add

+

Introduction INREV NAV

How do you comply?

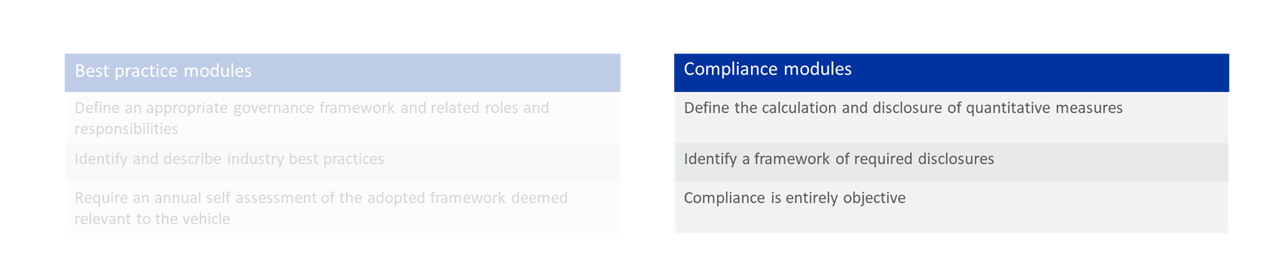

The INREV NAV module is a compliance module:

Read more at INREV Adoption and Compliance Framework.

INREV’s objective in establishing these guidelines is to provide managers with guidance on how to calculate and disclose an INREV NAV in financial reports of non-listed European real estate vehicles. This should lead to transparency and comparability of the performance of different types of vehicle and will enable investors to understand the information provided.

One of the purposes of reporting is to present investors with information relevant to the performance and valuation of their investment. The NAV derived from generally accepted accounting principles (GAAP), including IFRS, does not necessarily fulfil this objective. This guidance has therefore been prepared to provide an industry specific framework to enable managers to calculate a more meaningful adjusted NAV.

Both investors and managers seek an approach that is consistent across the real estate industry. The application of different accounting standards has also led to inconsistency of calculation of an adjusted NAV. Investors and managers also want to be able to compare the performance and valuation of non-listed European real estate vehicles against other vehicles.

INREV NAV should reflect a more accurate economic value of the investment (units) based on the fair value of the underlying assets and liabilities, as at the balance sheet date, as adjusted for the spreading of costs that will benefit different generations of investors, as compared to a NAV based on generally accepted accounting principles.

The main aim of the NAV is to compare vehicle performance across a peer group and for the valuation of the investment in the units for accounting purposes at the investor level. It is not intended to be a measure of the net realisable value of the vehicle units at the balance sheet date, which might be impacted by a wide range of other factors.

The principles and guidelines of how INREV NAV is determined are listed below. Where appropriate, further explanation is provided to assist your understanding. In addition, a tools and examples section includes a sample INREV NAV calculation containing many of the common adjustments that are required to derive an INREV NAV from financial statements prepared under IFRS. Finally a series of questions and answers has been added to provide further assistance with common queries.

The INREV NAV guidelines override the accounting principles by making adjustments to the results arrived at by following the chosen GAAP.

INREV NAV adjustments require material judgment by the manager (e.g., deferred tax, transfer taxes). Consequently, it is important to include sufficient disclosures to allow investors to understand positions taken by the manager.