add

+

Introduction

add

+

Introduction to INREV Guidelines

INREV aims to improve transparency and promote best practice and professionalism in the sector. INREV members have encouraged and strongly supported the establishment of industry guidelines over the past few years and developed an integrated set of principles and recommendations including tools and examples and standardised templates for investors and investment managers of non-listed real estate vehicles. The objectives of the INREV Guidelines are:

- to ensure that investors in non-listed real estate vehicles obtain consistent, understandable, easily accessible and reliable information that can be compared across investments and between different periods;

- to establish requirements and best practices within the industry and to help investment managers implement them in practice.

The INREV Guidelines are presented in an online format, allowing visitors to easily navigate and search through and view tailored guidelines for example for open end funds.

It is possible to download a full version of the Guidelines or to create a custom version module by module in a PDF format in our Guidelines section.

The INREV Guidelines are organised into ten modules.

.png)

The Guidelines are embedded in an Adoption and Compliance Framework which allows investment managers and investors to evaluate their implementation of the INREV Guidelines, module by module. To determine ways of implementation and add a hierarchy to the guidelines’ requirements and best practices it is important to understand the underlying terminology:

Principles

Principles serve as a basis for the requirements and best practices.

Best practices

Best practices have been developed by INREV to enable investors and investment managers to design vehicle products with an effective governance framework aligned with industry best practices and relevant to their specific needs. Investment managers should evaluate themselves, using the self assessment tool against such best practice frameworks and disclose their level of adoption.

Standardised templates

The Due Diligence Questionnaires (DDQs) and the Standard Data Delivery Sheet (SDDS) are standardised templates that complement the INREV Guidelines but they are not part of its formal structure. These are used for information exchange between industry participants.

Tools and Examples

Tools and examples are meant to assist in the application of the INREV Guidelines. Tools support market participants in assessing specific situations and in complying efficiently with the INREV Guidelines. Examples serve as a pattern to be followed by market participants to illustrate a certain standard.

Definitions

INREV definitions (‘Global Definitions’) were developed to achieve consistency of meaning and terminology within the non-listed real estate industry. Global definitions are being created via the collaboration with the NCREIF PREA Reporting Standards and can be found in the Global Definitions Database. They are gradually replacing the INREV Definitions.

add

+

Adoption and Compliance Framework

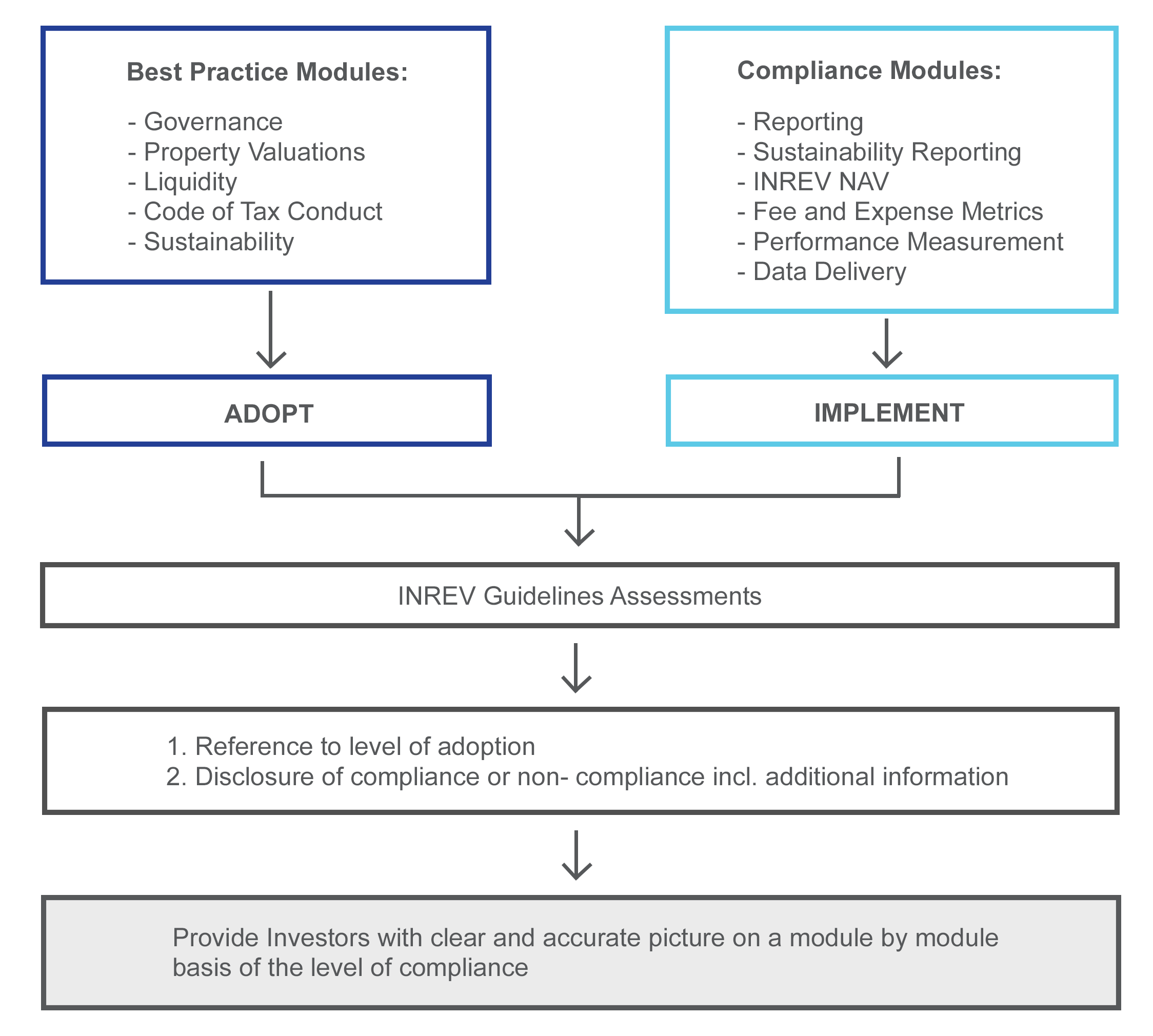

The INREV Guidelines are designed for non-listed real estate vehicles for institutional investors. Since non-listed vehicles can differ considerably, INREV provides a modular approach for investors and managers to agree on an appropriate level of adoption of INREV best practices and in deciding on the level of compliance with INREV requirements for individual modules.

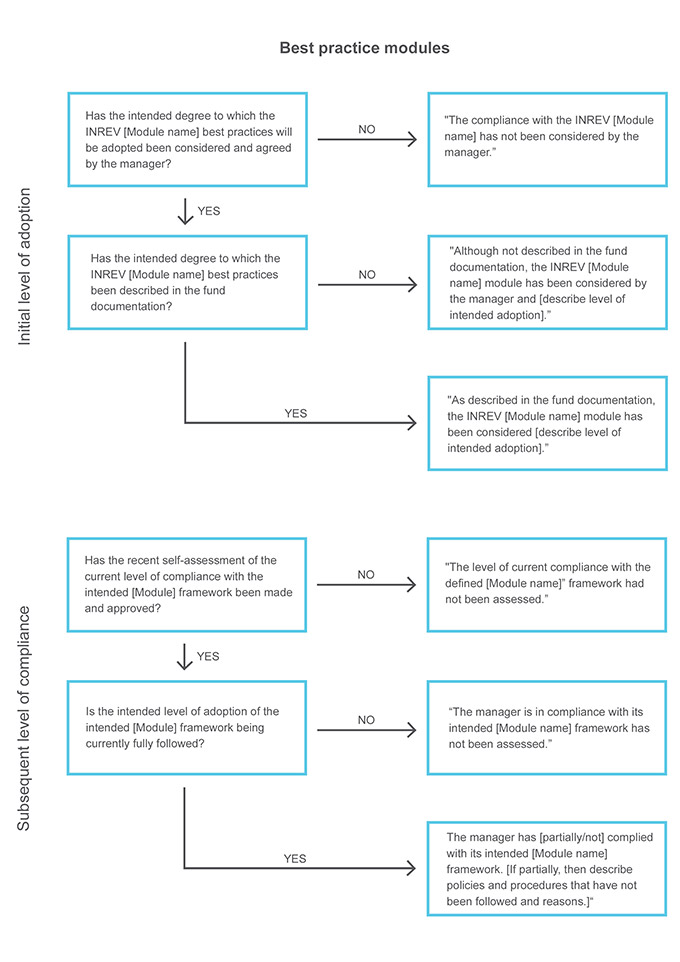

INREV’s best practice frameworks developed for the modules of Governance, Liquidity, Property Valuation, Tax Conduct and Sustainability, are qualitative in nature and individual vehicles will adopt them in different ways. INREV’s objective is to ensure that investors are provided with a clear and accurate description of these modules.

In contrast to best practices, INREV’s requirements in the modules covering Reporting, including Sustainability reporting, Performance Measurement, INREV NAV, Fee and Expense Metrics and INREV Data Delivery, are more technical in nature. These requirements leave no room for different interpretation: the requirements are either followed, or not. Additionally, in the Reporting module, Performance Measurement module and Fee and Expense module, some of the INREV Guidelines are recommendations rather than requirements. Although INREV would encourage members to follow such recommendations, they are not mandatory to claim full compliance with the respective modules.

The INREV Guidelines Assessments have been developed to assess the level of compliance with the INREV Guidelines. If all of the requirements for an individual module are fully implemented, the manager can disclose full compliance with the relevant module. If the requirements of a module are not fully met, the manager should disclose that the vehicle does not fully comply with that module of the INREV Guidelines and state the reasons for deviation including any additional information relevant to investors.

In all cases, investment managers should present investors with a clear and accurate picture of the level of compliance with the INREV Guidelines. The level of adoption and compliance with the INREV Guidelines is a matter to be discussed during the launch process of the vehicle. The vehicle documentation should describe, on a module by module basis, the extent to which the vehicle aims to be in compliance with INREV Guidelines.

INREV does not provide any assurance on the degree of adoption of best practices or on the level of compliance with requirements for individual vehicles.

The legal framework applicable to individual vehicles may require third party assurance on elements of compliance with INREV Guidelines, for instance where the legal NAV of the vehicle is the INREV NAV. We recommend that investors and managers discuss and agree the nature of such assurance as part of the launch process.

The INREV adoption and compliance framework is summarised below. The framework includes references to tools which can be used to assist in the application of the guidelines.

add

+

Best Practice Modules

| COMPLIANCE OBJECTIVE |

SELF-ASSESSMENT PROCESS |

DISCLOSURE | OVERSIGHT AND ASSURANCE |

| Module 1. Governance | |||

| Managers should evaluate the level of adoption of INREV best practices using the Governance INREV Assessment Tool. | Managers and investors should refer to and consider adopting INREV Governance best practices when designing and implementing an oversight framework for a specific vehicle. | Managers should describe in their annual report and vehicle documentation their governance practices and the degree to which they adopt INREV best practices. | Management and non-executive officers should review the adequacy of the description of the governance framework. |

| Module 3. Property valuation | |||

| Managers should follow the valuation best practices when determining the fair value of the property portfolio and prepare required disclosures to investors. | Managers should evaluate the level of adoption of INREV property valuation best practices. | Managers should describe their property valuation policies and the degree to which they have adopted INREV valuation best practices in their annual report and vehicle documentation. | Management and non-executive officers should review the basis and adequacy of disclosure to investors summarising the level of adoption with the property valuation best practices. |

| Module 7. Liquidity | |||

| Managers and investors should refer to and consider adopting INREV liquidity best practices when designing non-listed vehicle products. | Managers should evaluate, using the Liquidity Guidelines Assessment, the level of adoption of INREV liquidity best practices. | Managers should describe their liquidity policies and the degree to which they have adopted INREV best practices in their annual report and vehicle documentation. | Management and non-executive officers should review the basis and adequacy of disclosure to investors summarising the level of adoption with the liquidity best practices. |

| Module 9. Code of Tax Conduct | |||

| Managers should evaluate their level of adoption of Code of Tax Conduct best practices when examining their own tax policies and practices. | Managers and investors should refer to and consider adopting Code of Tax Conduct best practices when designing and implementing an oversight framework for a specific vehicle. | Managers should describe in their annual report and vehicle documentation their practices referred to in the Code of Tax Conduct and the degree to which they adopt INREV best practices. | Management and non-executive officers should review the adequacy of the description of the Code of Tax Conduct framework. |

| Module 10. Sustainability | |||

| Managers should evaluate the level of adoption of INREV best practices using the Sustainability INREV Assessment Tool. | Managers and investors should refer to and consider adopting INREV Sustainability best practices when designing and implementing an oversight framework for a specific vehicle. | Managers should describe in their annual report and vehicle documentation their sustainability practices and the degree to which they adopt INREV best practices. | Management and non-executive officers should review the adequacy of the description of the sustainability framework. |

add

+

Compliance Framework

| COMPLIANCE OBJECTIVE |

SELF-ASSESSMENT PROCESS |

DISCLOSURE | OVERSIGHT AND ASSURANCE |

| Module 2. Reporting | |||

| Managers should make disclosure corresponding to all relevant INREV reporting requirements and recommendations as a component of their annual or interim reports to investors. | Managers should evaluate the level of compliance with INREV requirements and recommendations, using the Reporting Guidelines Assessment. | Managers should include all information corresponding to applicable INREV reporting requirements and recommendations in their annual and interim reports. | Management and non-executive officers should review the adequacy of the compliance disclosure to investors summarising the level of compliance with reporting requirements. Auditors could give negative assurance on the degree to which INREV reporting requirements and recommendations are complied with. |

| 2.1 Sustainability Reporting | |||

| Managers should make disclosure corresponding to all relevant INREV sustainability reporting requirements and recommendations as a component of their annual or interim reports to investors. | Managers should evaluate the level of compliance with INREV requirements and recommendations, using the Reporting Guidelines Assessment. | Managers should include all information corresponding to applicable INREV sustainability reporting requirements and recommendations in their annual and interim reports. | Management and non-executive officers should review the adequacy of the compliance disclosure to investors summarising the level of compliance with sustainability reporting requirements. Auditors could give negative assurance on the degree to which INREV sustainability reporting requirements and recommendations are complied with. |

| Module 4. Performance Measurement | |||

| Managers should disclose all relevant INREV performance measures in accordance with performance measurement requirements. | Managers should evaluate the level of compliance with INREV requirements and recommendations. | Managers should include all information corresponding to applicable INREV performance measurement requirements and recommendations in their annual and interim reports. | Management and non-executive officers should review the adequacy of the compliance disclosure to investors summarising the level of compliance with performance measurement requirements. Auditors could give negative assurance on the degree to which INREV performance measurement requirements and recommendations are complied with. |

| Module 5. INREV NAV | |||

| Managers should calculate and disclose an INREV NAV in accordance with INREV requirements. | Managers should evaluate the level of compliance with INREV NAV requirements, using the INREV NAV Guidelines Assessment. | Managers should include the INREV NAV in their annual and interim reports along with required disclosures. Vehicle documentation should include the required information. | Management and non-executive officers should review the basis and adequacy of disclosure to investors summarising the level of compliance with INREV NAV requirements. Depending on circumstances, auditors can give assurance or negative assurance on the INREV NAV and level of compliance with related disclosure requirements. |

| Module 6. Fee and expense metrics | |||

| Managers should calculate and disclose fee and expense metrics in accordance with fee and expense metrics requirements. | Managers should evaluate the level of compliance with INREV fee and expense metrics requirements using the INREV Fee and Expense Metrics Guidelines Assessment. | Managers should include information corresponding to INREV fee and expense metrics requirements in their annual reports and in the vehicle documentation. | Management and non-executive officers should review the basis and adequacy of disclosure to investors summarising the level of compliance with fee and expense metrics requirements. Auditors could give negative assurance on the level of compliance with fee and expense metrics requirements. |

| Module 8. INREV data delivery | |||

| Managers should provide information to INREV in accordance with INREV data delivery requirements. | Managers should evaluate the level of compliance with INREV data delivery requirements. | Managers should provide INREV with all relevant information corresponding to INREV data delivery requirements. | Management and non-executive officers should review the basis and appropriateness of the compliance with INREV data delivery requirement disclosure to INREV. |

add

+

Revision and Change Procedure

Since the launch of the Guidelines, INREV received a growing number of questions and comments from members and non-members regarding their interpretation, adoption and implementation. A document below describes the change procedure for updates to the INREV Guidelines.

A major revision of the INREV Guidelines was performed during 2021-2022.

Reporting: Update done in January 2023 to reflect the latest developments including regulatory reporting and investor requirements and to align with the updates in other INREV modules INREV Reporting Guidelines Change Log 2023.

Property Valuation: Update done in January 2023 to reflect the latest market practices and regulatory requirements, to enhance the governance and oversight aspects and to ensure further transparency of sustainability inputs in the valuation process INREV Property Valuation Guidelines Change Log 2023.

Sustainability: Added in January 2023.

Governance: Update done in January 2022 to reflect the current functions, organisations and roles within an investment vehicle, in line with the latest regulations in today’s market INREV Governance Guidelines Change Log 2022.

Performance Measurement: Updated done in January 2022 to provide clarifications of the description of assumptions and to enable a more detailed performance analysis INREV Performance Measurement Guidelines Change Log 2022.

Code of Tax Conduct: Added in January 2021

Fee and Expense Metrics: Update done in March 2020 to replace TER by the TGER

add

+

Tools and Examples

Example - Statement of level of adoption of INREV Guidelines

Management has assessed the degree to which the best practices of INREV’s governance, property valuation, liquidity, tax conduct and sustainability frameworks have been adopted and followed by the vehicle. In addition, Management has assessed the level of compliance with INREV’s reporting, sustainability reporting, performance measurement, INREV NAV and fee and expense metrics frameworks. The results of such assessment are summarised below:

| MODULE | GUIDELINES | LEVEL OF ADOPTION OR COMPLIANCE |

|---|---|---|

| 1 | Governance | Although not described in the vehicle documentation, the INREV Governance module has been considered by the manager. The intended framework partially complies with the INREV governance best practices. All best practices have been adopted except for the fact that investors are not able to terminate the contract of the manager without cause. The vehicle formally assessed at the end of the financial year that it is currently following its intended governance framework. |

| 2 | Reporting | Although not detailed in the vehicle documentation, the INREV reporting module has been considered by the manager. The manager has complied with all the requirements of the INREV reporting module. |

| 2.1 | Sustainability Reporting | Although not detailed in the vehicle documentation, the INREV sustainability reporting requirements have been considered by the manager. The results of the INREV Guidelines assessment show that the manager has complied with all the requirements of the INREV sustainability reporting guidelines. |

| 3 | Property valuation | As described in the vehicle documentation, the INREV property valuation framework module has been considered. The manager has defined a valuation framework which fully adopts INREV valuation best practices. The level of current compliance with the defined valuation framework was last formally assessed during the financial year when it was determined that the vehicle was in compliance with all elements of the intended valuation framework. |

| 4 | Performance Measurement |

The manager has disclosed all relevant INREV performance measures in accordance with the requirements of the INREV Performance Measurement module. |

| 5 | INREV NAV | The manager has complied with all the requirements of the INREV NAV module, except for the fact that assumptions used to determine the fair value of deferred taxes are not fully disclosed for confidentiality reasons. |

| 6 | Fee and expense metrics | As described in the vehicle documentation, the INREV fee and expense metrics framework module has been considered The manager has fully complied with the requirements and recommendations of the INREV fee and expense metrics module. |

| 7 | Liquidity | As described in the vehicle documentation, the INREV liquidity framework module has been considered. The manager has defined a liquidity framework which fully adopts INREV liquidity best practices. The manager formally assessed in at the end of the financial year that it currently follows the defined liquidity framework. |

| 8 | INREV data delivery |

The manager is in compliance with the INREV data delivery module. |

| 9 | Code of Tax Conduct | Although not described in the vehicle documentation, the INREV Code of Tax Conduct module has been considered by the manager. The intended framework complies with the INREV Code of Tax Conduct best practices. All best practices have been adopted. The vehicle formally assessed at the end of the financial year that it is currently following its intended Code of Tax Conduct framework. |

| 10 | Sustainability | Although not detailed in the vehicle documentation, the INREV sustainability framework module has been considered by the manager. The intended framework partially complies with the INREV sustainability best practices. All best practices have been adopted except for the fact that the manager has not built a process to manage ESG impact in its supply chain. The manager formally assessed in at the end of the financial year that it currently follows its intended sustainability framework. |

As described in the vehicle documentation the results of the INREV Guidelines Assessments should be disclosed in investor reporting.

Extract "INREV Guidelines Compliance Statement" from results page of the INREV Guidelines Assessments.

Copy + paste the following example statement into your annual and interim reports

INREV Guidelines Compliance Statement - Example purposes only

The European Association for Investors in Non-Listed Real Estate Vehicles (INREV) published the revised INREV Guidelines incorporating industry standards in the fields of Governance, Reporting, Property Valuation, Performance Measurement, INREV NAV, Fees and Expense Metrics, Liquidity and Sustainability. The Assessments follow these guidelines.

INREV provides an Assessment Tool to determine a vehicle's compliance rate with the INREV Guidelines as a whole and its modules in particular.

THE OVERALL INREV GUIDELINES COMPLIANCE RATE OF THE EXAMPLE VEHICLE IS 92.75%, BASED ON 9 OUT OF 9 ASSESSMENTS

The compliance rate for each completed module is:

- Reporting Guidelines is 92.53%, based on 211 / 252 questions applicable.

- Property Valuation Guidelines is 94.35%, based on 48 / 54 questions applicable.

- INREV NAV Guidelines is 97.5%, based on 30 / 42 questions applicable.

- Liquidity Guidelines is 93.67%, based on 31 / 39 questions applicable.

- Sustainability Guidelines is 88.34%, based on 20 / 22 questions applicable.

- Governance Guidelines is 97.44%, based on 84 / 100 questions applicable.

- Fee and Expense Metrics Guidelines is 96.35%, based on 10 / 15 questions applicable.

- Performance Measurement Guidelines is 88.35%, based on 38 / 42 questions applicable.

- Code of Tax Conduct Guidelines is 89.5%, based on 30 / 41 questions applicable.