add

+

Introduction Reporting

What has changed?

The updated module includes asset-level reporting guidelines and a set of sustainability reporting disclosures complemented by required and recommended ESG KPIs. These are cross referenced in the Sustainability module. The ESG KPIs will be incorporated in the 2023 update of the INREV SDDS.

When it becomes effective?

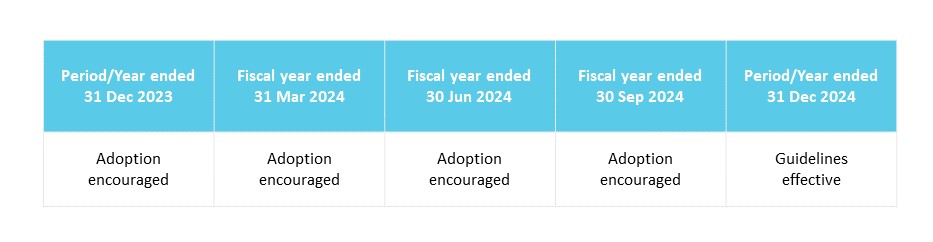

For vehicles to be compliant with this module, a transition period has been established. Investment managers and the governing body of the respective vehicle should assess and implement any organisational or reporting changes triggered by adoption of these guidelines during the period up to 31 December 2023. The guidelines will be applicable for reporting periods beginning on or after 1 January 2024. Earlier adoption is encouraged. Many of the guidelines reflect current industry practice and regulatory reporting which should enable partial or full adoption and compliance with this module as soon as possible.

How do you comply?

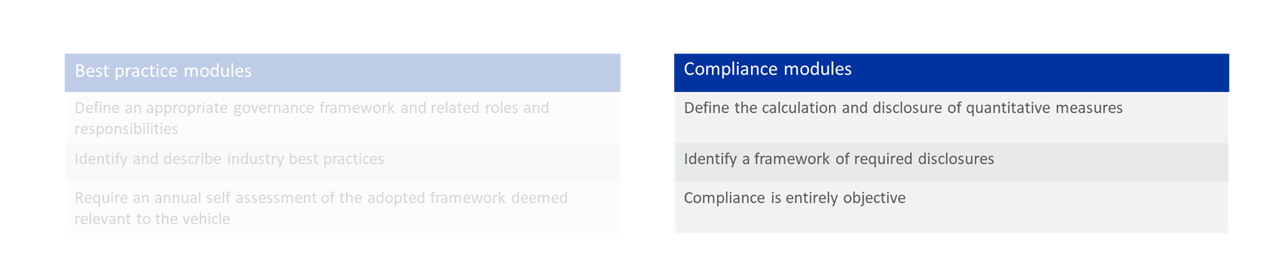

The Reporting module is a compliance module:

Read more at INREV Adoption and Compliance Framework.

The purpose of the Reporting module of the INREV Guidelines is to provide investment managers with a generic reporting framework that meets investors’ needs for comparability and transparency of information and facilitates their decision-making processes through relevant disclosures.

This module includes a list of required disclosures. In addition, users are encouraged to adopt a set of recommended guidelines related to asset-level reporting and sustainability metrics. If an investment manager chooses to adopt the recommended disclosures, the related definitions may be followed. The recommended disclosures are voluntary and do not trigger non-compliance with the Reporting module.

In principle, investment managers should annually report basic data including the characteristics of a vehicle, commentary on vehicle performance and an analysis of the relevant KPIs. The annual report also informs investors about the vehicle’s investment strategy, risk policies and exposures and how the investment manager has complied with its business objectives and policies.

The annual report is commonly composed of the annual review of the performance and activities of the vehicle for the year and the financial statements prepared under relevant GAAP. Alongside an annual report, investment managers should also provide interim reports to investors. The frequency and the level of detail of interim reporting should be defined in vehicle documentation.

Interim reports commonly aim to update investors on the activities and performance of the vehicle during the interim period covered, and provide details of any significant changes that have or could have a material impact on the vehicle’s organisation, governance and risk profile. As well as interim reports, there may be other more informal investor updates and ‘flash’ reports which are prepared on a more frequent basis (eg, monthly), which are outside the scope of the guidelines.

Quantitative data and KPIs, as defined in the Standard Data Delivery Sheet (SDDS), are an integral part of investor reporting under these guidelines and such information should be included in the reports to investors. The ESG KPIs will be included in a new standardised reporting template for ESG data and metrics (2023 release). This template will be integrated into the SDDS.

The quantitative data can be presented in a separate attachment to the annual or interim reports (using the SDDS template) or embedded into the relevant section of the report itself depending on the investment manager’s preference.

The framework of the Reporting module comprises the following topics:

- General vehicle information, organisation and governance;

- Vehicle performance and investor position;

- Manager’s report;

- Property report;

- Risk management;

- Environmental, social and governance (ESG)

The specific considerations incorporated into the Reporting module are as follows:

- Frequency: Financial information should be available on a regular basis for decision-making.

- Assurance/Governance: Sound governance is crucial at the senior management level, which in turn provides assurance over the financial information issued by an investment manager to investors.

- Financial statements: A reporting entity communicates information about its assets, liabilities, equity, income and expenses by presenting and disclosing information in its financial statements. The financial statements provide information about the nature and amounts of a reporting entity’s economic resources and liabilities, and can help users to identify the issuer’s financial strengths and weaknesses.

- Type of reports: Information about a reporting entity’s economic resources and liabilities may be communicated on a more frequent basis through other types of reports alongside the full set of financial statements.

- Regulations: Entities operate in different jurisdictions which are governed by different laws and regulations. Hence, it may be appropriate to disclose the impact, if deemed significant, such laws and regulations have on the issuer’s financial statements.

Annual and interim reporting to investors may include audited annual financial statements or abridged interim financial statements prepared in accordance with the appropriate generally accepted accounting standards.

The investment manager is free to present the INREV report disclosures as a single package together with the audited financial statements or in two separate documents.

Some investment managers may also opt to provide investors full financial statements on an interim basis. Such financial statements may contain some of the information required to be disclosed by these reporting guidelines and can be referred to as appropriate.

Information in the respective financial statements should be consistent with information presented in the annual or interim reports as a whole.

The reporting guidelines focus on the content of investor reports but do not prescribe the organisation and format of such reports.

The INREV SDDS is a standardised data tool that provides investors with the main financial management information they require in a format that allows them to easily upload the data into their own systems. Each reporting requirement has been referenced to relevant SDDS data fields and shows the relationship between the content of annual and interim reports.

The principles and guidelines for reporting are listed below. The frequency column indicates whether the guidelines are an annual reporting requirement or an interim reporting requirement. Where appropriate, further explanation is provided to assist the understanding of the user. In addition, the Tools and Examples section available on the INREV website contains a debt and derivatives disclosures note, a reporting self-assessment tool, the SDDS template, and examples of sustainability reporting and reporting on capital calls and distribution.

The governing body of the vehicle, in collaboration with the investment manager should evaluate the level of compliance with the requirements included in the guidelines – see RG09 for details.