add

+

Introduction Performance Measurement

What has changed?

The updated module provides clarifications on the description of assumptions and enables a more detailed performance analysis. It includes a methodology for asset-level return calculation in line with the INREV Asset Level Index. In addition, new guidelines for the calculation of gross of fee performance returns were added to assess the impact and complexity of fee models.

Effective date

The module is effective for reporting periods ending on or after 31 December 2022.

How do you comply?

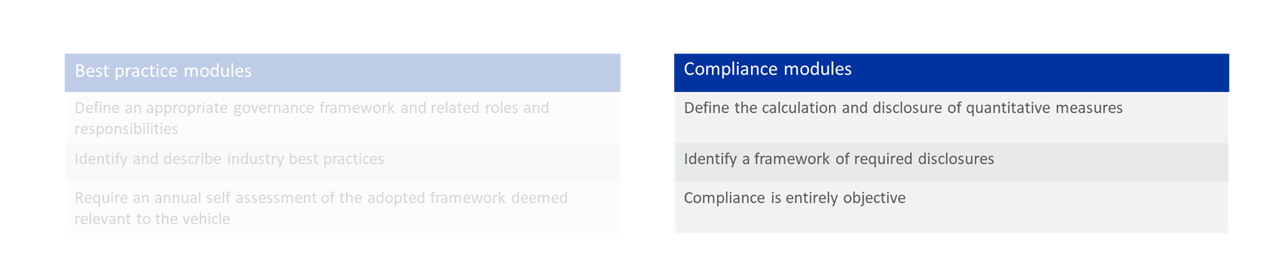

The Performance Measurement module is a compliance module:

Read more at INREV Adoption and Compliance Framework.

The purpose of the Performance Measurement module of the INREV Guidelines is to provide support to investment managers when computing and reporting historic performance measures, both at a vehicle and asset level. These guidelines have been designed primarily for direct property vehicles.

The guidelines aim to increase consistency in the reporting of performance to investors. The standardisation involved will also improve the relevance of indices, such as the INREV Indices, which may potentially be used as points of reference. Comparing the performance of a vehicle and of assets can add insight into the overall vehicle performance. The point of reference should relate to vehicles with similar investment mandates, objectives, or strategies.

The Performance Measurement module includes concepts that are consistent with the Global Investment Performance Standards (GIPS) issued by the CFA Institute and the NCREIF PREA Reporting Standards. Although the frameworks are different, the intention is to align the approaches and avoid conflicts in the methodologies.

This module has been developed in light of existing practice in the European non-listed real estate industry. It includes a list of required and recommended performance measures. If an investment manager chooses to disclose the recommended performance measures, the related computation and disclosure requirements should be followed to claim compliance with this module. Performance metrics that are recommended may be disclosed on a voluntary basis. The non-disclosure of such metrics would not trigger non-compliance with the Performance Measurement module.

Investment managers should evaluate the level of compliance with the requirements included in the guidelines. A self-assessment should be performed periodically. The level of compliance and the annual score representing compliance effectiveness should be disclosed to investors in the annual report. This process is facilitated by using INREV’s self-assessment tool, the use of which is described in more detail in the Adoption and Compliance Framework of the INREV Guidelines.

Read more at INREV Adoption and Compliance Framework.

Performance measures and the level of disclosures may vary depending on the style of the vehicle. The level of discretion of an investment manager in determining the cash flows of a vehicle and investment restrictions vary significantly depending on the vehicle type. Some performance measures may not be appropriate for some vehicles. For instance, investment managers of closed end vehicles have discretion over capital calls and distributions, while investment managers of open end vehicles need to accommodate new issues and redemptions, which may interfere with the portfolio strategy. In this context, money-weighted returns are more relevant for closed end vehicles whereas time-weighted returns are more relevant for open end vehicles.

This module includes several new metrics as presented in the following summary table:

For more detailed information on the module updates please check the Revision and Change Procedure section.