The investment manager should develop and implement a sustainable taxation policy.

An investment vehicle should follow a tax policy in relation to its structure and day-to-day transactions. The investment manager should operate an appropriate tax management framework and, together with the governing body of the vehicle, oversee the development of an effective application of tax structures, operations and compliance frameworks. Reference is made to the INREV recommendations and best practices regarding tax related matters included in Code of Tax Conduct module.

add

+

G-P02 Act in the best interests of investors and consider other stakeholders

The investment manager should act in the best interests of both existing and new investors that have committed undrawn capital.

When making investment decisions, the investment manager should not pursue transactions which merely optimise its own outcomes, for example through enhanced management or performance fees, but should consider the best interests and reasonable expectations of both existing and committed investors.

The constitutional documents of the vehicle should also clearly state how the interests of those investors who have committed capital but whose capital is undrawn are fairly treated.

The investment manager should set out in the constitutional documents of the vehicle the terms by which equity (or debt investments) is issued, transferred and redeemed, to ensure fair treatment of investors.

The investment manager should clearly state in the constitutional documents of the vehicle how equity (or debt investment) is issued and redeemed. In the case of closed end vehicles, the issue of equity (or debt investment) is likely to be through one initial or multiple closings where a number of investors subscribe at the same time, with distributions occurring towards the end of the vehicle’s life, as it sells its assets and winds down. Investors may have the ability to sell their investment on the secondary market but would not normally be expected to do so. The investment manager should clearly articulate the role that it provides in respect of secondary transfers, including any fees charged or interaction with third party trading platforms or placement agents.

In the case of open end vehicles, the process of issue and redemption of equity (or debt investment) would be on a periodic basis. This may be annually, quarterly, monthly or daily. The method of valuation of the equity (or debt investment) should be clearly set out, including the underlying valuation and accounting principles applied (see G09 for open end fund pricing best practices).

Read more at inrev-guidelines">Liquidity Module.

The investment manager should consider the legitimate interests of other stakeholders alongside those of investors.

When establishing a new vehicle, the investment manager should identify and understand the interests of all major stakeholders with which the vehicle transacts and interacts. These interests should be reflected in the objectives and operations of the vehicle. The investment manager should regularly evaluate relevant outcomes and communicate to investors and other stakeholders as appropriate. In addition to the investors, the following parties may, amongst others, be regarded as stakeholders:

- Employees;

- Customers and tenants;

- Lenders;

- Regulators;

- Suppliers;

- The business communities in which the investment manager and investors operate.

In addition, there are other types of stakeholders related to broader and social impacts which are considered under Principle 7.

The governing body should scrutinise any proposed changes to the vehicle, acting in the interests of all investors.

The governing body of the vehicle has a specific duty to ensure the interests of all investors are properly considered and advise on whether any proposed changes to the vehicle structure, strategy or constitution are in the best interests of all investors. The role of independent non-executive directors is particularly relevant in this context. For instance, their analysis of the merits of any proposed changes to constitutional documents or other material transactions should be supported by any reasonable resources at the expense of the vehicle, to enable them to properly fulfil this role.

Members of the governing body of the vehicle, including any independent non-executive directors, should have (i) adequate veto and approval rights on all important governance matters, (ii) access to sufficient high-quality information to make informed decisions, (see also Principle 6), (iii) the ability to convene meetings.

For open end real estate vehicles, the investment manager, together with the governing body of the vehicle, should ensure effective design, operation and governance of pricing that represents the best interests of investors.

Allocating transaction costs between different vintages of investors in open end real estate vehicles and protecting existing investors against dilution is a complex matter, subject to different circumstances and events. The investment manager should adopt a set of pricing governance best practices to drive increased transparency and to ensure pricing policies are operated effectively in the interests of investors.

Read more at fund-pricing">Open end fund pricing best practice.

The investment manager should ensure that the vehicle, through rights established in its constitutional documents, can react in a timely and appropriate way to external circumstances and significant events.

Exceptional external circumstances and significant events within the lifecycle of a vehicle should be anticipated and considered in the vehicle’s design and constitutional documents. These include exceptional economic or environmental circumstances, which may lead to a range of situations such as valuation uncertainty and breaches of covenants or liquidity issues that may require actions such as (i) deferral or suspension of trading in the vehicle’s equity, (ii) restructuring of the vehicle or (iii) liquidation of the vehicle (see G38 on communication to investors outside of the regular reporting obligations).

Procedures relating to analysis, decision- making and consent should be adequate and clearly documented. Outcomes should enable actions to be taken on a timely basis and in the best interests of investors as a whole (see G29 and G30 on material decisions requiring specific involvement or consent of the investors).

The investment manager should ensure that the liability of an investor is limited to its commitment to the vehicle.

The investment manager should ensure that the liability of an investor does not exceed its total commitment. The constitutional documents of the vehicle should contain an explicit provision dealing with such liability.

The investment manager should establish and maintain an up-to-date register of related-party transactions and potential conflicts of interest and relevant mitigating circumstances.

The investment manager, in collaboration with the governing body of the vehicle, should establish a policy to manage related-party transactions and conflicts of interest. This should be adapted to the nature and scale of the vehicle. Related-party transactions and potential conflicts of interest should be documented and reported to the governing body of the vehicle and communicated to investor representative groups as appropriate.

Related-party transactions and potential conflicts of interest may arise in different circumstances, such as but not limited to:

- The investment manager (or another vehicle/party affiliated with the investment manager) competes with the vehicle;

- The investment manager (or another vehicle/party affiliated with the investment manager) buys or sells assets from/to the vehicle or co-invests with the vehicle;

- The investment manager provides a service for secondary transfers between investors;

- The investment manager establishes contracts with related entities involved in the administration and operation of the vehicle. The allocation and arm's length nature of such fees and expenses for the contracted services are a consideration;

- The investment manager seeks to sell its interest in the vehicle or there is a material change in ownership within their organisation;

- The vehicle contracts for services with third-party service providers such as valuers and auditors that are incompatible with independence considerations.

The investment manager and its affiliates should adopt a methodology that ensures that investment opportunities are fairly allocated to the vehicle.

An investment manager may advise and provide investment opportunities to a range of vehicles with different investor bases. The investment manager should establish policies and procedures to ensure that investment opportunities are fairly allocated between such vehicles. Such an allocation approach should have appropriate oversight to ensure fair outcomes and be transparent to respective groups of investors. Different allocation methodologies may be considered, such as vintage, degree of alignment with investment strategy or a pro-rata approach.

The investment manager should consider co-investment in vehicles in which they are active.

For certain types of investment vehicles, a co-investment by the investment manager is an appropriate way to align interests with the investors. Such co-investment could consider key management and employees as well as other concerned entities. The amount and terms of such co-investment should support a meaningful alignment of interest.

The investment manager should have a policy in place defining how co- investment opportunities by investors in assets held by the vehicle are treated.

If certain investors have a contractual right to co-invest alongside a vehicle in certain assets, the investment manager should have a policy in place to define how key contractual terms, such as management and performance fees, should be allocated between the vehicle and co-investment entity to ensure that the other investors in the vehicle are fairly and transparently treated.

The investment manager should design management and performance- related fees that are aligned with the interests of investors.

Such fees should be aligned with the interests of investors and should incentivise the investment manager to behave in a manner consistent with the risk profile of the vehicle. The remuneration and fee structure of the investment manager should not encourage the investment manager, its staff or the management board members of a vehicle to act in their in interest, or to take risks that are not in keeping with the strategy and the risk appetite that has been agreed (see G33 on fee transparency).

See the inrev-guidelines">Fee and Expense Metrics module for specific guidelines on fees and costs.

add

+

G-P03 Act with skill, care and diligence

The governing body of the vehicle, together with the investment manager, should ensure that they have the appropriate skills, capacity and competence to act effectively in the best interests of investors.

The investment manager, together with the governing body of the vehicle, has a responsibility to assess whether the people involved in the vehicle are of sufficiently good repute, and possess sufficient knowledge, skills and experience to perform their duties. They should also be able to act with independence of mind to effectively assess and challenge the decisions of the management body in its management function, and to effectively oversee and monitor management decision-making. They should be able to commit sufficient time to perform their functions with respect to the vehicle.

The members of the governing body of the vehicle and the employees of the investment manager should actively engage in their duties and make their own sound, objective, and appropriate decisions and judgments when performing their functions and responsibilities.

The diversity, equity, and inclusion (DEI) of employees and members of the governing body of the vehicle should be considered.

For more information about integrating social aspects of ESG into investment decision-making processes, please refer to INREV’s Sustainability Guidelines.

The governing body of the vehicle, supported by appropriate parties, should oversee and take responsibility for key judgments and estimates related to financial and performance reporting.

Changes in assumptions and key estimates have a significant impact on business performance and reporting. This requires setting clear expectations for transparency and quality and ensuring that the management’s judgments and estimates impacting key assumptions and the external audit processes are effective. Considerations included in the inrev-guidelines">Reporting and property-valuation#inrev-guidelines">Property Valuation modules of the INREV Guidelines should also be taken into account.

The investment manager should ensure that all parties involved in the operations and management of the vehicle are adequately trained and have access to appropriate educational programmes.

It is important that all parties involved in the operations and management of the vehicle have an understanding of its structure, business model, risk profile and governance arrangements, which should be facilitated through relevant training programmes. The investment manager should allocate sufficient resources for education and training to such persons.

Key members of the operational and management team, including the governing body of the vehicle, should have capacity and devote adequate time to effectively operate and oversee the vehicle.

This consideration is especially important for team members that are instrumental to the success and the execution of the strategy of the vehicle. The factors to take into account in this regard are, amongst others, the number of other directorships or similar management responsibilities held by such persons at the same time, and the nature and complexity of these other roles.

add

+

G-P04 Design and operate an adequate oversight and control framework

The investment manager should document and communicate the operational, management and oversight structures related to the vehicles it manages.

The operational, management and oversight structures related to investment vehicles are often complex and involve a wide range of parties performing specific tasks. The investment manager should document and communicate the structure of the vehicle framework to potential and existing investors. This should include the identification of specific roles performed by the investment advisor, management company, administrator, custodian, external auditor and valuer, amongst others. It should also identify the existence and roles of oversight and advisory bodies, such as investment committees, management boards, valuation and pricing committees, investor representative committees and audit committees, amongst others.

The investment manager should define an appropriate risk management framework.

This should include the definition of relevant risks and risk appetite. It should also define the roles, responsibilities and controls within the risk management function. The investment manager should ensure that the process and outcomes are aligned with the investment objectives of the vehicle, aligned with the identification of key and relevant risks and adapted to the specific needs of the vehicle. The resultant risk management framework should also be designed to operate in accordance with applicable regulations, e.g., AIFMD.

A risk management framework generally consists of implementing a policy that identifies relevant risks, establishes risk limits based on the investors’ risk appetites and expectations, gathers and analyses relevant information, and responds on a timely basis.

Risk management is a continuous process that should be monitored by the investment manager and the governing body of the vehicle. The results of this process should be reported to investors, taking account of applicable regulatory and financial reporting requirements.

See the inrev-guidelines">Reporting module for specific reporting guidelines.

The investment manager, together with the governing body of the vehicle, should design and operate an effective system of internal controls.

An effective internal control framework is adapted to the specific risks, processes and organisational structure supporting an investment vehicle. It includes consideration of the operating environment of the investment manager and all relevant service providers to the vehicle. The design of an internal control environment starts with the definition of control objectives.

Based on this, effective internal controls can be designed, documented, and implemented. This should include the segregation of incompatible responsibilities and an appropriate transaction approval process that prevents an individual from acting alone or overriding internal controls. An internal control system should be tested on a recurring basis (e.g. by internal and external auditors) and the results reported to the governing body of the vehicle. Control remediation action plans to improve the environment can then be effectively directed.

The internal control framework should be aligned with legal and regulatory compliance functions and the overall risk management framework.

The investment manager, together with the governing body of the vehicle, should review the (vehicle) governance framework as part of any vehicle extension process.

Where the manager presents proposals for an extension of the life of the vehicle or a short run-off period to allow properties to be sold (which is not a fixed extension specified in the constitutional terms), this is in effect a new vehicle and provides an opportunity to review the constitutional terms of the vehicle.

The governing body of the vehicle should undertake a review of the continuing appointment or re-appointment of the external auditor, valuer, depositary and other key service providers on a regular basis.

This review should be undertaken at least every three years.

See also PV04 of the property-valuation#inrev-guidelines">Property Valuation module for guidelines on reviewing the performance of valuers.

The investment manager, together with the governing body of the vehicle, should evaluate the need for independent non-executive directors.

Given the wide range of investment vehicles and their features (open/closed end, number of investors, size, duration, risk profile, etc.), the need for independent non-executive directors varies across the industry.

For smaller vehicles, where investors may be closer to its day-to-day operation, the role and value of independent non-executive directors may be limited. For larger or more complex vehicles, it may be appropriate to appoint independent non-executive directors, which may form the majority of the governing body or occupy the chairperson role, to ensure decision-making always reflects the best interests of investors.

Where a vehicle appoints independent non-executive directors, the selection criteria should be clearly defined and focus on skills, qualifications, and relevant experience. Independent non-executive directors should at all times be independent of the investment manager and accountable to investors. The term of appointment of independent non-executive directors should be fixed, but for a period long enough for them to gain appropriate knowledge and to effectively execute their responsibility without losing their independence.

The investment manager, together with the governing body of the vehicle, should ensure that investor interests are adequately and appropriately represented.

This objective may be achieved through the constitution of various investor representative groups or committees, which generally have an advisory role in helping the investment manager and the governing body of the vehicle understand investor expectations.

Investor representative groups or committees should be able to convene meetings independently of the investment manager to enable them to exchange views or consider how to exercise their investor rights in relation to material matters.

In certain vehicles, depending on their legal structure, investors or their representative groups may need to be consulted and/or approve certain key decisions, e.g., vehicle liquidation or change of investment manager (see G30). Care should be exercised to ensure that the investors represented in these groups and committees do not gain an economic advantage over other investors.

Independent non-executive directors, where appointed, should act on behalf of all investors.

Independent non-executive directors, where appointed as members of the governing body of the vehicle, should represent the best interests of all investors, collectively. In this capacity, they play an important role in scrutinising and approving key matters that are subjective, complex, and material to the outcomes for investors (see also RG14 and RG15 of the inrev-guidelines">Reporting module).

For instance, particular areas of focus may include, but are not limited to:

- Ensuring communications and reporting to investors are clear, accurate, and transparent;

- Engaging with and reviewing reports from external auditors;

- Reviewing proposed changes to constitutional documents;

- Monitoring and approving any related- party transactions and conflicts of interest between investors and the investment manager;

- Ensuring a fair implementation of management and performance fee structures;

- Monitoring changes to pricing assumptions in open end vehicles;

- Overseeing the transition process when a manager’s mandate is terminated, either during or at the end of the vehicle lifecycle;

- Acting as a mediator between the investment manager and investors in certain circumstances, such as settling fee-related issues in the case of an investment manager termination;

- Monitoring the internal control framework of the vehicle (see G23) by, for example, receiving regular reports from, and having regular meetings with, the investment manager.

Read more at Reporting module.

The investment manager should define and communicate how certain material decisions, which include investors, are made, and how voting thresholds operate by reference to constitutional terms and local laws.

Certain material decisions (see G30), which may result in changes to the vehicle’s constitutional documents, generally require investor consent. Sufficient quantitative and qualitative information should be provided to investors to enable them to make an informed decision. Adequate time should be provided to consider this information and the proposal prior to any vote taking place.

The constitutional documents should therefore set out a practical voting process that enables the vehicle to effectively respond to circumstances.

A common approach is to require a qualified majority vote of investors. In determining which voting percentage is appropriate, consideration should be given to the individual voting power of the respective investors to establish a well- balanced voting ratio as well as any legal requirements.

The use of tacit approvals should be limited in scope and clearly described in the constitutional documents of the vehicle. If a proposed change is rejected by investors, there should be sufficient time before investors can be asked to reconsider a proposal that they have previously rejected.

The investment manager should identify and document any matters that require the specific involvement or consent of the investors.

The constitutional documents of the vehicle should clearly identify the process by which investors can exercise their rights, either through investor representative groups or committees, or by vote.

This enables investors to effectively propose and influence/control material changes related to the vehicle. Examples of such matters can include but are not limited to:

- Changes to the investment strategy, including allocation limits and use of leverage;

- Changes to valuation and financial reporting methodologies;

- Certain matters that relate to the resolution of conflicts of interest with related parties;

- Matters related to the appointment and operations of the investment manager, including key persons;

- Appointment of the members of the governing body of the vehicle and its external auditors;

- Liquidating or extending the life of the vehicle.

- Other material changes to the constitutional terms of the vehicle.

add

+

G-P05 Be transparent while respecting confidentiality considerations

The governing body of the vehicle should ensure that reporting to, and communication with investors is balanced and fairly represents the activities of the vehicle.

The governing body of the vehicle has an obligation, including applicable regulatory and legal obligations, to ensure that all forms of reporting by the vehicle to its investors are appropriate in the circumstances. In pursuing this responsibility, the governing body of the vehicle should always consider the best interests of investors.

The investment manager should ensure the constitutional documents set out clear obligations of confidentiality assumed by the vehicle and its investors.

The investment manager is aware of information relating to the vehicle, some of which will be disclosed to investors, either through regular reporting obligations or on an ad-hoc basis. Information that is commercially sensitive to the vehicle, should be treated as confidential and investors should refrain from acting on it. The constitutional terms of the vehicle should contain appropriate undertakings to ensure confidentiality of such commercially sensitive information.

The need to maintain confidentiality should be balanced by the need to ensure transparency; if there is a conflict, the need for transparency should prevail. Confidentiality provisions should not effectively prohibit investors exercising their rights under the constitutional documents, such as when engaging third- party advisors.

An investor may also be required to share confidential information related to the vehicle with a third party. In such a case, the investor should provide a notice to such third parties that such disclosure is made in confidence and should be kept in confidence. The investor remains responsible and accountable for the compliance of the third party to whom confidential information is disclosed.

The investment manager should ensure the constitutional documents of the vehicle include a clear and accurate description of the management and performance fee structures.

Management and performance fee structures, whilst being a key tool to align interests, (see G16), are often based on complex mathematical formulas which are subject to interpretation. The constitutional documents of the vehicle should clearly describe in detail how such fees are calculated over time. Best practice would be to include worked examples to ensure that subjective interpretation is limited.

The investment manager should also describe in detail the services to which the fees relate. For instance, there should be a clear distinction between a management fee and other charges and activities related to the administration of the vehicle, commonly conducted by third parties.

Where the investment manager has the right to make certain amendments to the constitutional documents of the vehicle without investor approval or through a power of attorney, such changes should be fully communicated and disclosed to investors.

If the investment manager has the right to amend certain elements of the constitutional documents of the vehicle, it should proactively communicate to investors the purpose and the intended results of any proposed changes and provide the amended documents on a timely basis. The constitutional documents of the vehicle should clearly describe the scope of such rights. (see G29 on voting thresholds).

The investment manager should disclose the existence and terms of side letters entered into with investors.

There may be circumstances in which different investors will have different arrangements, financial or otherwise, with a vehicle. For example, larger investors may receive a discount on fees payable to the investment manager and have the right to be represented in investor advisory groups. The investment manager should disclose how side letters and similar individual investor agreements are negotiated and implemented. The manager should also disclose the scope and terms of such side letters from a vehicle-wide perspective.

Investors should provide the investment manager on a timely basis with information legitimately required by the investment manager, such as for tax compliance purposes and anti-money laundering procedures.

Investors should respond in a timely manner to legitimate requests by the investment manager or service providers related to the vehicle to enable them to comply with certain legal or regulatory requirements such as tax compliance and anti-money laundering obligations. In addition, investors should provide other legitimate, non-statutory information, such as that related to conflicts of interest that they may have with the vehicle.

The investment manager should clearly define the annual and interim reporting requirements towards investors in the constitutional documents of the vehicle.

In accordance with INREV’s Reporting Guidelines, the constitutional documents of the vehicle should define the content and timing of investor reporting.

The investment manager should disclose relevant information periodically in a clear and concise manner under internationally accepted reporting standards and alongside the audited annual financial statements.

The annual report should describe the governance framework defined in the constitutional documents of the vehicle in accordance with applicable regulations (see also RG14 of the Reporting module).

The annual report should also include information such as the risk framework of the vehicle, its portfolio strategy and objectives, its sustainability strategy, and the economic outlook. It should further describe how the investment manager has complied with its business objectives and policies.

Read more at Reporting module.

In addition to respecting the contractual reporting obligations of the vehicle, the investment manager should provide further clear, timely and accurate information to investors and/ or key stakeholders, as relevant.

During the lifecycle of a vehicle, there may be situations or unforeseen events that the investment manager understands to be material to the outcomes of investors, which warrant timely and clear communication to investors outside of the regular reporting obligations. The investment manager, together with the governing body of the vehicle, should enable such communications to take place through appropriate channels such as written reports and/or convening meetings. The information communicated should be relevant and reliable.

The investment manager and the governing body of the vehicle should enable potential investors to fully utilise the INREV Due Diligence Questionnaire (DDQ) when considering an investment opportunity.

The INREV DDQ provides a consistent due diligence framework, helping potential investors achieve a high level of scrutiny when entering a vehicle. The investment manager should consider the adoption of the INREV DDQ and answer all its questions appropriately and in a clear and precise manner.

The investment manager, in collaboration with the governing body of the vehicle, should clearly state in the constitutional documents the vehicle’s intended level of adoption of the INREV (Vehicle) Governance Guidelines and perform an annual self-assessment of the effectiveness of its intended implementation.

To enable investors to fully understand the nature and extent of compliance of the vehicle’s intended governance framework with the INREV Guidelines, an initial as well as ongoing annual self-assessment by the governing body of the vehicle should be performed and the results disclosed appropriately.

See also RG16 and RG17 of the Reporting module.

The investment manager should ensure that the constitutional terms of the vehicle enable it to comply with INREV’s data collection requirements.

The investment manager should describe in the constitutional documents of the vehicle the type, frequency and purpose of information that will be provided to INREV. The investment manager should use reasonable efforts to ensure timely and accurate submission of such information and data required by INREV in the context of industry data analysis and performance measurement.

Read more at INREV Data Delivery module.

add

+

G-P06 Be accountable

The investment manager, together with the governing body of the vehicle, should demonstrate how they are actively engaged with and accountable to investors.

The investment manager and the governing body of the vehicle are accountable to the investors of the vehicle as a whole. Demonstration of this accountability could include, for example, being available upon reasonable notice, defining the specific role of independent non-executive directors towards investors where applicable and meeting investors and investor representative groups to review and discuss matters relating to the vehicle.

The investment manager and the governing body of the vehicle are also expected to maintain relations with and oversee the work of external advisers and service providers, including external auditors, valuers, portfolio and property managers and risk managers.

The investment manager and the governing body of the vehicle should be willing to accept a certain level of liability subject to reasonable indemnifications.

There should be a fair allocation of risk between the investment manager, the governing body of the vehicle and the investors. The extent of the liability should be in accordance with the relevant laws and regulations and described in the constitutional documents of the vehicle. At the same time, the investment manager and the governing body of the vehicle can expect to be indemnified by the vehicle for losses, except in cases of fraud and culpable behaviours such as wilful misconduct or gross negligence.

The investment manager should enable investors to perform compliance audits, where appropriate.

Investors should have the right, in appropriate circumstances, to request an inspection of the books and records of the vehicle or have a third-party auditor conduct an audit.

Where multiple investors acting together through investor representative groups or committees, or the governing body of the vehicle, request and agree on an independent audit, the cost should be borne by the vehicle.

The investment manager should ensure that the constitutional documents of the vehicle include clear provisions for the rights and obligations of all relevant parties involved in the removal of the investment manager and the early termination of the vehicle.

The constitutional documents may provide that the investors, through the governing body of the vehicle, have the right to replace the investment manager. This may occur in a range of situations which include but are not limited to key changes of control in the investment manager organisation, un-resolvable performance issues or conflicts of interest.

For cause removal: Vehicles should have a ‘removal for cause’ clause in place that gives investors, dependent on a defined threshold, the right to call at any time for a vote to remove the investment manager. The vehicle documentation should clearly describe how cause can be established. The documentation should clearly disclose the investment manager’s rights regarding management fees and reasonable expenses, including consideration of the transition period in such situations.

No fault removal: The constitutional documents of the vehicle should contain a removal at will or ‘no fault removal’ clause, whereby the manager’s mandate can be terminated due to the request of a majority or qualified majority of investors (see G29). The documentation should clearly disclose the investment manager’s rights regarding management fees and reasonable expenses, including consideration of the transition period in such situations.

Termination of the vehicle: The constitutional documents of the vehicle should provide the right for investors to terminate and dissolve the vehicle in certain circumstances. This decision is generally subject to a qualified majority vote of investors. The documentation should clearly disclose the manager’s rights regarding management fees and reasonable expenses, including consideration of the transition period in such situations.

For specific guidelines related to the wind up of a vehicle, see the inrev-guidelines">Liquidity module.

add

+

G-P07 Be sustainable: Evaluate and manage sustainability impacts

The investment manager, together with the governing body of the vehicle, should consider and develop a strategy to address sustainability impacts.

The investment manager should identify material sustainability aspects, including impacts and risks, and develop a sustainability strategy, with clear and measurable goals, to mitigate environmental concerns and consider social impact, as appropriate to the overall strategy of the vehicle. This may include, among others, sustainability requirements of the real estate assets the vehicle may invest in, and any additional ESG investment criteria. The investment manager should regularly report to investors on how the relevant ESG factors of the investments made have been addressed.

The investment manager should consider abstaining from making investments related to the vehicle that, on balance, are likely to adversely affect desired sustainable outcomes.

The investment manager, together with the governing body of the vehicle, should establish a framework which defines how the vehicle will act as a ‘responsible owner’ of real estate assets.

The investment manager should act as a responsible owner by engaging with tenants, property companies, and other stakeholders related to the vehicle and developing programmes and policies that seek to improve the social and environmental performance of the real estate assets held by the vehicle. These programmes should be aligned with the overall sustainability strategy of the vehicle, as appropriate. Considerations driving the development of such programmes could include, among others, property types and uses, and cooperation, and forms of engagement with tenants and community interests. The investment manager should clearly describe the sustainability criteria, targets, and the expected impact of such programmes.

The investment manager, together with the governing body of the vehicle, should implement INREV’s Guidelines on sustainability, as appropriate.

The INREV sustainability best practice recommendations aim to provide a coherent framework for sustainability reporting in line with annual financial reporting and present a clear picture from the vehicle’s strategy through environmental key performance indicators.

The investment manager should adopt INREV’s Guidelines, as appropriate, when including sustainability in a long-term strategy and translating it into objectives and annual targets for implementation.

More information on the areas to be considered will be included in the new Sustainability module (end of 2022 release).

For more information on sustainability reporting guidelines see the Reporting module of the INREV Guidelines.

add

+

Further guidance and interpretation

Club deals and joint ventures

In this section, we deal with variations in the application of the (Vehicle) Governance Guidelines to club deals and joint ventures. In practice, there can be many forms of regulated and unregulated vehicles including a range of separate accounts with single investors, club deals with a limited number of investors, and joint ventures where investors share control. In these situations, contractual arrangements, and in particular management and performance fees, tend to be very specific and customised to the circumstances and to the parties involved.

Control over investments

Investors participating in club deals and joint ventures are usually seeking greater control over the strategy and activities of the vehicle. They generally set more focused investment strategies and seek greater control of investment decisions. In addition to the matters set out in G30 of the Guidelines normally reserved for investors, investors are therefore likely to want to control the other matters such as the timing of acquisition and disposal of real estate assets.

The role of independent non-executive directors in club deals and joint ventures

In circumstances where a small number of investors are actively involved in the running of a vehicle, it would be expected that investors who participate in club deals and joint ventures would have the personnel resources to engage fully in the activities of the vehicle, without creating any management inefficiencies, such as delay in ratifying decisions. In these circumstances, the role of the independent non-executive directors may not be relevant.

add

+

Q&A

add

+

Compliance of AIFM

As well as complying with general Governance guidelines, what additional factors should the Board of an investment vehicle defined as an Alternative Investment Fund (AIF) consider when appointing and monitoring a regulated Alternative Investment Fund Manager (AIFM)?

Most large real estate investment vehicles need to be managed by regulated managers or AIFMs. Although INREV’s guidelines apply equally to regulated and unregulated managers, there are additional specific considerations concerning regulated managers in order to comply with the applicable regulation. This scenario may typically occur where an AIF within the scope of the AIFMD appoints an external AIFM as its manager. In this case, there are a number of important activities which the Board of the AIF delegates to the manager, but which it must monitor in order to ensure that the AIFM is performing such tasks reasonably and in compliance with legal and regulatory requirements.

Important tasks delegated to the AIFM must include portfolio management and risk management and will often also include administration and marketing. The AIFM may also, for example, provide support to the Board of the AIF in the performance of its duties. In addition, the AIFM commonly identifies and manages key service provider relationships on behalf of the AIF, such as depositories and auditors, and under the AIFMD has a responsibility to manage the valuation of the AIF’s assets and liabilities on behalf of the AIF to which it has been appointed. Clearly, the Board of the AIF has to be comfortable with the competencies and performance of the AIFM and will normally perform a degree of due diligence on the AIFM pursuant to this goal.

There are two key elements to this due diligence role:

- Initial due diligence

- Ongoing due diligence

Both initial and ongoing due diligence should be documented.

Initial due diligence