add

+

Introduction Governance

What has changed?

The updated module reflects the current functions and processes within an investment vehicle, in line with the latest regulations in today’s market. It includes clarifications of the roles and responsibilities with an emphasis on the investment manager of the vehicle. The key principles and concepts from the previous version have been retained. In addition, the module introduces a new Sustainability principle and guidelines reflecting the responsibility towards the environment, society and other stakeholders, and incorporates a set of Open end fund pricing best practices.

Effective date

The module is effective for reporting periods ending on or after 31 December 2022.

How do you comply?

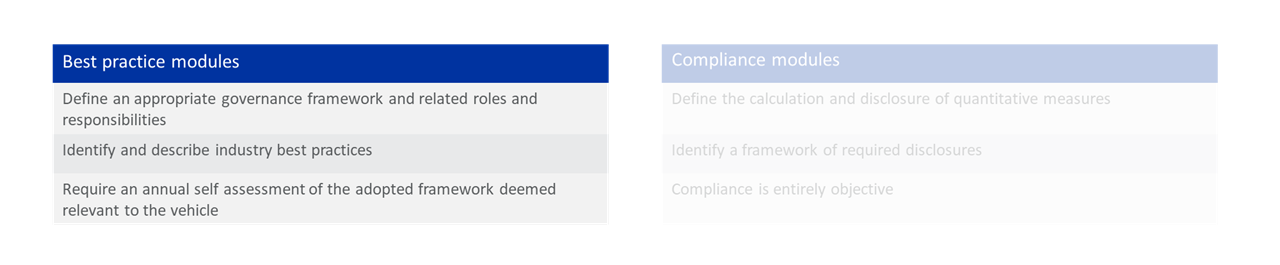

The Governance module is a best practice module:

Read more at inrev-guidelines#inrev-guidelines">INREV Adoption and Compliance Framework.

Good governance is a cornerstone of the success of non-listed real estate vehicles. As well as defining and allocating responsibility for key decisions, good governance impacts the structure, processes, and policies that determine how a vehicle is managed and controlled. Governance frameworks work alongside and are complementary to the external legal and regulatory environment at both international and national levels. For instance, the EU’s Alternative Investment Fund Directive (AIFMD) has a significant impact in shaping the structure of management companies and their relationship with the investment vehicles they manage.

INREV's objective is to promote sound governance and to ensure that investors understand and trust the governance frameworks of the non-listed vehicles in which they invest.

The Governance module comprises both Principles and Guidelines. The Principles set out overarching objectives and obligations and are universally applicable for all participants in a vehicle. The Guidelines, which reflect best practices in the industry, provide a practical framework and set forth actionable steps to align with the meaning of the Principles.

The Guidelines provide general best practices which are applicable in most circumstances to the design, operation, and ongoing management of a vehicle. They include various specific components and examples, which guide the user as to how the Principles should be implemented in practice. The Guidelines are illustrative and should not be considered exhaustive.

At vehicle launch, the governing body of the vehicle, in collaboration with the investment manager manager and investors, should design an intended governance framework that is adapted to the respective vehicle structure and style. As part of this process, the principles and best practice guidelines included in this module should be evaluated and adopted to the extent relevant to the vehicle and referred to in the constitutional documents as appropriate.

The governing body of the vehicle, in collaboration with the investment manager, should thereafter, periodically, perform a self-assessment against the intended governance framework and take actions as appropriate. The level of adoption of the best practice guidelines and the annual score representing implementation effectiveness should be disclosed to investors in the annual report. This process is facilitated by using INREV’s self-assessment tool, the use of which is described in more detail in the Adoption and Compliance Framework of the INREV Guidelines.

How should this module be applied?

Investment managers and the vehicles they manage are diverse in nature. They represent a wide variety of forms in terms of structure, operating models, size and complexity. Since most vehicles are managed and/or advised by an investment manager, as a practical matter, many of the governance responsibilities of the governing body of the vehicle are executed through the appointment, supervision, and oversight of the investment manager. As a consequence, many of the detailed guidelines focus on the conduct of the investment manager.

The role of independent non-executive directors, investor representatives which may form various investor advisory committees, and other parties involved in the operation of the vehicle, including investors and service providers, are also considered as part of this module. See Tools and Examples section for more information on the roles of parties involved in vehicle governance.

The diversity of investment models, risk profiles, vehicle sizes, and the different roles played by third parties mean that it would be inappropriate to be overly prescriptive when defining governance guidelines of an investment vehicle. Our objective is to provide a generic framework, which can be applied to the various types of vehicles that make up the non-listed investment universe. At the same time, specific considerations for open end and closed end vehicles as well as joint ventures and club deals, have been included.