add

+

INREV NAV

add

+

Introduction INREV NAV

How do you comply?

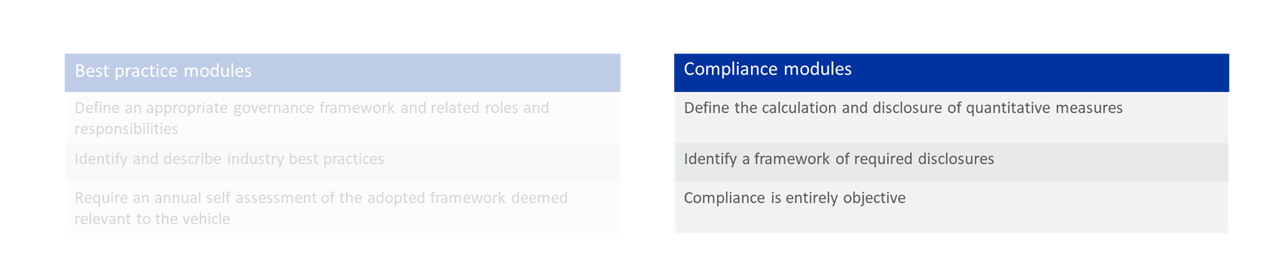

The INREV NAV module is a compliance module:

Read more at INREV Adoption and Compliance Framework.

INREV’s objective in establishing these guidelines is to provide managers with guidance on how to calculate and disclose an INREV NAV in financial reports of non-listed European real estate vehicles. This should lead to transparency and comparability of the performance of different types of vehicle and will enable investors to understand the information provided.

One of the purposes of reporting is to present investors with information relevant to the performance and valuation of their investment. The NAV derived from generally accepted accounting principles (GAAP), including IFRS, does not necessarily fulfil this objective. This guidance has therefore been prepared to provide an industry specific framework to enable managers to calculate a more meaningful adjusted NAV.

Both investors and managers seek an approach that is consistent across the real estate industry. The application of different accounting standards has also led to inconsistency of calculation of an adjusted NAV. Investors and managers also want to be able to compare the performance and valuation of non-listed European real estate vehicles against other vehicles.

INREV NAV should reflect a more accurate economic value of the investment (units) based on the fair value of the underlying assets and liabilities, as at the balance sheet date, as adjusted for the spreading of costs that will benefit different generations of investors, as compared to a NAV based on generally accepted accounting principles.

The main aim of the NAV is to compare vehicle performance across a peer group and for the valuation of the investment in the units for accounting purposes at the investor level. It is not intended to be a measure of the net realisable value of the vehicle units at the balance sheet date, which might be impacted by a wide range of other factors.

The principles and guidelines of how INREV NAV is determined are listed below. Where appropriate, further explanation is provided to assist your understanding. In addition, a tools and examples section includes a sample INREV NAV calculation containing many of the common adjustments that are required to derive an INREV NAV from financial statements prepared under IFRS. Finally a series of questions and answers has been added to provide further assistance with common queries.

The INREV NAV guidelines override the accounting principles by making adjustments to the results arrived at by following the chosen GAAP.

INREV NAV adjustments require material judgment by the manager (e.g., deferred tax, transfer taxes). Consequently, it is important to include sufficient disclosures to allow investors to understand positions taken by the manager.

add

+

Principles

INREV NAV should reflect a more accurate economic value of the investment (units) based on the fair value of the underlying assets and liabilities, as at the balance sheet date, as adjusted for the spreading of costs that will benefit different generations of investors, than the NAV based on generally accepted accounting principles.

add

+

Guidelines

add

+

Fund documentation for INREV NAV framework

The fund documentation should include details of valuation rules and procedures, pricing methodology including the methods used in valuing hard-to-value assets, and the frequency of valuation for all material assets and liabilities of the vehicle.

The fund documentation should disclose the frequency of the NAV calculation.

add

+

INREV NAV Adjustments

The INREV NAV best practice requirements for the calculation of an adjusted NAV should be used for both open end and closed end vehicles. In this section direct links will be made to IFRS as a basis for calculating the required adjustments and, if needed, to other fair value concepts. If another basis of GAAP is used, further adjustments may be required to align with IFRS as the basis for determining an INREV NAV. References to further guidance by INREV on the interpretation of fair value and provision accounting will also be included.

A vehicle NAV calculated in accordance with IFRS should be adjusted for the following items to calculate an INREV NAV:

| Total | |

|---|---|

| NAV per the IFRS financial statements | x |

| Reclassification of certain IFRS liabilities as components of equity | |

| a) Effect of reclassifying shareholder loans and hybrid capital instruments (including convertible bonds) that represent shareholders long term interests in a vehicle | x |

| b) Effect of dividends recorded as a liability which have not been distributed | x |

| NAV after reclassification of equity-like interests and dividends not yet distributed | x |

| Fair value of assets and liabilities | |

| c) Revaluation to fair value of investment properties | x/(x) |

| d) Revaluation to fair value of self-constructed or developed investment property | x/(x) |

| e) Revaluation to fair value of investment property held for sale | x/(x) |

| f) Revaluation to fair value of property that is leased to tenants under a finance lease | x/(x) |

| g) Revaluation to fair value of real estate held as inventory | x/(x) |

| h) Revaluation to fair value of other investments in real assets | x/(x |

| i) Revaluation to fair value of indirect investments not consolidated | x/(x) |

| j) Revaluation to fair value of financial assets and financial liabilities | x/(x |

| k) Revaluation to fair value of construction contracts for third parties | x/(x |

| l) Set-up costs | x/(x) |

| m) Acquisition expenses | x/(x |

| n) Contractual fees | x/(x) |

| Effects of the expected manner of settlement of sales/vehicle unwinding | |

| o) Revaluation to fair value of savings of purchaser’s costs such as transfer taxes | x/(x) |

| p) Revaluation to fair value of deferred taxes and tax effect of INREV NAV adjustments | x/(x |

| q) Effect of subsidiaries having a negative equity (non-recourse | x/(x) |

| Other adjustments | |

| r) Goodwill | (x) |

| s) Non-controlling interest effects of INREV adjustments | x/(x) |

| INREV NAV | x |

Reclassification of certain IFRS liabilities as a component of the INREV NAV:

a) Effect of reclassifying shareholder loans and hybrid capital instruments (including convertible bonds) that represent shareholders’ long term interest in a vehicle

Investors’ capital can take various forms aside from equity – examples include shareholder loans and hybrid capital instruments such as convertible bonds. Some vehicles are structured via a combination of equity participations and shareholder loans.

Shareholder loans and hybrid capital instruments are generally seen as part of the investors’ overall interest in the vehicle. They should be included as a component of equity in the INREV NAV and reclassified as such if they have been classified as liabilities in the financial statements of the vehicle under IFRS. The amount to be reclassified should reflect the corresponding carrying value of the liabilities in the IFRS accounts.

The existence of such instruments as part of the capital structure of a vehicle at its origination, or investor loans that are pari-passu to their equity stake and at off-market loan terms, are indicators, among others, that these items should be reclassified as part of the INREV NAV.

The reclassification should also take account of accrued interest, which is treated in a similar fashion to dividends.

b) Effect of dividends recorded as a liability which have not been distributed

Under certain circumstances dividends are recorded as a liability but have not yet been legally distributed. For the determination of INREV NAV, these accrued dividends should be reversed to the NAV.

Fair value of assets and liabilities

c) Revaluation to fair value of investment properties

If a real estate vehicle uses the option to account for investment properties under the cost model, this adjustment represents the impact on NAV of the revaluation of the investment property to fair value under the fair value option of IAS 40.

The effect of straight-lining of lease incentives, rent guarantees, insurance claims (for damages, lost rent, etc.) should be taken into account when valuing the property at fair value in accordance with IAS 40 and SIC 15 to ensure that any asset is not double-counted in the NAV.

d) Revaluation to fair value of self-constructed or developed investment property

If a real estate vehicle uses the option to account for self-constructed or developed investment property under the cost model, the adjustment represents the impact on NAV of the revaluation of the self-constructed or developed investment property to fair value under the fair value option of IAS 40.

e) Revaluation to fair value of investment property held for sale

Some investment properties may be classified as assets held for sale or as a group of assets held for sale. The carrying value of such investment properties depends on the chosen accounting treatment under IAS 40 (either fair value or cost).

The adjustment represents the impact on NAV of the revaluation of the investment property intended for sale, measured at fair value or cost, to the net realisable value (fair value less disposal costs).

f) Revaluation to fair value of property that is leased to tenants under a finance lease

Property that is leased to tenants under a finance lease is initially measured on a net investment basis and subsequently re-measured based on an amortisation pattern reflecting a constant rate of return.

The adjustment represents the impact on NAV of the revaluation of the finance lease receivable to fair value.

g) Revaluation to fair value of real estate held as inventory

Properties intended for sale and accounted for under IAS 2 (Inventory) are measured at the lower of cost or net realisable value in the financial statements. This adjustment represents the impact on the NAV of the revaluation of such properties to net realisable value (fair value less disposal costs). This adjustment should be included under the caption ‘revaluation to fair value of real estate held as inventory’.

Where the likely disposal date is more than one year from the date of the NAV computation, disposal costs should not be deducted from fair value in calculating this adjustment.

h) Revaluation to fair value of other investments in real assets

Under IAS16 other investments in real assets are normally accounted for at cost.

The adjustment represents the impact on NAV of the revaluation of other investments in real assets to fair value in accordance with the fair value assumptions under IFRS 13.

i) Revaluation to fair value of indirect investments not consolidated

Indirect investments in real estate, such as investments in associations and joint ventures, have different accounting treatments and carrying values under IFRS. Such investments can be valued at cost, fair value or NAV.

The adjustment represents the impact on NAV of the revaluation of indirect investments to fair value if not yet accounted for at fair value.

j) Revaluation to fair value of financial assets and liabilities (including revaluation to fair value of debt obligations)

Financial assets and liabilities such as hedging instruments or debt obligations are generally measured at amortised cost, taking into account any impairment when applicable. The adjustment represents the impact on NAV of the revaluation of financial assets and financial liabilities to fair value as determined in accordance with IFRS, if not yet accounted for at fair value.

In addition, vehicles may incur costs for redemption of bank debts as a result of sales of properties. As with disposal costs, these costs are generally not accrued in IFRS. Where the property is classified as held for sale, any bank debt early redemption costs should be accrued in the NAV.

k) Revaluation to fair value of construction contracts for third parties

Under IAS11, construction contracts for third parties are normally accounted for based on the stage of completion. The adjustment represents the impact on NAV of the revaluation of construction contracts for third parties to fair value in accordance with the fair value principles of IFRS 13.

Adjustments to reflect the spreading of one-off costs

As described in further detail below, set-up costs and acquisition expenses should be capitalised and amortised. The rationale for these adjustments is to spread these costs over a defined period of time to smooth the effect of the write-off of costs on the vehicle’s performance. Furthermore, it is a simple mechanism to spread costs between different investor groups entering or leaving the vehicle’s equity at different times.

In practice, there are many other ways in which vehicles address such issues for pricing, valuation, or other purposes including using bid-ask spreads for issue premium or redemption discounts on the NAV calculated on the basis of set percentages, the capitalisation and amortisation of such costs over different time periods or, indeed, not taking into account such costs at all in the calculation of the vehicle NAV. Since the INREV NAV is primarily intended to facilitate comparability between different vehicles, the INREV approach is a simple but fixed methodology. Please note that these capitalised costs are subject to an impairment test each time the NAV is calculated and therefore should always be recoverable over time. As the adjustments with respect to set-up costs are separately disclosed in the calculation of a vehicle’s INREV NAV, investors can choose how these are taken into account when valuing their holding.

l) Set-up costs

Under IFRS, vehicle set-up costs are charged immediately to income after the inception of a vehicle.

Such costs should be capitalised and amortised over the first five years of the term of the vehicle.

The rationale for capitalising and amortising set-up costs is to better reflect the duration of the economic benefits to the vehicle.

When capitalising and amortising set-up costs, a possible impairment test should be taken into account every time the adjusted NAV is calculated when market circumstances change and it is not expected that the capitalised set-up costs can be recovered through the sale of units of a vehicle. For instance, when a decision is made to liquidate the vehicle or stakeholders no longer expect to recover the economic benefit of such capitalised expenses, they should be written down.

m) Acquisition expenses

Under the fair value model, acquisition expenses of an investment property are effectively charged to income when fair value is calculated at the first subsequent measurement date after acquisition. This results in the fair value of a property on subsequent fair value measurement being lower than the total purchase price of the property, all other things being equal.

Property acquisition expenses should be capitalised and amortised over the first five years after acquisition of the property.

The rationale for capitalising and amortising acquisition expenses is to better reflect the duration of the economic benefits to the vehicle of these costs.

When capitalising and amortising acquisition costs, a possible impairment test should be taken into account every time the adjusted NAV is calculated when market circumstances change and it is not expected that the capitalised acquisition costs can be recovered through the sale of units of a vehicle. When a property is sold during the amortisation period or is classified as held for sale, the balance of capitalised acquisition expenses of that property should be expensed.

n) Contractual fees

A liability represents a present obligation as a result of past events. A fee payable at the end of the life of a vehicle or at any other time during the life of a vehicle may not meet the criteria for recognition as a provision or liability in accordance with IFRS at reporting date.

Examples of such fees include performance fees, disposal fees, or liquidation fees, representing a present obligation from contractual arrangements.

Most of these fees are normally accrued under IFRS accounting rules. The adjustment represents the impact on the NAV of the amount of the estimated contractual fees payable based on the current NAV of the vehicle in the rare circumstances in which these fees are not already recognised in financial statements produced under IFRS and it is probable that they will be incurred. In order to determine the amount of the adjustment, reference should be made to IFRS standards for the measurement (but not necessarily the recognition) of provisions or deferred liabilities.

A description of the calculation methodology and the terms of the underlying agreement should be disclosed (or reference could be made to the related party disclosures in which such agreements and terms are explained).

Effects of the expected manner of settlement of sales/vehicle unwinding

o) Revaluation to fair value of savings of purchaser’s costs such as transfer taxes

Transfer taxes and purchaser’s costs which would be incurred by the purchaser when acquiring a property are generally deducted when determining the fair value of investment properties under IAS 40.

The effect of an intended sale of shares in a property-owning vehicle, rather than the property itself, should be taken into account when determining the amount of the deduction of transfer taxes and purchaser’s costs, to the extent this saving is expected to accrue to the seller when the property is sold.

The adjustment therefore represents the positive impact on the NAV of the possible reduction of the transfer taxes and purchaser’s costs for the benefit of the seller based on the expected sale of shares in the property-owning vehicle.

Disclosure should be made on how the estimate of the amount the manager expects to benefit from intended disposal strategies has been made. Reference should be made to both the current structure and prevailing market conditions.

p) Revaluation to fair value of deferred taxes and tax effect of INREV NAV adjustments

Under IFRS, deferred tax assets and liabilities are measured at the nominal statutory tax rate. The manner in which the vehicle expects to realise deferred tax (for example, for investment properties through share sales rather than direct property sales) is generally not taken into consideration.

The adjustment represents the impact on the NAV of the difference between the amount determined in accordance with IFRS and the estimate of deferred tax which takes into account the expected manner of settlement (i.e., when tax structures and the intended method of disposals or settlement of assets and liabilities have been applied to reduce the actual tax liability).

Disclosures should include an overview of the tax structure including, for instance, details of the property ownership structure, key assumptions and broad parameters used for estimating deferred taxes for each country, the maximum deferred tax amount estimated assuming only asset sales (i.e., without taking into account the intended method of disposal) and the approximate tax rates used.

It is possible that the estimate of the amount of the adjustment required to bring the deferred tax liability related to property disposals to fair value could have a large impact on the INREV NAV. Since tax structures may differ from vehicle to vehicle, significant judgement is required and the mechanics of the calculation methodology for this adjustment may vary from vehicle to vehicle. Other components of the overall deferred tax adjustment require less judgement and are more mechanical in nature.

This adjustment should include a full assessment of the tax impact on NAV of INREV NAV adjustments.

As with IFRS, deferred tax balances are not discounted to take into account time value of money.

q) Effect of subsidiaries having a negative equity (non-recourse)

The NAV of a consolidated group under IFRS may include the net liability position of subsidiary undertakings. In practice, however, the group may have neither a legal nor a constructive obligation to fund the accumulated losses in situations where the financing of the subsidiaries is non-recourse to the vehicle.

In this scenario it is appropriate to make an adjustment when calculating the INREV NAV in order to recognise the group’s interest in such subsidiaries at nil or an adjusted negative amount rather than at a full net liability position, to the extent there is no intention or obligation on the vehicle to make good those losses.

The adjustment represents the positive impact on the NAV of the partial or full reversal of the negative equity of the specific subsidiary. If the vehicle has granted shareholder loans to the subsidiary, these should be taken into account.

Other adjustments

r) Goodwill

At acquisition of an entity which is determined to be a business combination, goodwill may arise as a result of a purchase price allocation exercise. Often a major component of such goodwill in property vehicles reflects the difference between the full recognition of deferred tax, purchaser’s costs or similar items in the IFRS accounts (which does not generally take account of the likely or intended method of subsequent exit), and the economic value attributed to such items in the actual purchase price. Except where such components of goodwill have already been written off in the NAV as determined under IFRS, they should be written off in the INREV NAV.

s) Non-controlling interest effects on the above adjustments

This adjustment represents the impact on the NAV of the recognition of non-controlling interests on all of the above adjustments.

Computation of INREV NAV per share and effect of exercise of options, convertibles and other equity interests

The INREV NAV represents the economic value of the total investment by the investors as a group. To derive the NAV per unit, managers should take into consideration any rights (such as carried interest, performance fees, manager remuneration schemes, terms or different classes of units, NAV waterfall calculation, option shares etc.) held by equity shareholders, or prospective equity stakeholders (in the case of options) of the vehicle in allocating the overall INREV NAV of the vehicle to individual classes of equity shareholders and in determining the individual value of units or shares.

In some circumstances, where the vehicle has raised and called capital, some investors may not have fully paid in their contributions. The INREV NAV per share should take into account the impact of called but unpaid capital.

INREV NAV disclosure requirements

Managers should make following disclosures related to the NAV computation:

- the reconciliation between GAAP NAV and INREV NAV should be presented in line with guideline NAV03

Managers should explain material estimates and computation methodologies to enable investors to understand the components of the reconciliation between GAAP NAV and INREV NAV. Explanatory notes to the reconciliation should describe key assumptions, methods used, and in particular:

- the basis for reclassifying certain shareholder loans or hybrid capital instruments as a component of equity;

- the basis for the determination of fair value of investment property, self-constructed or developed investment property, property that is leased to tenants under finance lease, investment property held for sale and real estate held as inventory;

- the basis of the estimate of other investments in real estate assets;

- the basis for the determination of the fair value of indirect investments not consolidated;

- details of the methodology used to calculate the fair value of financial assets and liabilities;

- the basis of the estimate of the fair value of construction contracts with third parties;

- the basis of the estimate of the fair value of contractual fees;

- details of the assumptions used to estimate the fair value of deferred tax and the tax effect of INREV NAV adjustments. Such disclosure gives an overview of the tax structure including, for instance, details of the property ownership structure, key assumptions and broad parameters used for estimating deferred taxes for each country, the maximum deferred tax amount estimated assuming only asset sales (i.e., without taking into account the intended method of disposal) and the approximate tax rates used;

- reasons for making adjustments to the carrying value of subsidiaries having negative equity (non-recourse);

- under IFRS, the fair value of investment properties does not take into account the expenses incurred by the seller when selling a property. As with IFRS, no adjustment is required to include a provision for such costs in the INREV Guidelines, unless they are held for sale. The manager should, however, estimate and disclose the amount of disposal costs likely to be incurred on the sale of properties, taking account of the intended method of exit, assuming an exit without duress and in the current market environment;

- set-up costs - Description of impairment and reasons for booking if applicable;

- set-up costs - Description of the reasons for departure from the five year amortisation period if applicable;

- acquisition expenses - Description of impairment and reasons for booking if applicable;

- acquisition expenses - Description of the reasons for departure from the five year amortisation period if applicable.

add

+

Tools and examples

Introduction to INREV NAV - INREV eLearning module

Example - INREV NAV computation

Vehicle details:

Multi-sector;

Single-country vehicle: Euroland;

Reporting under IFRS.

Note: the example does not include all required disclosures.

| Assets | Notes | Amount | Liabilities and Equity | Notes | Amount |

|---|---|---|---|---|---|

| Investment property | 1 | 4,500 | Vehicle capital (NAV) | 7 | 1,000 |

| Investment property under construction | 2 | 350 | Deferred tax liability | 8 | 100 |

| Inventory property | 3 | 250 | Fixed rated debt | 9 | 3,000 |

| Finance lease | 4 | 100 | Shareholder Loans | 10 | 2,245 |

| Deferred tax asset | 5 | 25 | Derivative financial instruments | 100 | |

| Investment property held for sale | 6 | 1,275 | Other liabilities | 11 | 55 |

| Total | 6,500 | Total | 6,500 |

Summary of accounting principles and notes

1) Investment property

The investment property is valued at fair value under the fair value option of IAS 40. The current fair value of the property based on an independent valuation report is 4,500. The vehicle is structured as far as possible as a tax neutral structure. All investment properties are held by special purpose vehicles (SPVs). Management’s strategy is to sell all properties through the sale of the shares in the relevant SPVs. It is estimated that this method will save the potential purchaser approximately 200 of transfer taxes.

2) Investment property under construction

Investment property under construction is composed of a self-constructed or developed investment property valued at cost until construction or development is complete. The current fair value of the property under construction based on an independent valuation report is 400.

3) Inventory

Property classified as inventory is measured at the lower of cost or net realisable value. Currently, such inventory is carried at cost in the balance sheet. The current fair value of the property held for sale based on an independent valuation report and including a provision for disposal costs is 300.

4) Finance lease

Property that is leased to tenants under a finance lease is initially measured at the initial net investment and subsequently re-measured based on an amortisation pattern reflecting a constant rate of return. Key assumptions include: Lease contract rent: 6%. Current rent: 7%. The current fair value of the finance lease based on current market interest rate conditions is 125.

5) Deferred tax asset

The deferred tax asset is measured in the financial statements at the nominal statutory tax rate. The nominal tax rate is 25%. This deferred tax asset relates to the revaluation of the derivative financial instruments. Management’s opinion is that a tax rate of 12.5% should be used to reflect the fair value of the deferred tax position concerning the derivative financial instruments.

6) Investment property held for sale

The vehicle is in the process of selling a property located in Euroland. The property has been reclassified as investment property held for sale and is measured at fair value in accordance with IAS 40 which does not include disposal costs of 30.

7) Vehicle equity (NAV)

The vehicle capital structure does not include any options, convertibles and other equity interests other than shareholder loans (see below).

Details of the equity structure of the vehicle are as follows:

In addition to the performance fee arrangement included as a contractual liability, the manager of the vehicle, shareholder A, has a preferred right to an additional 10% of the profit of the year when an IRR hurdle rate is reached. The hurdle rate was reached for the first time in 2013. The profit for 2013 amounts to 100.

The vehicle shareholders are as follows:

| Units | % | |

|---|---|---|

| Shareholder A | 1 | 0.1 |

| Shareholder B | 333 | 33.3 |

| Shareholder C | 333 | 33.3 |

| Shareholder D | 333 | 33.3 |

| Total units issued | 1,000 | 100 |

8) Deferred tax liability

The deferred tax liability is measured in the financial statements at the nominal statutory tax rate. The nominal tax rate is 25%. This deferred tax liability relates to the revaluation of the investment property. The vehicle is structured as a tax neutral structure. All investment properties are held by special purpose vehicles (SPVs). Management’s strategy is to sell all properties through the sale of the shares in the relevant SPVs. It is currently estimated that the sale will not lead to any payments to tax authorities but the deferred tax liability will be settled between the seller and the purchaser. Current market practice for this settlement is estimated to be 50% of the nominal rate.

9) Fixed rate debt

Debt is initially recognised at fair value net of transaction costs and subsequently measured at amortised cost using the effective interest rate method. Key assumptions include: Debt interest 5%. Current interest 5.25%. The current fair value of the fixed rate debt is estimated to be 2,850.

10) Shareholder loans

The financial statements under IFRS show shareholder loans of 2,275. The shareholder loans are judged to form part of the long term interest of the vehicle’s shareholders.

11) Other liabilities

Under the vehicle’s constitution, a component of income in a period is contractually required to be paid out to shareholders. Consequently, other liabilities include undistributed dividends of 30.

12) Set-up costs

Set-up costs are expensed immediately at the inception of the vehicle. The total amount of set-up costs is 100. The vehicle was incorporated in 2010. It is assumed that set-up costs are not deductible.

13) Acquisition expenses

Under the fair value model, acquisition expenses of an investment property are charged to income as a component of fair value changes at the first subsequent measurement date after acquisition.

| Building | Amount | Year of acquisition | |

|---|---|---|---|

| 1 | Building A | 50 | 2010 |

| 2 | Building B | 70 | 2011 |

| 3 | Building C | 30 | 2012 |

| 4 | Building D | 60 | 2013 |

We have assumed that the acquisition costs are incurred on 1 January each year.

14) Contractual fees

Under the other liabilities an obligation is recorded in relation to the fair value of potential performance fees for an amount of 10.

15) Subsidiaries with negative net equity

The vehicle holds a 100% interest in a subsidiary which is in a position of negative equity. The vehicle currently has no intention or constructive obligation to fund the losses. The current accumulated negative equity (including shareholder loans) included in the consolidated accounts relating to this subsidiary is 100.

INREV NAV Calculation

| Total | Notes | |

|---|---|---|

| NAV as per the IFRS financial statements | 1,000 | |

| Reclassification of certain IFRS liabilities as components of equity | ||

| Effect of reclassifying shareholder loans and hybrid capital instruments | 2,245 | |

| Effect of dividends recorded as a liability which have not been distributed | 30 | |

| NAV after reclassification of equity-like interests and dividends yet distributed | 3,275 | |

| Fair value assets and liabilities | ||

| Revaluation to fair value of investment properties | ||

| Revaluation to fair value of self-constructed or developed investment property | 50 | 1 |

| Revaluation to fair value of investment property held for sale | (30) | |

| Revaluation to fair value of property that is leased to tenants under a finance lease | 25 | 2 |

| Revaluation to fair value of real estate asset held as inventory | 50 | 3 |

| Revaluation to fair value of other investments in real assets | ||

| Revaluation to fair value of indirect investments not consolidated | ||

| Revaluation to fair value of financial assets and financial liabilities | 150 | 4 |

| Revaluation to fair value of construction contracts for third parties | ||

| Set-up costs | 20 | 5 |

| Acquisition expenses | 104 | 6 |

| Contractual fees | ||

| Effects of the expected manner of settlement of sales/ vehicle unwinding | ||

| Revaluation to fair value of savings of purchaser’s costs such as transfer taxes | 200 | |

| Revaluation to fair value of deferred taxes and tax effect of INREV NAV adjustments | (16.1) | 7 |

| Effect of subsidiaries having a negative equity (non-recourse) | 100 | 8 |

| Other | ||

| Goodwill | ||

| Non-controlling interest effects of INREV adjustments | ||

| INREV NAV | 3,927.9 |

Notes to the INREV NAV

1. Revaluation to fair value of self-constructed or developed investment property

| Value per IFRS financial statements | 350 |

| Value per INREV Guidelines | 400 |

| INREV NAV adjustment | 50 |

The adjustment represents the impact on the NAV of the measurement of the self-constructed or developed investment properties to fair value.

2. Revaluation to fair value of property that is leased to tenants under a finance lease

| Value per IFRS financial statements | 100 |

| Value per INREV Guidelines | 125 |

| INREV NAV adjustment | 25 |

In the financial statements, properties that are leased to tenants under a finance lease are initially measured at the net investment and subsequently based on a pattern reflecting a constant rate of return. The adjustment represents the impact on the NAV of the measurement of such finance leases to fair value.

3. Revaluation to fair value of inventory property

| Value per IFRS financial statements | 250 |

| Value per INREV Guidelines | 300 |

| INREV NAV adjustment | 50 |

The adjustment represents the impact on the NAV of the measurement of the properties intended for sale recorded using the lower of cost or net realisable value model to fair value less disposal costs.

4. Revaluation to fair value of financial assets and financial liabilities

| Value per IFRS financial statements | 3,000 |

| Value per INREV Guidelines | 2,850 |

| INREV NAV adjustment | 150 |

In the financial statements, debt is initially measured at fair value net of transaction costs and, generally, subsequently measured at amortised cost using the effective interest method. The adjustment represents the impact on NAV of the measurement of all debt and related derivatives to their fair values.

5. Set-up costs

In 2010, an amount of 100 of vehicle set-up costs was expensed immediately to the income statement prepared under IFRS. In accordance with INREV Guidelines, these vehicle set-up costs have been capitalised and amortised over the first five years of the life of the vehicle. During the year 2013, the vehicle amortised an amount of 20, resulting in a cumulative amortisation of 80. The manager assesses that no impairment should be recorded as it is not to be expected that the capitalised set-up costs can be recovered through the sale of the units of the vehicle.

6. Acquisition expenses

From 2010 to 2013, acquisition expenses amounting to 210 were expensed immediately to the income statement prepared under IFRS. In accordance with INREV Guidelines, these acquisition expenses have been capitalised and amortised over the first five years after the acquisition of the buildings. During the year 2013, the vehicle amortised an amount of 42, resulting in a cumulative amortisation of 106. The unamortised amount at 2013 is 104.

The manager assesses that no impairment should be recorded as it is not to be expected that the acquisition expenses can be recovered through the sale of the units of the vehicle.

7. Deferred tax

The deferred tax assets and liabilities are measured in the financial statements at the nominal statutory tax rate. The manner in which the vehicle expects to settle deferred tax is not taken into consideration. The adjustment represents the impact on the NAV of the deferred tax for the assets and liabilities of the vehicle (in this case properties and derivative financial instruments) based on the expected manner of settlement (i.e., when tax structures have been applied to reduce tax on capital gains or allowances, this should be taken into consideration).

Based on the example, the following adjustment would be made:

| Deferred tax | Exit assumption | Temporary taxable difference |

Effective tax rate |

NAV adjustment |

|---|---|---|---|---|

| Revaluation to fair value of self-constructed or developed investment property | Share sale | 50 | 12.5% | (6.3) |

| Revaluation to fair value of inventory | Asset sale | 50 | 25% | (12.5) |

| Revaluation to fair value of property that is leased to tenants under a finance lease | Share sale | 25 | 12.5% | (3.1) |

| Revaluation to fair value of financial assets and financial liabilities | N/A | 150 | 12.5% | (18.8) |

| Acquisition expenses | Share sale | 104 | 12.5% | (13) |

| Existing deferred tax measured at fair value | 37.5 | |||

| Total Effect on NAV | (16.1) |

Key assumptions that support the computation are as follows:

- Management’s opinion is that a tax rate of 12.5% should be used to reflect the fair value of the deferred tax position concerning debts and related derivative financial instruments. For the adjusted NAV calculation all potential other deferred taxes are valued at 50% of the nominal rate.

- Property assets accounted for as inventory are expected to be sold in asset deals and therefore the full statutory rate has been applied to the temporary taxable difference;

- Under IFRS reporting the deferred tax liability for investment property is based on a nominal rate of 25%. All investment properties are held by SPVs. Management’s strategy is to sell properties only through the sale of the shares in the SPVs. The sale will not lead to any tax payments. The deferred tax liability will be settled between the seller and the purchaser. Market practice for this settlement is 50% of nominal rate;

- The difference between the fair value of properties leased to tenants under a finance lease and the corresponding tax book value is expected to reverse as an effective rate of 12.5%, taking into account the vehicle tax structure and likely exit scenario.

- The existing deferred tax measured at fair value is calculated by multiplying the difference between the deferred tax asset and deferred tax liability by 50%.

8. Effect of subsidiaries having a negative equity (non-recourse)

The vehicle holds a 100% interest in a subsidiary which is in a position of negative equity. The vehicle currently holds no intention or constructive obligation to fund the losses. The current accumulated negative equity (including shareholder loans) position is 100. An adjustment of 100 is therefore made to the INREV NAV.

9. NAV per share

| Computation | NAV/share | ||

|---|---|---|---|

| Shareholder A | 10% of profit + 0.1% of the remaining NAV | (10%*100 + 0.1% x (3,927.9-10))/1 | 13.9179 |

| Shareholder B | 33% of NAV minus performance allocation to shareholder A | (33.3% x (3,927.9-10))/333 | 3.9179 |

| Shareholder C | 33% of NAV minus performance allocation to shareholder A | (33.3% x (3,927.9-10))/333 | 3.9179 |

| Shareholder D | 33% of NAV minus performance allocation to shareholder A | (33.3% x (3,927.9-10))/333 | 3.9179 |

The NAV per share is calculated based on the INREV NAV adjusted for any preferences due to shareholders based on the current equity structure. Initially, profit allocation to preferred shareholders is calculated, and then the remaining INREV NAV is allocated according to the current equity structure.

Related Tools & Examples |

Applied Tags |

add

+

Q&A

add

+

Capitalisation and amortisation of set-up costs and acquisition expenses

What is the rationale behind the adjustments in determining the INREV NAV whereby set-up costs and acquisition expenses are capitalised and amortised over five years? Do these adjustments not simply inflate the NAV of the entity given that the property portfolio is already included at its fair value in the NAV calculation?

The initial main aim of the INREV NAV is to help compare vehicle performance across a peer group and for the valuation of the investment in the units for accounting purposes at the investor level.

During the initial INREV NAV project in 2007 it was decided after several workshops, interviews and the white paper process to have one INREV NAV for both open end and closed end vehicles, with the intention of increasing comparability. It was noted that for some adjustments the suggested treatment would not necessarily lead to the correct approach for certain types of vehicle. However, when measuring performance of different types of vehicle (such as in the INREV INDEX), comparability would be increased if all vehicles treated adjustments in the same way.

The initial rationale for capitalising and amortising set-up/acquisition expenses is to better reflect the duration of economic benefit to the vehicle of these costs. This is for both performance measurement and valuation of investments.

This was prompted by the fact that, under IFRS, set-up costs are charged immediately to income after the start/inception of a vehicle and under the fair value model, acquisition expenses of investment property are effectively charged to income when fair value is calculated at the first subsequent measurement date after acquisition – resulting in the so-called J-curve.

Performance measurement

Based on the outcome of the analyses in 2007 it was INREV’s intention to use an adjusted NAV for performance measurement (including in the INREV Index) to mitigate the negative effects of the J-curve. If for performance measurement different types of vehicle, with different vintages, are compared in one index the treatment of set-up costs and acquisition expenses as a one-off expense would lead to an underperformance of that specific vehicle, in comparison with its point of reference, in the first years of the life of the vehicle (acquisition phase). For the years up to the disposal phase it would more easily outperform the point of reference, as the effects of the J-curve arising on new vehicles would lower the overall performance point of reference. During the disposal phase, a vehicle would generally underperform the point of reference as the one-off effects of the disposal costs would have a negative effect on the individual performance of the vehicle.

Valuation of units in investment vehicles

With the amortisation of set-up costs and property acquisition expenses the effect of the so-called “J-curve” can be eliminated in the valuation of units in investment vehicles. Some investors were using an adjusted NAV for valuation, others, at that time, were recording the investments at cost for the first three years and only starting to use IFRS NAV when the appreciation of real estate values had driven IFRS NAV above the initial cost price.

Furthermore, it was noted that investors were of the opinion that such expenses have a value, and were seen as part of the initial investment. These costs were directly incurred in order to receive direct returns from the rental income and hopefully indirect returns by way of value appreciation upon liquidation. This return would flow back to the investor during the whole holding period of an investment.

add

+

Is it required to start with an IFRS NAV to calculate the INREV NAV?

As described in module 4 of the INREV guidelines, INREV’s objective in establishing these guidelines is to provide managers with guidance on how to calculate and disclose an INREV NAV in financial reports of non-listed European real estate vehicles. This should lead to transparency and comparability of the performance of different types of vehicles.

One of the purposes of reporting is to present investors with information relevant to the performance and valuation of their investment. The NAV derived from generally accepted accounting principles (GAAP), including IFRS, does not necessarily fulfil this objective. The INREV guidelines have therefore been prepared to provide an industry specific framework to enable managers to calculate a more meaningful adjusted NAV.

For the sake of clarity, all of the adjustments presented in the guidelines are based on IFRS. However, IFRS also offer some options and INREV adjustments may differ based on the selected option (i.e: cost versus fair value). Consequently, the guidelines are describing all the adjustments which should be done in order to compute an INREV NAV.

Taking this into consideration, it is not mandatory to first calculate an IFRS NAV, adjustments can be applied directly to the chosen GAAP as long as the fund manager clearly understands the purpose of the adjustments and amends the adjustments accordingly.

If the adjustments are performed correctly, the INREV NAV should be the same whatever the initial starting point GAAP was.

add

+

Materiality assessment of INREV NAV adjustments

How can fund managers and investors access their own materiality and disclose this?

Calculating INREV NAV, the question might arise if a certain suggested INREV NAV adjustment would have a material impact on the total INREV NAV.

The reason might be that a fund manager has to take some effort to collect, assess, calculate and evaluate all data and information that is needed to come to a correct INREV NAV Adjustment with sufficient disclosure.

Expecting only immaterial effects and considering the cost-benefit-ratio fund managers might want to decide not to include a certain adjustment.

INREV does not feel to be in the position to determine an accepted amount or % of materiality for INREV NAV Adjustments since materiality level could be different for each vehicle, fund manager, investor or other user of the INREV NAV (for example indices).

Guidance on Materiality can be found in the International Standard on Auditing (ISA) 320: Materiality in Planning and Performing an Audit.

add

+

Materiality in the Context of an Audit

Financial reporting frameworks often discuss the concept of materiality in the context of the preparation and presentation of financial statements. Although the topic is approached in different terms, it is generally explained that:

- Misstatements, including omissions, are considered to be material if they, individually or in the aggregate, could reasonably be expected to influence the economic decisions of users taken on the basis of the financial statements;

- Judgments about materiality are made in light of surrounding circumstances, and are affected by the size or nature of a misstatement, or a combination of both; and

- Judgments about matters that are material to users of the financial statements are based on a consideration of the common financial information needs of users as a group. The possible effect of misstatements on specific individual users, whose needs may vary widely, is not considered.

Determining materiality involves the exercise of professional judgment. A percentage is often applied to a chosen point of reference as a starting point in determining materiality for the financial statements/INREV NAV as a whole.

In the case of a regulated vehicle, the determination of materiality for the financial statements/adjusted NAV, INREV NAV as a whole (and, if applicable, materiality level or levels for particular classes of transactions, account balances, INREV NAV adjustments or disclosures) is/might therefore be influenced by law, regulation or other authority.

Based on circumstances a fund manager could assess if there is a need for a materiality. The materiality could be used to decide not to include certain adjustments.

Since assessing materiality levels might be a complex exercise, INREV recommends to request the auditor of the vehicle what the specific materiality is that he is using for the audit of the financial statements as a whole.

If a fund manager for what so ever reason does not want to include one or more adjustments, the impact on the total INREV NAV should be assessed as a whole. Leaving out one or more individual immaterial adjustments can sum up to a total material error

Further guidance on determining materiality can be found on the website of www.ifac.org.

If the fund manager decided not to include an adjustment, since he expects that leaving out that adjustment should not have a material effect on the INREV NAV in total, proper disclose should be provided.

The fund manager shall include in the disclosure notes to the INREV NAV calculation sufficient background of his decision and the following amounts and the factors considered in their determination:

- Which adjustments are not included as a result of materiality;

- What the rational is for not included these adjustments;

- A statement that in the opinion of the fund manager not including the(se) adjustment(s) does not have a material effect on the INREV NAV as a whole;

- If applicable, the materiality level or levels for particular classes of transactions, account balances, INREV NAV adjustments or disclosures

add

+

INREV NAV Fair Value of DTL of properties

VERNI Real Estate S.A. - and notes

The Balance sheet and Profit and Loss account of VERNI Real Estate S.A. are prepared according to IFRS accounting principles.

The Balance sheet and Profit and Loss account of VERNI Real Estate S.A. are prepared according to IFRS accounting principles.

Accounting principle IFRS

Current and deferred income tax

The tax expense for the period comprises current and deferred tax. Tax is recognised in the income statement, except to the extent that it relates to items recognised directly in other comprehensive income or equity - in which case, the tax is also recognised in other comprehensive income or equity.

The current income tax charge is calculated on the basis of the tax laws enacted or substantively enacted at the date of the statement of financial position in the countries where the Group operates. Management periodically evaluates positions taken in tax returns with respect to situations in which applicable tax regulation is subject to interpretation, and establishes provisions where appropriate on the basis of amounts expected to be paid to the tax authorities.

Deferred income tax is provided in full, using the liability method, on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the consolidated financial statements. However, deferred income tax is not accounted for if it arises from initial recognition of an asset or liability in a transaction other than a business combination that at the time of the transaction affects neither accounting nor taxable profit or loss. Deferred income tax is determined using tax rates (and laws) that have been enacted or substantially enacted by the date of the statement of financial position and are expected to apply when the related deferred income tax asset is realised or the deferred income tax liability is settled.

Deferred income tax assets are recognised to the extent that it is probable that future taxable profit will be available against which the temporary differences can be utilised.

The carrying value of the Group’s investment property is assumed to be realised by sale at the end of use. The capital gains tax rate applied is that which would apply on a direct sale of the property recorded in the consolidated statement of financial position regardless of whether the Group would structure the sale via the disposal of the subsidiary holding the asset, to which a different tax rate may apply. The deferred tax is then calculated based on the respective temporary differences and tax consequences arising from recovery through sale.

Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset current tax assets against current tax liabilities and when the deferred income taxes assets and liabilities relate to income taxes levied by the same taxation authority on either the same taxable entity or different taxable entities where there is an intention to settle the balances on a net basis.

Initial recognition exemption

DTL should be recognized for all taxable temporary differences, except when DTL arises from [IAS12.R15]:

- The initial recognition of goodwill or;

- The initial recognition of an asset or liability in a transaction which:

- is not a business combination and

- at the time of the transaction, affects neither accounting profit nor taxable profit (tax loss)

No deferred tax liability should then be recognised because of the initial recognition exemption rule.

INREV NAV principle on deferred taxes

(Revaluation to fair value of deferred taxes and tax effect of INREV NAV adjustments)

Revaluation to fair value of deferred taxes and tax effect of INREV NAV adjustments Under IFRS, deferred tax assets and liabilities are measured at the nominal statutory tax rate.

The manner in which the vehicle expects to realise deferred tax (for example, for investment properties through share sales rather than direct property sales) is generally not taken into consideration.

The adjustment represents the impact on the NAV of the difference between the amount determined in accordance with IFRS and the estimate of deferred tax which takes into account the expected manner of settlement (i.e., when tax structures and the intended method of disposals or settlement of assets and liabilities have been applied to reduce the actual tax liability).

Disclosures should include an overview of the tax structure including, for instance, details of the property ownership structure, key assumptions and broad parameters used for estimating deferred taxes for each country, the maximum deferred tax amount estimated assuming only asset sales (i.e., without taking into account the intended method of disposal) and the approximate tax rates used.

It is possible that the estimate of the amount of the adjustment required to bring the deferred tax liability related to property disposals to fair value could have a large impact on the INREV NAV. Since tax structures may differ from vehicle to vehicle, significant judgement is required and the mechanics of the calculation methodology for this adjustment may vary from vehicle to vehicle. Other components of the overall deferred tax adjustment require less judgement and are more mechanical in nature.

This adjustment should include a full assessment of the tax impact on NAV of INREV NAV adjustments.

As with IFRS, deferred tax balances are not discounted to take into account time value of money.

Tax structure

- A fund is structured that it has 6 properties in different countries.

- These are held via 4 SPV's.

Tax structure |

|||||||

|---|---|---|---|---|---|---|---|

| Property name | Deal 1a | Deal 1b | Deal 2 | Deal 2 | Deal 3 | Deal 4 | |

| Company | Company 1 | Company 1 | Company 2A | Company 2B | Company 3 | Company 4 | |

| Category | Investment properties | Investment held for sale | Investment properties | Investment properties | Investment properties | Finance lease | |

| Country of company | BE | BE | NL | NL | GER | NL | |

| Country of property | BE | BE | NL | NL | GER | NL | |

| Tax rate | 34% | 34% | 31% | 31% | 22% | 31% | |

| Commercial book value | 43,000,000 | 13,500,000 | 19,000,000 | 52,000,000 | 67,000,000 | 18,750,000 | 213,250,000 |

| Fair value | 44,500,000 | 16,500,000 | 20,000,000 | 54,000,000 | 69,000,000 | 19,500,000 | 223,500,000 |

| Tax book value | 40,475,000 | 12,575,000 | 17,925,000 | 48,650,000 | 63,150,000 | 17,687,500 | 200,462,500 |

| Exit Strategy | Share deal | Property deal | Share deal | Property deal | Share deal | Share deal | |

| DTL saving allo-cated to seller % | 50% | 50% | 40% | 40% | 60% | 40% | |

| DTL booked in the IFRS accounts | 0 [1] | 1,334,500 | 643,250 | 1,658,500 | 1,287,000 | 561,875 | 5,485,125 |

[1] Due to initial recognition exemption (FV at acquisition 45,000,000)

add

+

Calculation of adjustment in respect of deferred tax liability

Is it appropriate to calculate the fair value of the deferred tax liability as a fixed percentage of the total possible tax liability on a portfolio basis or any other aggregate basis?

The rationale behind this adjustment is that under IFRS (and many other GAAPs) deferred tax liabilities (DTL) are measured at the nominal statutory tax rate. Also, there may be initial recognition exemptions (for example, IAS 12 “Income Taxes”, paragraph 15) that affect the basis for the DTL calculation for the accounting purposes. The manner in which a vehicle expects to settle deferred taxes is generally not taken into consideration. Accordingly, the DTL provision calculated based on the respective accounting rules may not be representative of the fair value of the DTL (i.e., the actual tax effects expected to be crystalised upon disposal of the property assets or a disposal price deduction in respect of the “latent capital gain tax”, as discussed below).

In calculating the adjustment of the fair value of the DTL, based on the expected manner of settlement, the adjustment should be assessed on an asset-by-asset basis.

For each asset, therefore, consideration should be given as to the most likely form of disposal (e.g., asset deal or share deal) based on the intended disposal method and tax structuring of the entities directly or indirectly owning the asset as well as market conditions relevant to that property as at the date of calculation. Assumption of changes in disposal method based on as-yet unrealised future changes in market conditions are considered too subjective for the purposes of calculating the INREV NAV adjustments. If applicable, the history of the entity with regard to disposals should also be considered. The fair value of the DTL is then calculated in accordance with the assessed manner of settlement as well as the applicable rates at which the transaction would be taxed. IFRS allows only the rates that have been enacted or substantially enacted at the balance sheet date to be used whereas rates which have been enacted or substantially enacted after the balance sheet date can be used for the purposes of calculating the INREV NAV adjustment.

The calculation should also take into account any discounts to the sale price of a property sold via a share deal that are likely to be granted. For example, it may be that the sale of the shares of the property-owning entity is exempt from tax (or attracts minimal tax) but a deduction in respect of a portion of the latent capital gain tax within the property owning entity is made in arriving at the sale price. This amount in addition to any tax likely to crystalise on the disposal transaction should be taken into account when calculating the INREV NAV adjustment.

On this basis, therefore, a fixed percentage approach as outlined above will not be appropriate unless it represents a reasonable estimate of the adjustment required in respect of the DTL for each of the individual properties in the portfolio.

It is imperative to ensure that the calculation of the adjustment, either in part or in full, is not already included within the DTL calculated for the vehicle under IFRS / local GAAP, so as to avoid double-counting of the adjustment.

Care should also be taken to ensure that the other taxes, including transfer taxes, are not mixed with the deferred income taxes assessed in this adjustment. The positive effect of the INREV adjustment “Revaluation to fair value of savings of purchaser’s costs such as transfer taxes“ with regard to the valuation of property should however be considered when assessing the fair value of the DTL. This is because the latent capital gain, subject to an eventual discount granted to the buyer, will likely consider the effects of transfer tax savings on the asset fair value. However, if in market practice the "Revaluation to fair value of savings of purchaser’s costs such as transfer taxes" is excluded from the agreed discount calculation on deferred taxes, this addition to the property's fair value might not be applicable for the purpose of the INREV DTL fair value.

Example:

| INREV NAV 04 reference | IFRS | INREV (asset deal) |

INREV (share deal) |

|

|---|---|---|---|---|

| 20X1 | 20X1 | 20X1 | ||

| Property fair value (in accordance with IFRS) | c) - k) | 100 | 100 | 100 |

| Fair value of savings of purchaser's costs | o) | n/a | - | 5 |

| Adjusted fair value | 100 | 100 | 105 | |

| Property tax value (in accordance with tax books) | 65 | 65 | 65 | |

| Temporary taxable difference (fair value minus tax value) | 35 | 35 | 40 | |

| Initial recognition exemption | (10) | - | - | |

| Temporary difference subject to deferred tax | 25 | 35 | 40 | |

| Tax rate | 20% | 20% | 20% | |

| Deferred tax liability (negative) | (5) | (7) | (8) | |

| Discount on latent capital gain tax (assumed here at 25%) | n/a | 25% | ||

| INREV fair value of the DTL | (7) | (2) | ||

| INREV NAV adjustment (INREV minus IFRS)* | p)* | (2) | 3 |

Given the subjective and complex nature of this calculation, therefore, it is recommended that managers document a formal internal policy with regard to the calculation methodology and review the policy on an ongoing basis (for example, with respect to changes in tax law and market conditions) in order to ensure that it remains appropriate. Disclosure should be given on the overall tax structure, including the ownership structure, key assumptions, expected manner of asset disposals and broad parameters for each country (including quantum of assumed discounts), what the maximum taxation calculation would be on a traditional basis (i.e., without tax structures) and the approximate tax rate as a percentage.

* Excluding possible tax effects of other INREV NAV adjustments as discussed in NAV-Q06-2

How are the “tax effects of INREV NAV adjustments” calculated? Do all INREV adjustments give rise to the INREV tax effects adjustment?

The rationale behind this requirement is to account for a possible tax impact of all INREV adjustments onto the INREV NAV. Care should be taken not to double-count the tax effects with the INREV DTL fair value adjustment (NAV-Q06-1). It is likely that the INREV NAV adjustments, such as Revaluation to fair value of investment properties, self-constructed or developed, held for sale, leased or held as inventory, and other investments in real estate, are already considered when calculating the INREV DTL fair value adjustment (see the Example in NAV-Q06-1).

“Revaluation to fair value of indirect investments not consolidated” may give rise to extra tax effects on the NAV, depending on the direct taxation of the capital gain on the sale of associates and joint ventures, or other direct or indirect tax effects associated with them**.

“Revaluation to fair value of financial assets and liabilities (including revaluation to fair value of debt obligations)” will normally give rise to a tax effect in the INREV NAV if these financial instruments are at the level of a taxable entity. Indeed, had these instruments been fair valued in the balance sheet, a deferred tax would have likely been accrued. Economically, such deferred tax represents the tax effects associated with the financial instrument cashflows. For example, a higher fair value of debt (hence, a negative INREV NAV adjustment) will likely reflect the higher interest payments, which in turn will likely attract extra tax deductible effects and hence, a positive INREV NAV adjustment**.

A similar approach should be taken in relation to “Revaluation to fair value of construction contracts for third parties"**.

The adjustments to reflect the spreading of the set-up costs and acquisition expenses may also give rise to the tax effects in the future, depending on whether they are tax deductible at the level of the entity where they were incurred. It will be common that the set-up cost at a fund level will be non-deductible due to the fund tax regime, while the acquisition costs may be tax deductible. It is also important to consider that some of the acquisition costs will be capitalised as part of the property and thus are part of its tax value, hence captured by the DTL FV adjustment (“Property tax value” in the Example).

Adjusting for the Contractual fees may give rise to a positive tax effect if these fees are tax deductible in the future, and thus should be considered**.

Caution should be taken in relation to the “Revaluation to fair value of savings of purchaser’s costs such as transfer taxes” – as illustrated in the Example, and following the market practice, when this adjustment is applicable (intended sale of shares in a property-owning vehicle) the DTL FV adjustment (NAV-Q06-1) will likely consider the gross fair value (i.e. including savings of the purchaser’s cost) and thus no further tax effects should be reflected in the INREV NAV.

Other adjustments – goodwill, non-controlling interest effects, and INREV reclassifications – should not result INREV NAV tax effects.

** The tax effects of this INREV NAV adjustment are not illustrated in the Example in NAV-Q06-1.

add

+

Calculation of adjustment in respect of transfer taxes

How should this adjustment be calculated? Is it appropriate to compute this as a fixed percentage (e.g., 50%) of the transfer taxes for the vehicle under IFRS/local GAAP?

The calculation of the adjustment to the deduction of transfer tax (and other purchaser’s costs) inherent in the property valuation based on the expected manner of settlement, should be assessed on an asset-by-asset basis.

For each asset, therefore, consideration should be given as to the most likely form of disposal (e.g., asset deal or share deal) based on the intended disposal method and tax structuring of the asset as well as market conditions relevant to that property. If applicable, the history of the entity with regard to disposals and the agreed allocation of the tax burden between the seller and the purchaser should also be considered. This is the same rationale as for the calculation of the deferred tax liability adjustment. Where the assessed disposal method would result in a reduction in the transfer taxes (and purchaser’s costs) in the fair valuation of the property, this adjustment is made in arriving at the INREV NAV. However, the adjustment should only be included to the extent to which it is not already included in the property valuation, in order to avoid double-counting.

For this reason it is important that transfer taxes and other purchaser’s costs are considered as separate components when computing the adjustment. The same reduction may not be appropriate in both cases. For example, a share deal disposal may result in lower transfer taxes but may, in fact, increase the other purchaser’s costs due to the need for additional legal expenditure and diligence required to complete any such deal.

On this basis, therefore, a fixed percentage approach as outlined above will not be appropriate unless it represents a reasonable estimate of the adjustment required for both transfer taxes and other purchaser’s costs for each of the individual properties in the portfolio.

Given the subjective and complex nature of this calculation, therefore, it is recommended that managers document a formal internal policy with regard to the calculation methodology and review the policy on an ongoing basis (for example, with respect to changes in tax law and market conditions) in order to ensure that it remains appropriate. Adequate disclosures should also be provided so that users of the financial information can understand the calculation methodology with regard to the adjustment, as well as the key assumptions that the manager has made in the calculation and how the manager expects to utilise this additional value based on the current structure and market circumstances.

add

+

Investment in an associate/joint venture

How should the INREV Guidelines be applied when valuing an entity’s investment in an associate/joint venture which is accounted for in the IFRS/local GAAP accounts of the entity (using either the equity method or proportionate consolidation)?

For the purposes of the INREV NAV, management’s best estimate of the fair value of the entity’s holding in the associate/joint venture should be used. Depending on the type of investment there will be a hierarchy of valuation methods in order to assess this:

1. If the investment is quoted on an active market then the fair value should be calculated using the quoted price as at the calculation date;

2. For investments in vehicles where there is a right of redemption at a contractually set NAV, then this should be used to value the holding irrespective of whether this NAV is consistent with INREV Guidelines;

3. If the investment is in a closed end vehicle or a similar type of entity and there is no fixed redemption price or listed price then the fair value of the holding should be estimated so as to be consistent with INREV Guidelines;

4. If there is not sufficient information available to compute the INREV NAV of the investment then another valuation technique should be used including, for example, an estimate based on recent comparable transactions if these are available.

add

+

Portfolio premium/discount

Should the INREV NAV calculation include a portfolio premium/discount where, for example, the independent appraiser’s valuation report includes a statement that the portfolio as a whole would command a premium/discount in addition/decrease to/of the individually appraised values of each property?

The portfolio premium/discount should not be included in the INREV adjusted NAV and, according to the INREV Guidelines for property valuation, should not be included within the fair value of property. Nevertheless it is recommended that any such premium or discount be disclosed separately.

add

+

Held-to-maturity derivatives

Is it not the case that, for open end vehicles, there is no need for fair valuations for hedging derivatives on the basis that upon maturity the value of these should be nil?

For both closed end and open end vehicles, the diluted INREV NAV should reflect all hedging derivatives at their fair value.

add

+

Treatment of Debt arrangement fees and costs

For INREV NAV calculation purposes, capitalised debt arrangement fees and costs should not be considered when the fair value of the loan is compared with the carrying amount at balance sheet date. This is because the debt arrangement fees and costs are netted with the related financial instrument.

The fair value of the financial liability should be compared with the long- and short-term part of the principal amount still open at balance sheet date, also referred to as the nominal value of the financial instrument.

Rationale

Based on various technical questions and debates from within the INREV community on this topic, INREV notes that practitioners use different approaches regarding the treatment of debt arrangement fees and costs for the following INREV NAV adjustment j) Revaluation to fair value of financial assets and financial liabilities.

Background

Under IFRS, financial liabilities within the scope of IFRS 9 are measured at:

- Financial liabilities at fair value through profit or loss

- Financial liabilities at amortised cost.

Financial liabilities are generally classified and measured at amortised cost, unless they meet the criteria for classification at fair value through profit or loss.

In this Q&A, we initially focus on financial liabilities measured at amortised cost and then on financial liabilities at fair value through profit or loss.

Initial measurement at initial recognition: an entity shall measure a financial liability at its fair value plus or minus, in the case of a financial liability not at fair value through profit or loss, transaction costs that are directly attributable to the issue of the financial liability.

Debt arrangement expenses includes fees and commission paid to agents (including employees acting as selling agents), advisers, brokers and dealers, levies by regulatory agencies and security exchanges, and transfer taxes and duties. Debt arrangement expenses do not include debt premiums or discounts, or internal administrative or holding costs.

Reference is made to the INREV Global Definitions Database (GDD) in respect to debt arrangement costs and debt arrangement fees.

In the amortised cost approach after initial recognition, the amount at which the financial asset or financial liability is measured at initial recognition minus the principal repayments, plus or minus the cumulative amortisation, using the effective interest method of any difference between that initial amount and the maturity amount and, for financial assets, adjusted for any loss allowance.

The effective interest method that is used in the calculation of the amortised cost of a financial asset or a financial liability and in the allocation and recognition of the interest revenue or interest expense in profit or loss over the relevant period.

When applying the effective interest method, an entity generally amortises any fees, points paid or received, transaction costs and other premiums or discounts that are included in the calculation of the effective interest rate over the expected life of the financial instrument.

Treatment of capitalised debt arrangement expenses

Based on these assumptions, when the debt position is accounted for at amortised cost, the debt arrangement expenses remaining to be amortised should be considered.

INREV NAV should be adjusted for the spreading of costs that will benefit different generations of investors. The assessment on how to consider the capitalised debt arrangement expenses in the INREV NAV should be based on this principle.

Under IFRS, when applying the effective interest method, an entity generally amortises any fees and transaction costs that are included in the calculation of the effective interest rate over the expected life of the financial instrument. Therefore, the treatment for the capitalised debt arrangement expenses under IFRS is already in line with the INREV NAV principle of spreading one-off costs over time to benefit different generations of investors.

Example

|

Debt accounted for at amortised cost |

|

|

Original principal amount |

€ 100 million |

|

Fixed interest |

8% |

|

Current market fixed interest |

6% |

|

Remaining term |

5 years |

|

Capitalised debt arrangement cost at balance sheet date |

€3 million |

|

Remaining principal amount at balance sheet date (after previous repayments) |

€ 80 million |

|

Carrying amount at balance sheet date |

€ 77 million |

|

Fair value of the debt at balance sheet date |

€ 90 million |

Calculation of the adjustment:

As previously indicated, the capitalised debt arrangement cost should not be taken into account when the fair value of the loan is compared with the carrying amount at balance sheet date.

| Items | Amount (€ M) |

| Fair value of the loan | 90 |

| Remaining principle amount | 80 |

| To be adjusted amount | (10) |

As the current market fixed interest is lower than the actual fixed rate, the fair value is more than the remaining principal amount. As a result, the INREV NAV adjustment is a negative adjustment of € 10 million.

Accounting of financial liability at fair value

Under IFRS 9, debt instruments under certain circumstances can be measured at fair value through Profit and Loss. However, the accounting of debt instruments at fair value is not a common approach.

All financial instruments are initially measured at fair value plus or minus transaction costs. As a result, for financial liability at fair value through profit or loss, the debt arrangement fees and costs are not capitalised and directly expensed in Profit and Loss.