add

+

Introduction to Sustainability

What does it cover?

The module includes guidelines for developing an ESG strategy for real estate investment vehicles and guides users on how to implement ESG best practices into their day-to-day operations.

When it becomes effective?

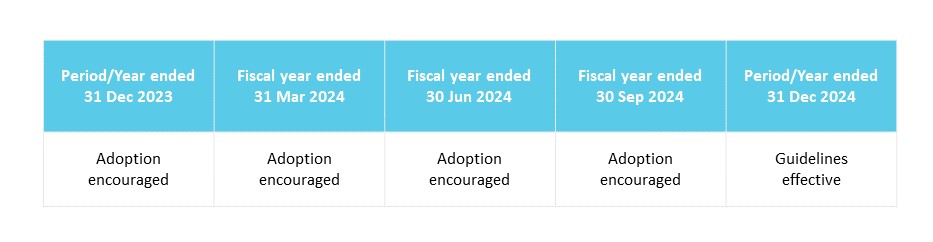

For vehicles to be compliant with this module, a transition period has been established. Investment managers and the governing body of the respective vehicle should assess and implement any organisational or reporting changes triggered by adoption of these guidelines during the period up to 31 December 2023. The guidelines will be applicable for reporting periods beginning on or after 1 January 2024. Earlier adoption is encouraged. Many of the guidelines reflect current industry practice and regulatory reporting which should enable partial or full adoption and compliance with this module as soon as possible.

How do you comply?

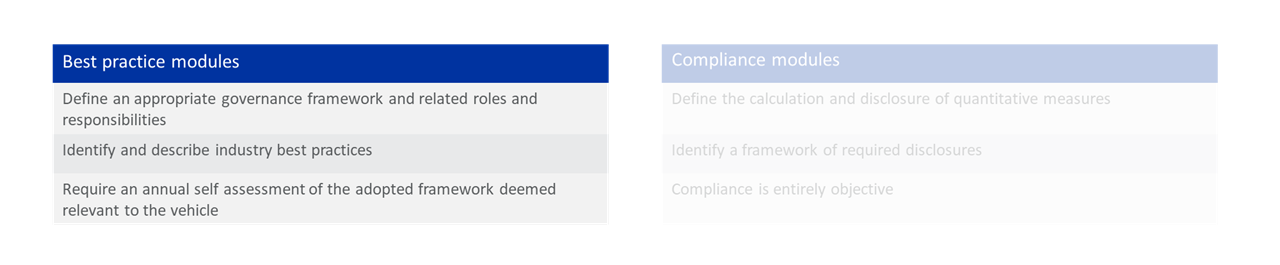

The Sustainability module is a best practice module:

Read more at inrev-guidelines#inrev-guidelines">INREV Adoption and Compliance Framework.

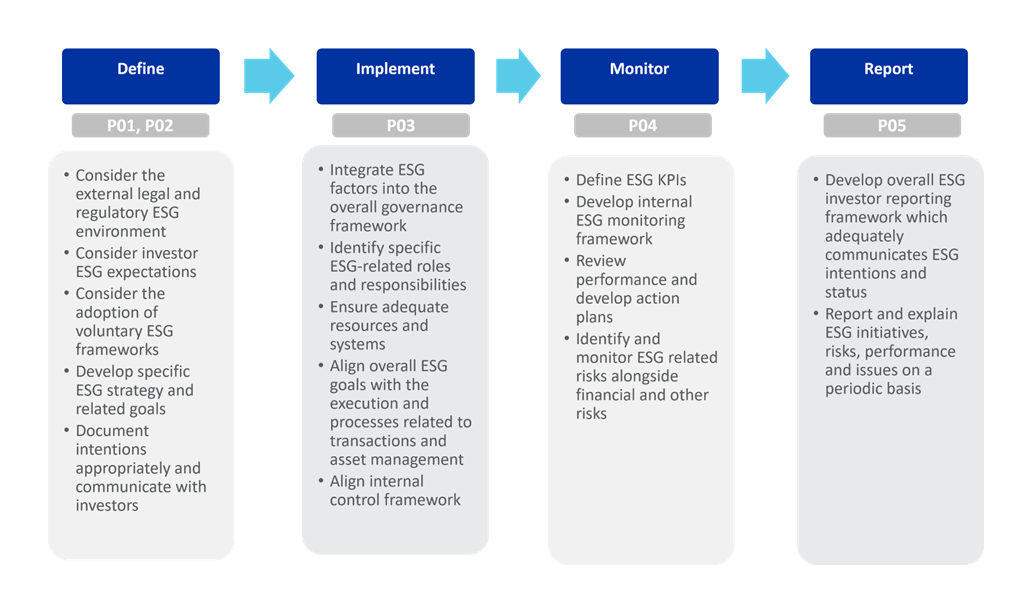

The INREV Sustainability module provides a generic framework for real estate investment vehicles to appropriately consider ESG goals, alongside other business objectives, as part of their overall strategy development. The module then guides users in implementing these goals through an appropriate governance framework established by the investment manager in collaboration with the governing body of the relevant vehicle. This involves establishing and empowering certain roles in an appropriate organisational model and embedding ESG considerations in key business processes. The module also emphasises the importance of effective and regular monitoring throughout the vehicle’s life.

As well as guiding users to implement ESG best practices into their day-to-day operations, the module also references a set of reporting requirements and recommendations as part of the INREV Reporting module, which promote transparency and a degree of standardisation across the industry from the point of view of investor reporting on ESG matters.

The overall process can be summarised by the following diagram.

These best practices and reporting guidelines were developed in order to meet growing investor expectations in this area as well as an acceleration in the pace of regulatory and business initiatives which aim to promote a more sustainable investment approach. In the development of the module as many of these regulatory and voluntary frameworks were considered to ensure the best possible alignment.

For instance, the guidelines include a reference table to other industry standards which are implemented in the real estate industry: GRI, UN PRI, GRESB and TCFD (see list of abbreviations in Appendix 4 under Tools and Examples). The references only intend to show the relationship between the INREV Guidelines and these other frameworks. The module and Appendix 5 also identify common areas which overlap with regulatory requirements but does not go as far as providing a comprehensive disclosure framework to comply with the relevant regulations.

The INREV sustainability guidelines can be applied to a wide variety of different vehicle types, including open end and closed end funds, as well as vehicles that apply specific sustainability frameworks to the conduct of their business and market themselves as such. Although there is significant degree of alignment between these other frameworks and the INREV Guidelines, compliance with these other frameworks, including current regulations, must be assessed independently.

From an operational point of view, real estate investment vehicles generally operate in an environment where the specific roles and responsibilities that support both strategic decision-making, as well as day-to-day operations, are allocated to a number of different parties, including external service providers. Many of the key ESG-related policies and procedures operate within the investment manager’s organisation, some or all of which may be adopted by the vehicle concerned. This typically results in complex and diverse governance models, which are reliant on an effective definition and allocation of roles and responsibilities among those concerned. While these guidelines do not mandate any specific activity to be undertaken by a specific function, the investment manager together with the governing body of the vehicle should ensure collectively that the governance structure is appropriate to effectively govern the vehicle from an ESG perspective in the best interest of its investors and other stakeholders. The structure of the governance framework, and how roles and responsibilities within it are allocated and applied to the vehicle concerned should be explained to its investors.

The INREV Sustainability module has been developed in conjunction with other relevant modules of the INREV Guidelines such as Property Valuation, Reporting, and Governance. For instance, the best practice guidelines are driven from the general principles established in the Governance module, tailored for specific ESG outcomes. In addition, many of the ESG performance indicators specified will become more important as key inputs in the property valuation process, as described in the Property Valuation module. Finally, the sustainability reporting requirements and recommendations are fully integrated into the Reporting module.

For more information, see INREV Property Valuation, Reporting, and Governance modules.

As with other best practice modules of the INREV Guidelines, at vehicle launch, the governing body of the vehicle, in collaboration with the investment manager and investors, should design an intended ESG framework that is adapted to the respective vehicle. As part of this process, the principles and best practice guidelines included in this module should be evaluated and adopted to the extent relevant to the vehicle and referred to in the constitutional documents as appropriate.

The governing body of the vehicle, in collaboration with the investment manager, should thereafter, periodically, perform a self-assessment against the intended ESG framework and take actions as appropriate. The level of adoption of the best practice guidelines and the annual score representing implementation effectiveness should be disclosed to investors in the annual report. This process is facilitated by using INREV’s self-assessment tool.

For more information see the Adoption and Compliance Framework of the INREV Guidelines.

The INREV Sustainability module was developed alongside the new sustainability reporting guidelines of the Reporting module which include a list of required and recommended disclosures that are categorised as follows:

- data and disclosures which are required to be included in a vehicle’s annual report to comply with INREV’s reporting guidelines – these include essential metrics and related explanations which cover key attributes such as energy consumption, greenhouse gas emissions, and other ESG measures;

- a recommended dataset comprising a more comprehensive list of metrics which provide a more granular view of a vehicle’s ESG performance across a wide range of aspects, thus providing more transparency – these recommended metrics may be included and discussed, as applicable, in the annual report and related documents.

If an investment manager chooses to adopt the recommended disclosures, the related data definitions should be followed. The recommended disclosures are voluntary and do not trigger non-compliance with the guidelines.