add

+

Introduction Fee and Expense Metrics

What has changed?

The updated module incorporates the Total Global Expense Ratio (TGER) which replaced the INREV TER. In addition, the INREV REER calculation was refined.

Effective date

The module is effective for reporting periods ending on or after 31 December 2020.

How do you comply?

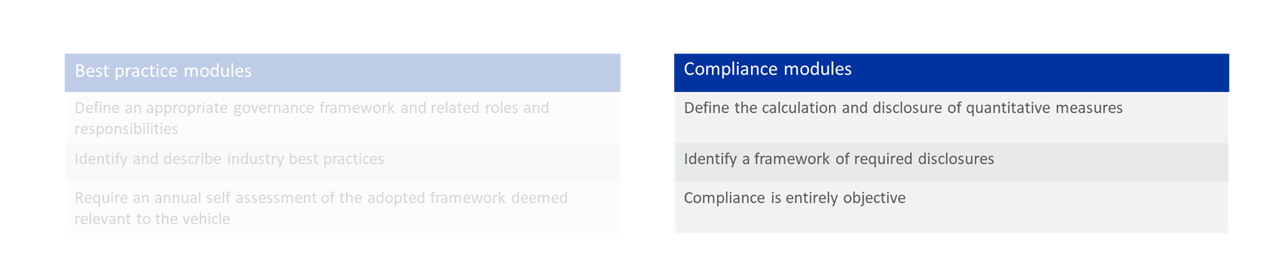

The Fee and Expense Metrics module is a compliance module:

Read more at INREV Adoption and Compliance Framework.

The module has been updated to replace TER by the TGER. For vehicles to be compliant with the INREV Guidelines a transition period has been put in place. Vehicle may choose to either report a TER or TGER before reporting periods ending on 31 December 2020. See Q&A on TGER reporting periods.

The objective of this module is to clarify the calculation and disclosure of the INREV fee and expense metrics: The Total Global Expense Ratio (“TGER”) and the Real Estate Expense Ratio (“REER”). These form part of the standard measures included in the regular reporting of overall performance to investors in a vehicle. When analysed in the context of vehicle style, investment strategy and underlying risks, these fee and expense metrics will help those involved in the non-listed real estate market – both institutional investors and managers – to compare fee and cost structures between different non-listed vehicles and with other investment structures.

INREV aims to improve consistency in the presentation and categorisation of fees and expenses when comparing vehicles from different domiciles. The aim is to provide the greatest possible comparability while also maximising the availability of relevant information in fee and expense metrics. INREV fee and expense metrics have been designed to be straightforward, easy to understand and compatible with the vehicle’s normal reporting cycle.

Fee and expense metrics should reflect the nature of the expenses concerned, in line with the various types of services for which managers charge fees, and the basis on which they charge them. There should be clear disclosure of all the fees that the manager charges, together with the activities to which they relate.

It is important to analyse and explain fee and cost ratios in their correct context. For instance, the TGER for different vehicles should be compared taking account of historical and forecasted return.

At vehicle launch, investors have a particular interest in understanding its forward-looking or projected operating expenses compared to the amount of invested capital, as well as the potential impact of the cost structure on the overall investment return. Accordingly, INREV supports the principle of including forward-looking expenses in the vehicle’s launch documentation.

The principles and guidelines for reporting fee and expense metrics are listed below. Where appropriate, further explanation is provided to enhance the reader’s understanding. In addition, the Tools and Examples section includes a typical calculation of INREV fee and expense metrics.

For more detailed information on the module updates please check the Revision and Change Procedure section.