add

+

Introduction Liquidity

How do you comply?

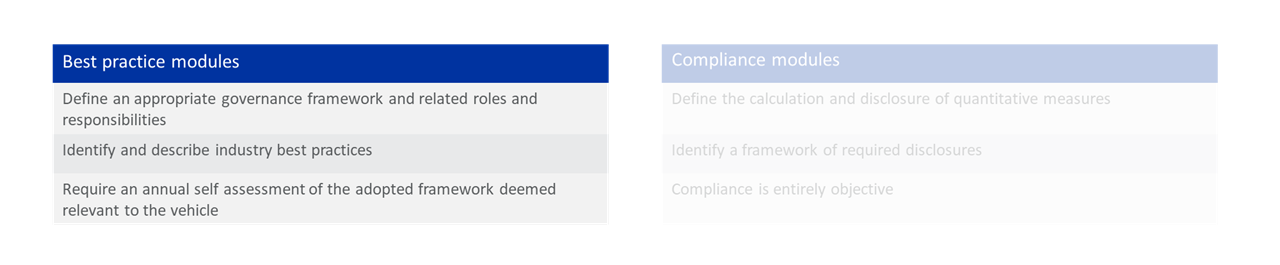

The Liquidity module is a best practice module:

Read more at inrev-guidelines#inrev-guidelines">INREV Adoption and Compliance Framework.

INREV’s objective is to ensure all investors fully understand the liquidity rights that they have when investing into a vehicle and to establish common standards of behaviour among managers and investors in non-listed real estate vehicles in the context of the exercise of liquidity rights.

The way equity (or debt investment) is subscribed to and redeemed from a vehicle has a material impact on the interests of new and existing investors. Overseeing the establishment of a fair liquidity mechanism and the disclosure of it to investors should be one of the objectives of a vehicle’s corporate governance activities. In some jurisdictions and in relation to certain vehicle structures the mechanism is prescribed by legislation or government regulations. In these cases, full disclosure of the rights, obligations and process should still be considered best practice to ensure the vehicle is suitable for the investor.

INREV recognises that non-listed real estate vehicles in Europe are set up under, and governed by, a variety of different national laws. To minimise the conflict between local legislation and the liquidity guidelines, care has been taken to limit the scope of the liquidity guidelines. INREV intends to expand the Tax and Regulations Guide to include information on liquidity mechanisms relating to open end vehicles in the various countries covered.

The importance of liquidity to individual investors varies enormously. Therefore, it is for the manager and the investors to determine at the launch of the vehicle the extent to which the vehicle should adopt these best practices. INREV expects the manager to adopt the best practices as a matter of policy and to diverge from them only with the express consent request of all the investors in a vehicle. The manager should report throughout the life of the vehicle on the level of adoption of the liquidity best practices.

Relationship with other INREV products

Given the liquidity guidelines’ focus on disclosure, there is significant overlap with other guidelines, tools and examples published by INREV. The reader is encouraged to review and to comply with the following:

- Governance guidelines;

- Reporting guidelines.