add

+

Introduction Property Valuation

What has changed?

The updated module includes new best practices related to the governance and oversight of the valuation process. The guidelines are now assembled under the principles of the Governance module. The language reflects the roles and responsibilities of the valuation function, in line with the latest regulations such as AIFMD. In addition, the module introduces guidelines related to the disclosure of sustainability inputs when determining market values to increase transparency over the potential impact of sustainability factors.

When it becomes effective?

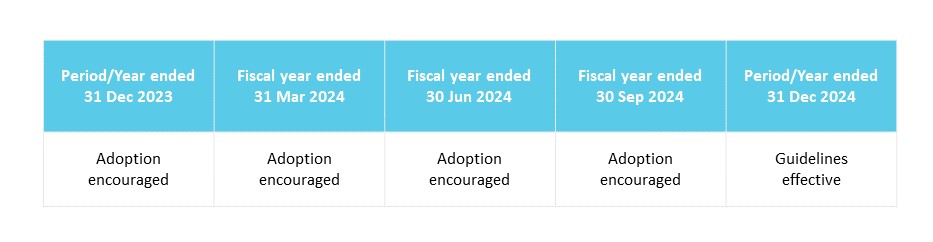

For vehicles to be compliant with this module, a transition period has been established. Investment managers and the governing body of the respective vehicle should assess and implement any organisational or reporting changes triggered by adoption of these guidelines during the period up to 31 December 2023. The guidelines will be applicable for reporting periods beginning on or after 1 January 2024. Earlier adoption is encouraged. Many of the guidelines reflect current industry practice and regulatory reporting which should enable partial or full adoption and compliance with this module as soon as possible.

How do you comply?

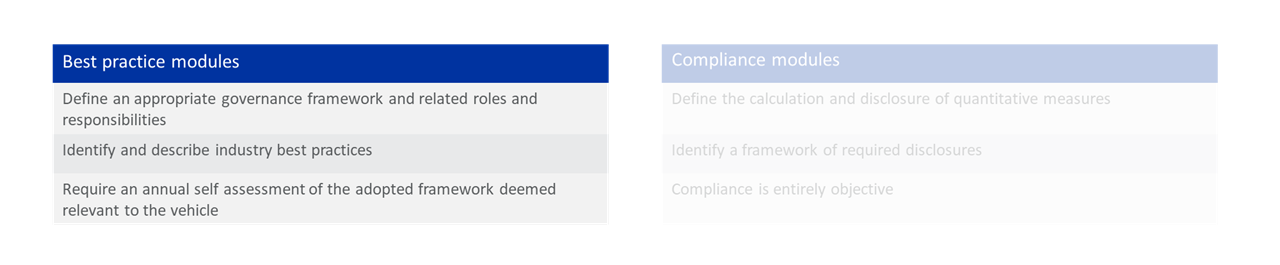

The Property Valuation module is a best practice module:

Read more at inrev-guidelines#inrev-guidelines">INREV Adoption and Compliance Framework.

The INREV Property Valuation module provides a generic framework for the conduct of the property valuation process, its oversight and governance. Although the module specifically focuses on the valuation of property, the general principles of governance and oversight applied in this process are equally relevant to estimating the fair value of other assets and liabilities making up the Net Asset Value (NAV) of the vehicle.

There are also relevant governance guidelines applicable to the oversight of judgements and estimates in general made by management in establishing the NAV of the vehicle as well as specific transparency requirements.

For more information see INREV Governance, INREV NAV and INREV Reporting modules.

The market value of property is a fundamental concept that supports various aspects of the real estate market. As well as being a key performance attribute at an asset level, it is also used in development appraisals and facilitating financing arrangements.

Property values are a key component in the assessment of the NAV which drives a number of performance measures and underlies the determination of pricing of units, management and performance fee arrangements as well as compliance with loan covenants. It is therefore important that investors have confidence in the valuation process for the vehicles in which they invest and have access to objective, consistent and transparent information regarding valuation outcomes. Information about property valuations is also utilised by other stakeholders in the non-listed real estate market such as lending banks and regulators.

Market value, as defined by the International Valuation Standards (IVS), is the estimated amount for which an asset or liability should exchange on the valuation date between a willing buyer and a willing seller in an arm’s length transaction, after proper marketing and where the parties had each acted knowledgeably, prudently and without compulsion.

In this context, the fair value of a property is its market value. For the purposes of this module, property comprises all real estate assets related to the rights of ownership and development of land and physical construction thereon. Underlying market values are determined by independent and qualified external valuers engaged by the investment manager.

The external valuer, as defined by the Royal Institution of Chartered Surveyors (RICS), is a professional valuer who, together with any associates, has no material links with the client, an agent acting on behalf of the client or the subject of the assignment. The valuation function, along with its related roles and responsibilities, is also defined by applicable regulations (for example Alternative Investment Fund Managers Directive in Europe). For more information on the roles of parties involved in vehicle governance see Governance module.

Although the purpose and use of property valuation outcomes may vary across a wide range of vehicle types (eg open end, closed end), the fundamental concepts that drive the integrity of the valuation process remain the same. Property valuations should be determined at least once a year but may be more frequent depending on the vehicle type or economic circumstances.

The module consists of general best practices which are not intended to prescribe technical valuation methodologies or to provide specific instructions on how to assess the market value of a property. These methodologies should be based on applicable regulatory frameworks and valuation standards such as IVS, RICS and European Valuation Standards (EVS).

The Property Valuation guidelines are focused on the determination of market value as described above. Alongside the concept of market value, INREV is currently working on a project to assess the potential for developing best practices on how to model and evaluate future outcomes based on projected cash flows and business scenarios that will meet specified sustainability targets such as net zero or other sustainability criteria. Referring to text and guidelines produced by other industry bodies and regulators on this subject may be relevant.

This module, however, is limited in scope to the disclosure of sustainability inputs into the determination of market value at a valuation date. It does not include the determination of investment value/ worth which takes account of the successful implementation of specific future strategies.

At vehicle launch, the governing body of the vehicle, in collaboration with the investment manager and investors, should design an intended valuation framework that is adapted to the respective vehicle structure and style. As part of this process, the principles and best practice guidelines included in this module should be evaluated and adopted to the extent relevant to the vehicle and referred to in the constitutional documents of the vehicle as appropriate.

The governing body of the vehicle, in collaboration with the investment manager, should thereafter, periodically, perform a self-assessment against the intended property valuation process and framework and take actions as appropriate. The investment manager should describe their property valuation policies and the degree to which they have adopted the INREV Property Valuation best practices in their annual report and vehicle documentation.