add

+

Fee and Expense Metrics

add

+

Introduction Fee and Expense Metrics

What has changed?

The updated module incorporates the Total Global Expense Ratio (TGER) which replaced the INREV TER. In addition, the INREV REER calculation was refined.

Effective date

The module is effective for reporting periods ending on or after 31 December 2020.

How do you comply?

The Fee and Expense Metrics module is a compliance module:

Read more at INREV Adoption and Compliance Framework.

The module has been updated to replace TER by the TGER. For vehicles to be compliant with the INREV Guidelines a transition period has been put in place. Vehicle may choose to either report a TER or TGER before reporting periods ending on 31 December 2020. See Q&A on TGER reporting periods.

The objective of this module is to clarify the calculation and disclosure of the INREV fee and expense metrics: The Total Global Expense Ratio (“TGER”) and the Real Estate Expense Ratio (“REER”). These form part of the standard measures included in the regular reporting of overall performance to investors in a vehicle. When analysed in the context of vehicle style, investment strategy and underlying risks, these fee and expense metrics will help those involved in the non-listed real estate market – both institutional investors and managers – to compare fee and cost structures between different non-listed vehicles and with other investment structures.

INREV aims to improve consistency in the presentation and categorisation of fees and expenses when comparing vehicles from different domiciles. The aim is to provide the greatest possible comparability while also maximising the availability of relevant information in fee and expense metrics. INREV fee and expense metrics have been designed to be straightforward, easy to understand and compatible with the vehicle’s normal reporting cycle.

Fee and expense metrics should reflect the nature of the expenses concerned, in line with the various types of services for which managers charge fees, and the basis on which they charge them. There should be clear disclosure of all the fees that the manager charges, together with the activities to which they relate.

It is important to analyse and explain fee and cost ratios in their correct context. For instance, the TGER for different vehicles should be compared taking account of historical and forecasted return.

At vehicle launch, investors have a particular interest in understanding its forward-looking or projected operating expenses compared to the amount of invested capital, as well as the potential impact of the cost structure on the overall investment return. Accordingly, INREV supports the principle of including forward-looking expenses in the vehicle’s launch documentation.

The principles and guidelines for reporting fee and expense metrics are listed below. Where appropriate, further explanation is provided to enhance the reader’s understanding. In addition, the Tools and Examples section includes a typical calculation of INREV fee and expense metrics.

For more detailed information on the module updates please check the Revision and Change Procedure section.

add

+

Principles

Comparability - Fees and costs should be consistently categorised, defined and presented, to support investors and managers to compare vehicle performance.

Transparency - There should be clear and appropriate disclosure of the fees and costs charged to the vehicle. Investment managers should also explain the calculation methodology and assumptions used. Communication of all relevant information should be open, accessible and easy to understand.

add

+

Guidelines

add

+

Vehicle documentation for fee and expense metrics framework

Vehicle documentation should include a statement of the level of compliance with this module and of the fee and expense metrics that are expected to be disclosed to investors by the manager.

add

+

Fee and expense metric requirements

Fees and costs should be measured in line with the principles defined under INREV NAV and INREV GAV.

Fees describe charges borne by the vehicle for services provided by the manager and costs describe charges to a vehicle by external service providers. Fees charged by the manager directly to their investors are not taken into account, with the exception of fees charged for services rendered to the vehicle.

Where a single fee is charged to cover a variety of activities, the constituent elements will need to be identified, allocated to the appropriate cost category and disclosed appropriately.

Historic Total Global Expense Ratio

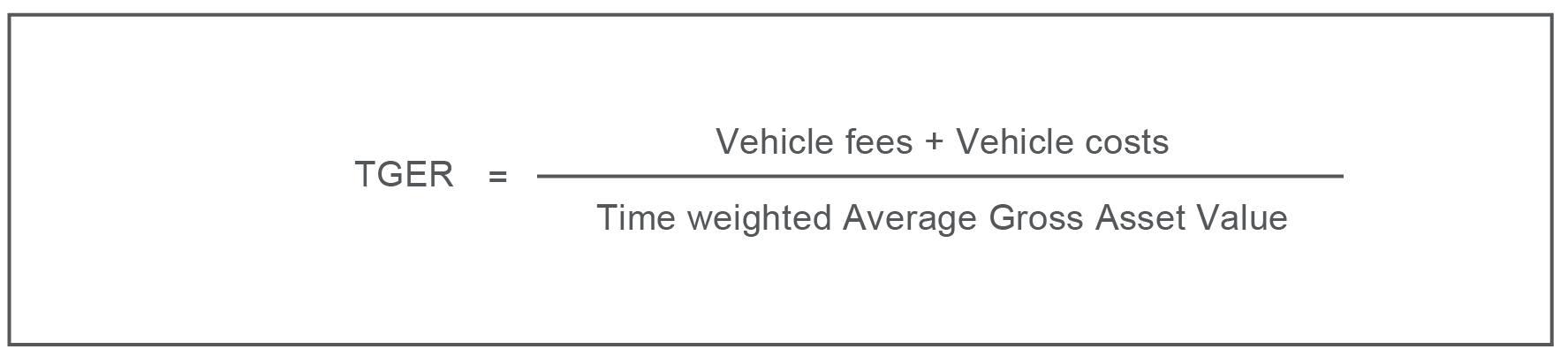

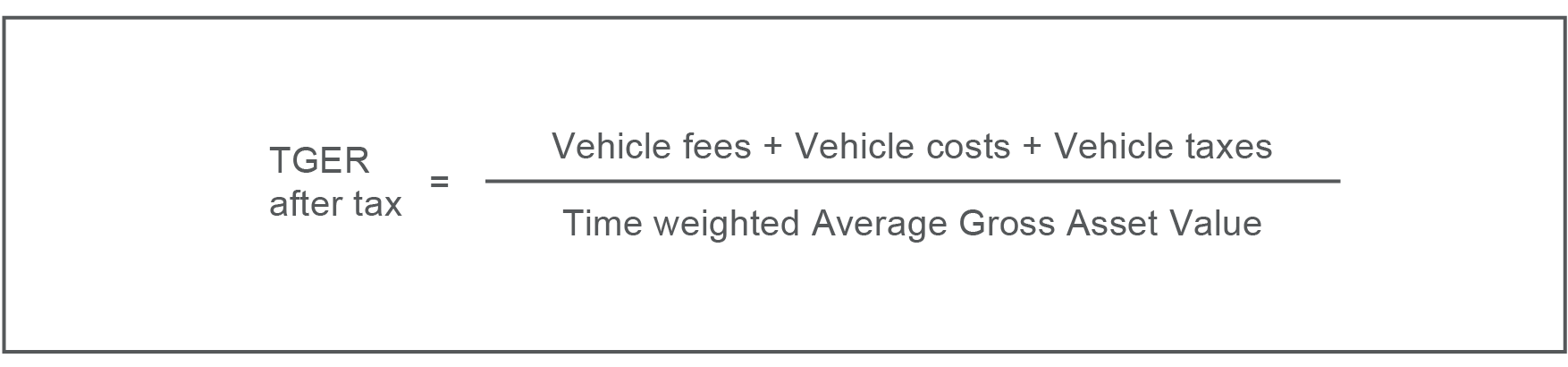

A historic TGER, based on the time-weighted average INREV GAV of the vehicle over twelve months, should be provided annually.

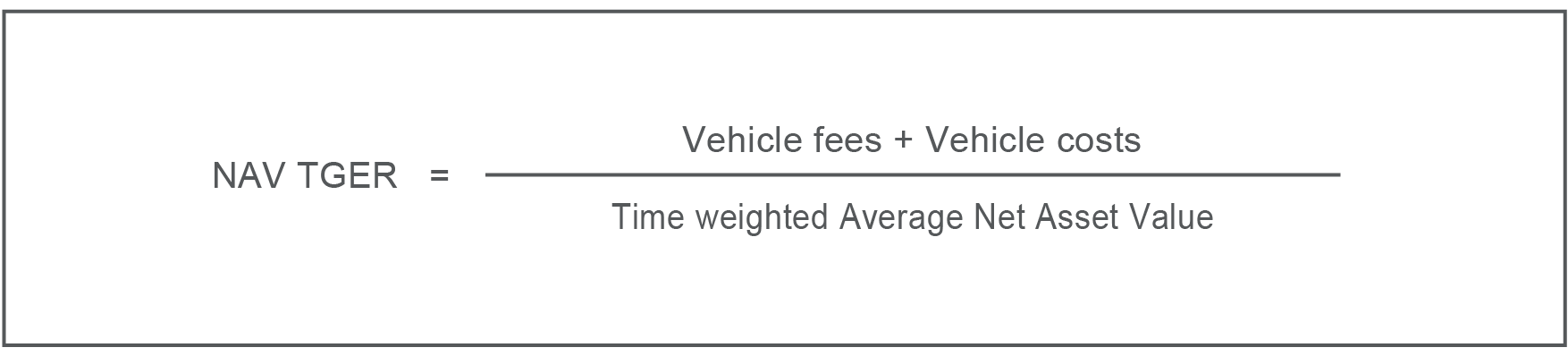

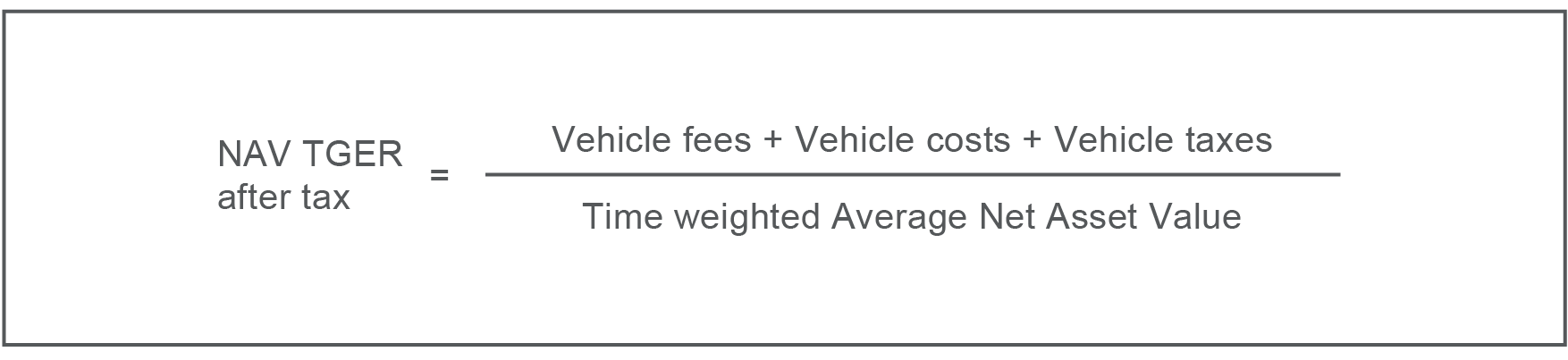

This approach removes the effect of leverage and provides a more relevant comparison between investment vehicles with different capital structures. Depending on the investor needs, investment managers may also provide a historic NAV TGER based on the time-weighted average INREV NAV.

If considered meaningful, managers may compute and disclose TGER on a quarterly basis (annualised), since inception, or on rolling multiple period averages. The approach should be consistent with the fee and cost allocation and computation methodology on an annual basis.

For the calculation methodology, daily weighting of cash flows is recommended. If not feasible, at a minimum, quarterly figures should be used to calculate the time weighted average INREV GAV and INREV NAV.

The components of the numerator include the vehicle fees and costs for the reporting period, as defined below.

Certain fees and costs, such as property-level costs charged by the manager, should not be included when calculating the TGER; they do however form part of the REER (see below). If the manager charges a single fee covering both property and vehicle management activities, it should be split into its constituent elements.

The formulae for TGER are:

The TGER is an historic or ‘actual’ figure, based on data published annually. Consequently, newly launched vehicles cannot have an historic TGER.

Historic Real Estate Expense Ratio

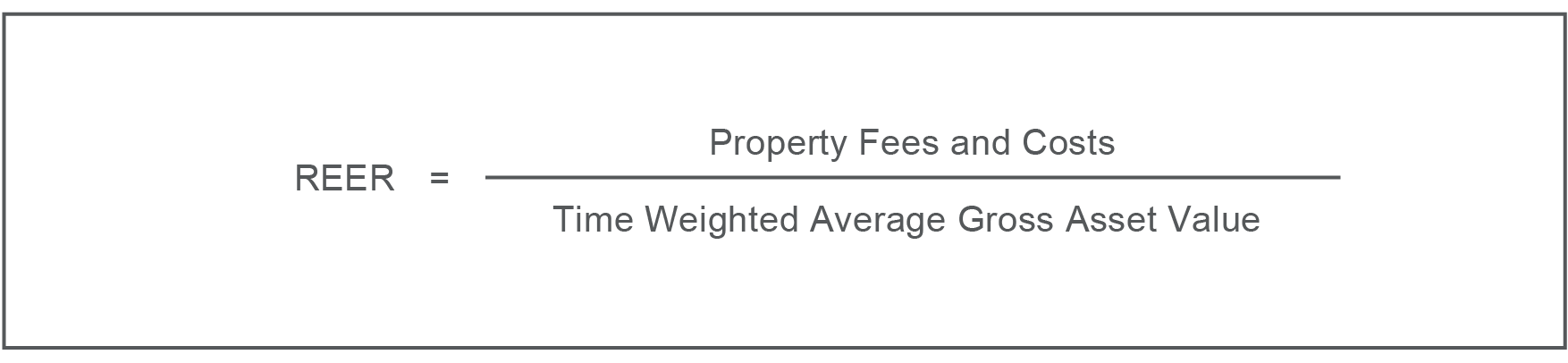

An historic REER, based on the time-weighted average INREV GAV of the vehicle over twelve months, should be disclosed annually.

While the TGER relates to the operating costs borne by the vehicle, the REER captures only those costs that relate to the management of the real estate assets. The REER includes the property-specific costs described below.

The numerator should include the fees and costs associated with managing the properties, while the denominator should be the time-weighted average INREV GAV.

The formula for REER is:

Forward-looking ratios

Forward-looking ratios and metrics are useful items in the vehicle documentation. However, they are ‘theoretical’, in that they are based on estimated costs, anticipated numbers of assets, and assumptions such as growth rate, vehicle life and tax structuring. Requirements for forward-looking fee and expense metrics at the vehicle launch stage are described below. Once the vehicle has commenced operations, there should be no further requirement for forward-looking metrics as historic metrics based on historic data should then be available.

Forward-looking Total Global Expense Ratio

A forward-looking TGER, based on the time-weighted average INREV GAV for the first year when the vehicle is expected to be stabilised, should be provided in the vehicle documentation. A forward-looking NAV TGER based on the time-weighted average INREV NAV may also be provided. These measures should be calculated following the same methodology as for a historic TGER and for NAV TGER, although they will be based on estimates.

The forward-looking TGER and NAV TGER should be accompanied by disclosure of the estimates used to calculate this metric.

Forward-looking real estate expense ratio

A forward-looking REER, based on the time-weighted average INREV GAV of the vehicle for the first year when the vehicle is expected to be stabilised, should be provided in the documentation. This should be calculated following the same methodology as for an historic REER, although it will be based on estimates.

The forward-looking REER should be accompanied by a disclosure of the estimates used to calculate this metric.

add

+

Fee and expense metrics calculation

Expense ratio cost classification

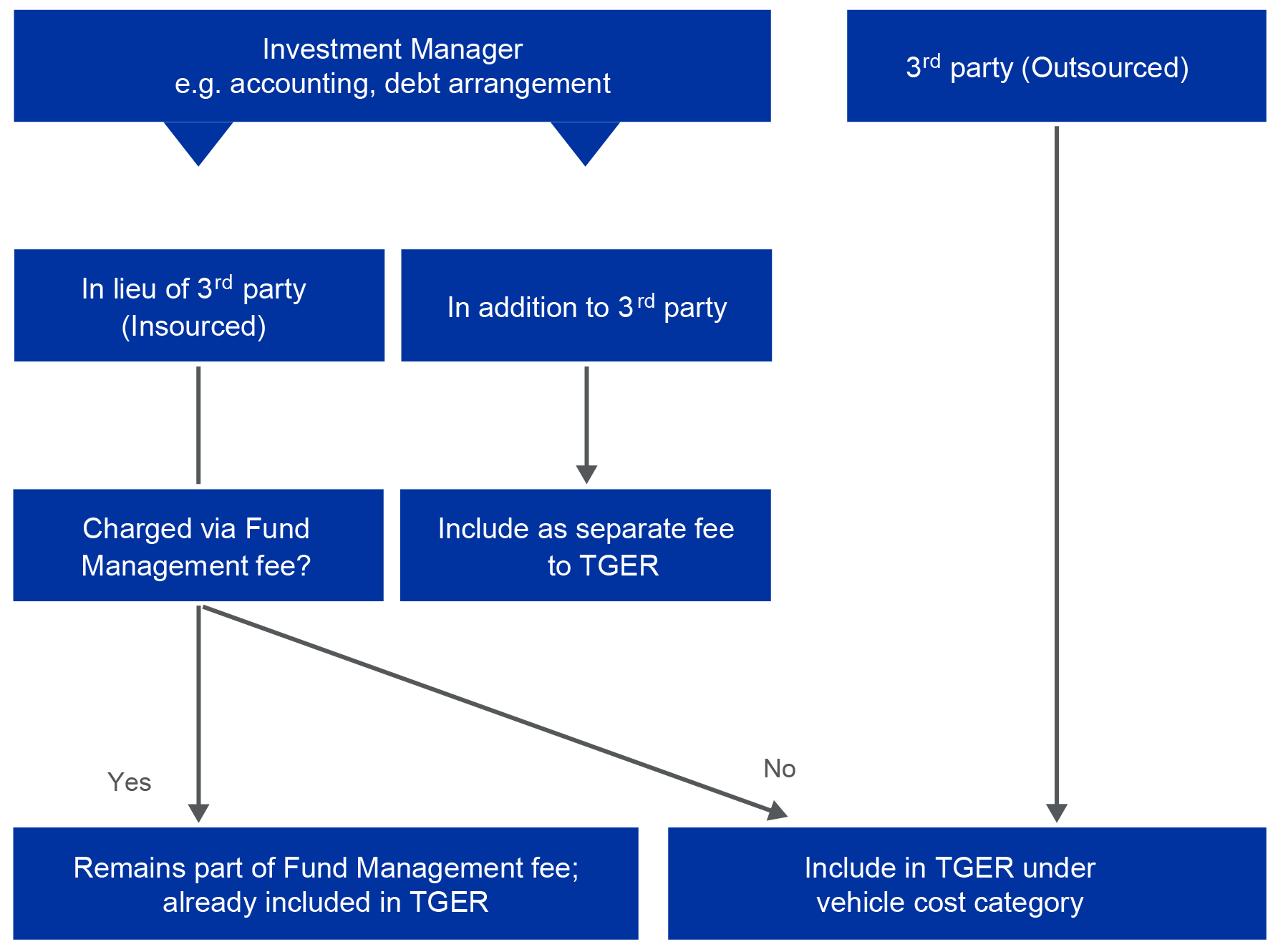

Fees and costs should be classified consistently for the purpose of calculating the INREV fee and expense metrics. Fees and costs included in TGER are categorised according to the respective nature of the underlying services. To the extent that the fee is charged for a service provided by the manager in lieu of a service provided by a third party, and is charged in addition to the fund management fee, or is otherwise disclosed separately from the fund management fee, it should be classified according to the nature of the service rather than whether the service is provided by the investment management or third party.

Vehicle fees included in the TGER comprise of:

A. Ongoing management fees and transaction-based management fees:

- Asset management fees;

- Fund management fees;

- Wind-up fees;

- Debt arrangement fees;

- Commitment fees;

- Subscriptions fees;

- Redemption fees;

- Property acquisition fees amortization for the year;

- Property disposition fees;

- Project management fees.

Where a single fee is charged to cover a variety of activities, the constituent elements will need to be identified, allocated to their appropriate category and disclosed appropriately.

B. Performance fees:

- Performance fees;

- Incentives and promotes;

- Carried interest;

- Other performance fees.

Fee reductions, fee waivers, and transaction offsets recognised in the financial statements of the vehicle, should be disclosed as part of the ongoing investor reporting, and included in TGER. Existence of fee rebates should be disclosed if permitted under the provisions of the vehicle documents. Fee reductions, fee waivers, and transaction offsets not recognised in the financial statements of the vehicle are excluded from the TGER and may be disclosed if permitted.

Vehicle costs:

- Audit costs;

- Bank charges;

- Custodian costs;

- Dead deal costs;

- Debt arrangement costs;

- Other/miscellaneous vehicle costs;

- Professional service costs (incl. valuation costs);

- Vehicle formation costs (amortisation for the period);

- Placement agent costs;

- Staff costs (if applicable);

- Transfer agent costs;

- Vehicle administration costs;

The costs incurred by Special Purpose Vehicles (“SPVs”), which sit above the acquisition structure in the holding structure, are included in vehicle expenses. Costs of this nature that are charged to the acquisition vehicle should also be included in this category.

Property fees included in the REER are directly attributable to the management and the maintenance of specific properties. These fees comprise:

- Asset management fees (certain services not included in the TGER);

- Internal leasing commissions;

- Property management fees;

- Development fees.

Property costs included in the REER are directly attributable to the management and the maintenance of specific properties. These costs comprise:

- External leasing commissions;

- Property acquisition costs (amortisation for the period);

- Other/miscellaneous/sundry costs;

- Property insurance costs;

- Property management costs;

- Repairs and maintenance costs;

- Taxes on property-related activities;

- Utilities costs (non-rechargeable portion).

Fees and costs excluded from the TGER and REER comprise:

- Deferred taxes on property-related activities

- Development costs;

- Disposition costs;

- Fair value adjustments;

- Gain/loss on currency exchange rates;

- Gain/loss on investment disposition;

- Goodwill write-off;

- Impairment of goodwill;

- Losses on disposal of subsidiaries;

- Payments related to financial derivatives;

- Provisions and allowances;

- Receivables write-off costs;

- Rent free/discounts;

- Securities handling charges;

- Share of losses of associates and joint ventures;

- Taxes on real estate transactions;

- Unwinding of discounts and effect of changes in discount rate on provisions.

add

+

Fee and expense metrics disclosures

The constituent elements of the metrics calculations should be disclosed annually.

| Disclosure table | Current year/ period | Prior year/period |

| TGER | ||

| NAV TGER (recommended) | ||

| REER | - |

The following notes clarify the components of each fee and expense metric and should also be read in conjunction with the classifications shown in the fees and costs matrix.

| Constituent elements | Current Year/Period (Amount & Currency) | Prior Year/Period (Amount & Currency) |

|

Ongoing management fees |

||

|

Transaction-based management fees |

||

|

Performance fees |

||

|

Vehicle costs |

||

|

Time-weighted average GAV (required) |

||

|

Time-weighted average NAV (recommended) |

There should also be a clear disclosure of all the fees charged by the manager and the activity to which they relate. A disclosure table should be presented annually providing an analysis of all components of the fees (including any element of performance fee) earned by the manager or by any other affiliate or related party of the manager, for the management of the vehicle.

| Fees earned by the investment manager | Current Year / Period (Amount & Currency) | Prior Year / Period (Amount & Currency) |

| Asset management fees | ||

| Fund management fees | ||

| Performance fees | ||

| Wind-up fees | ||

| Debt arrangement fees | ||

| Commitment fees | ||

| Subscription fees | ||

| Redemption fees | ||

| Property acquisition fees | ||

| Property disposition fees | ||

| Project management fees | ||

| Fees earned by the manager incl. in TGER | ||

| Other fees earned by the manager excl.from TGER |

The fees included in this table should be accounted for in the financial statements for the financial reporting period concerned, in accordance with accounting conventions used by the vehicle.

add

+

Tools and examples

The previous guidelines with the TER is available on INREV-Fee-and-Expense-Metrics-Guidelines-2019_0.pdf">INREV Fee and Expense Metrics Guidelines with TER.

Related Tools & Examples |

Applied Tags |

add

+

Q&A

add

+

How should the INREV GAV be calculated for the Total Global Expense Ratio (TGER) and the Real Estate Expense ratio (REER)?

For the disclosure of the INREV TGER and REER a calculation based on INREV GAV is required.

In using/preparing the INREV TGER and REER the question might arise about which components should be included in calculating the (INREV GAV) denominator of these ratios.

The fund manager should be transparent in its reporting to investors and explain the methodology and assumptions used for the calculation of the GAV, as required by both INREV NAV and Fee and Expense Metrics modules.

The Total Assets derived from Generally Accepted Accounting Principles (GAAP), including IFRS, could be used as a starting point in the calculation of the denominator of the ratios presented in the Fee and Expense Metrics module.

INREV suggests to start from the same accounting framework as it was used in calculating the INREV NAV, i.e., IFRS, local GAAP or other vehicle specific GAAP.

From there, the various adjustments should be included, or excluded, to come to an INREV GAV that can be used in the calculation of the INREV TGER and REER.

In preparing this Q&A the guidance provided to the users should be read in light of the requirements included in the Fee and Expense Metrics module.

It should be noted that the INREV GAV used for the INREV TGER and REER calculation might be different than an adjusted GAV used for performance measurement or other disclosure requirements. Additional adjustments could be included, or excluded, to come to an adjusted GAV to better suit a particular purpose.

The INREV GAV guidance overrides the accounting principles by making adjustments to the results arrived at by following the chosen GAAP.

INREV GAV adjustments require some material judgment by the manager. Consequently, it is important to include sufficient disclosures to allow investors to understand positions taken by the manager.

In this Q&A, direct links will be made to IFRS as a basis for calculating the required adjustments, and if needed, to other fair value concepts. If another basis of GAAP is used as a starting point, further adjustments may be required to align with IFRS for determining the INREV GAV. References to further guidance by INREV on the interpretation of fair value and provision accounting are also included.

For the use of calculating the INREV TGER and REER, a vehicle GAV calculated in accordance with IFRS should be adjusted for the following items:

INREV GAV adjustment table:

| Total | |

| GAV per the IFRS financial statements (Total Assets) | x |

| Fair value of assets | |

| a) Revaluation to fair value of investment properties | x/(x) |

| b) Revaluation to fair value of self-constructed or developed investment property | x/(x) |

| c) Revaluation to fair value of investment property held for sale | x/(x) |

| d) Revaluation to fair value of property that is leased to tenants under a finance lease | x/(x) |

| e) Revaluation to fair value of real estate held as inventory | x/(x) |

| f) Revaluation to fair value of other investments in real assets | x/(x) |

| g) Recognition to fair value of indirect investments not consolidated | x/(x) |

| h) Revaluation to fair value of financial assets | x/(x) |

| i) Revaluation to fair value of construction contracts for third parties | x/(x) |

| j) Set-up costs | x/(x) |

| k) Acquisition expenses | x/(x) |

| Effects of the expected manner of settlement of sales/vehicle unwinding | |

| l) Revaluation to fair value of savings of purchaser’s costs such as transfer taxes | x/(x) |

| Other adjustments | |

| m) Goodwill | x(x) |

| n) Derecognition of financial derivatives | x/(x) |

| o) Derecognition of deferred tax assets | x/(x) |

| INREV GAV | x |

Fair value of assets

a) Revaluation to fair value of investment properties

If a real estate vehicle uses the option to account for investment properties under the cost model, this adjustment represents the impact on GAV of the revaluation of the investment property to fair value under the fair value option of IAS 40.

The effect of straight-lining of lease incentives, rent guarantees, insurance claims (for damages, lost rent, etc.) should be taken into account when valuing the property at fair value in accordance with IAS 40 and SIC 15 to ensure that any asset is not double counted in the GAV.

b) Revaluation to fair value of self-constructed or developed investment property

If a real estate vehicle uses the option to account for self-constructed or developed investment property under the cost model, the adjustment represents the impact on GAV of the revaluation of the self-constructed or developed investment property to fair value under the fair value option of IAS 40.

c) Revaluation to fair value of investment property held for sale

Some investment properties may be classified as assets held for sale or as a group of assets held for sale. The carrying value of such investment properties depends on the chosen accounting treatment under IAS 40 (either fair value or cost).

The adjustment represents the impact on GAV of the revaluation of the investment property intended for sale, measured at fair value or cost, to the net realisable value (fair value less disposition costs).

d) Revaluation to fair value of property that is leased to tenants under a finance lease

Property that is leased to tenants under a finance lease is initially measured on a net investment basis and subsequently re-measured based on an amortisation pattern reflecting a constant rate of return.

The adjustment represents the impact on GAV of the revaluation of the finance lease receivable to fair value.

e) Revaluation to fair value of real estate held as inventory

Properties intended for sale and accounted for under IAS 2 (Inventory) are measured at the lower of cost or net realisable value in the financial statements. This adjustment represents the impact on the GAV of the revaluation of such properties to net realizable value (fair value less disposition costs). This adjustment should be included under the caption ‘revaluation to fair value of real estate held as inventory’.

Where the likely disposition date is more than one year from the date of the GAV computation, disposition costs should not be deducted from fair value in calculating this adjustment..

f) Revaluation to fair value of other investments in real assets

Under IAS16 other investments in real assets are normally accounted for at cost.

The adjustment represents the impact on GAV of the revaluation of other investments in real assets to fair value in accordance with the fair value assumptions under IFRS 13.

g) Recognition to fair value of indirect investments not consolidated

Indirect investments in real estate, such as investments in associations and Joint Venture ">joint ventures, have different accounting treatments and carrying values under IFRS. Such investments can be valued at cost, fair value or NAV.

The adjustment represents the impact on GAV of the recognition of indirect investments not consolidated and depending on the type of investment at fair value.

Under this adjustment, two situations can be identified:

1. Investments for which fees and costs are proportionally taken into consideration in the calculation of the fee and expense metrics

The adjustment represents the impact on GAV when including the proportional GAV of the associations and joint ventures based on the share that the vehicle holds.

In this case, all assets should be included proportionally for the share that the vehicle holds in the assets of the associations or joint venture. These assets should be valued in accordance with the guidance provided herein. All corrections should be taken into consideration and should be reflected, as applicable, when calculating the INREV GAV for the purpose of preparing the INREV TGER and REER.

2. Investments for which fees and costs are not taken into consideration in the calculation of the fee and expense metrics

The adjustment represents the impact on GAV of the revaluation of indirect investments to fair value, if not yet accounted for at fair value. Reference is made to the INREV NAV guidelines, and more specifically to Q&A-4 of the INREV NAV module.

h) Revaluation to fair value of financial assets

Financial assets are generally measured at amortised cost, taking into account any impairments (when applicable). The adjustment represents the impact on GAV of the revaluation of financial assets to fair value, as determined in accordance with IFRS, if not yet accounted for at fair value.

i) Revaluation to fair value of construction contracts for third parties

Under IAS11, construction contracts for third parties are normally accounted for based on the stage of completion.

The adjustment represents the impact on GAV of the revaluation of construction contracts for third parties to fair value in accordance with the fair value principles of IFRS 13.

Adjustments to reflect the spreading of one-off costs

As described in further detail below, set-up costs and acquisition expenses should be capitalised and amortised. The rationale for these adjustments is to spread these costs over a defined period of time to smoothen the immediate impact of costs on the vehicle’s performance. Furthermore, it is a simple mechanism to spread costs between different investor groups entering or leaving the vehicle’s equity at different times. Such adjustments are taken into account in the calculation of the ratio numerator included in the Fee and Expense Metrics module.

Since the INREV GAV is primarily intended to facilitate comparability between different vehicles, the INREV approach is a simple but stable methodology where these capitalised costs are subject to an impairment test each time the GAV is calculated and therefore should always be recoverable over time.

j) Set-up costs

Under IFRS, vehicle set-up costs are charged immediately to income after the inception of a vehicle. Such costs should be capitalised and amortised over the first five years of the term of the vehicle.

The rationale for capitalising and amortising set-up costs is to better reflect the duration of the economic benefits to the vehicle. Furthermore these costs are taken into account in the calculation of the ratio numerator included in the Fee and Expense Metrics module.

When capitalising and amortising set-up costs, a possible impairment test should be taken into account every time the adjusted GAV is calculated when market circumstances change and it is not expected that the capitalised set-up costs can be recovered through the sale of units of a vehicle. For instance, when a decision is made to liquidate the vehicle or stakeholders no longer expect to recover the economic benefit of such capitalised expenses, they should be written off.

k) Acquisition expenses

Under the fair value model, acquisition expenses of an investment property are effectively charged to income when fair value is calculated at the first subsequent measurement date after acquisition. This results in the fair value of a property on subsequent fair value measurement being lower than the total purchase price of the property, all other things being equal.

Property acquisition expenses should be capitalised and amortised over the first five years after acquisition of the property.

The rationale for capitalising and amortising acquisition expenses is to better reflect the duration of the economic benefits to the vehicle of these costs. Furthermore these cost are taken into account in the calculation of the ratio numerator included in the Fee and Expense Metrics module. When capitalising and amortising acquisition costs, a possible impairment test should be taken into account each time the adjusted GAV is calculated when market circumstances change and it is not expected that the capitalised acquisition costs can be recovered through the sale of units of a vehicle. When a property is sold during the amortisation period, or is classified as held for sale, the balance of capitalised acquisition expenses of that property should be expensed.

Effects of the expected manner of settlement of sales/vehicle unwinding

l) Revaluation to fair value of savings of purchaser’s costs such as transfer taxes

Transfer taxes and purchaser’s costs which would be incurred by the purchaser when acquiring a property are generally deducted when determining the fair value of investment properties under IAS 40.

The effect of an intended sale of shares in a property-owning vehicle, rather than the property itself, should be taken into account when determining the amount of the deduction of transfer taxes and purchaser’s costs, to the extent this saving is expected to accrue to the seller when the property is sold.

The adjustment therefore represents the positive impact on the GAV of the possible reduction of the transfer taxes and purchaser’s costs for the benefit of the seller based on the expected sale of shares in the property-owning vehicle.

Disclosure should be made on how the estimate of the amount the manager expects to benefit from intended disposition strategies has been made. Reference should be made to both the current structure and prevailing market conditions.

Other adjustments

m) Goodwill

At acquisition of an entity which is determined to be a business combination, goodwill may arise as a result of a purchase price allocation exercise. Often a major component of such goodwill in property vehicles reflects the difference between the full recognition of deferred tax, purchaser’s costs or similar items in the IFRS accounts (which does not generally take account of the likely or intended method of subsequent exit), and the economic value attributed to such items in the actual purchase price.

Except where such components of goodwill have already been written off in the GAV as determined under IFRS, they should be written off in the INREV GAV.

n) Financial derivatives

This adjustment relates to the derecognition of any financial derivatives which are reported on the asset side of the balance sheet.

This relates to all financial derivatives as interest instruments, cash flow instruments and or currency exchange instruments. The rationale is that all the expenses/charges in respect to these instruments are linked to a liability or exempted for the calculation of the ratio numerator included in the Fee and Expense Metrics module.

o) Deferred tax assets

This adjustment relates to the derecognition of any deferred tax assets which are reported on the asset side of the balance sheet. The rationale is that all the expenses/charges in respect to taxes are linked to a liability or exempted for the calculation of the ratio numerator included in the Fee and Expense Metrics module.

add

+

How should staff costs be allocated to the TGER and the REER?

It may happen that some vehicles have hired employees. Related staff costs should be allocated based on the activity of the employees.

For instance, the wage and related costs of employees working on property related matters should be allocated to property expenses and therefore included in the REER.

add

+

Determination and disclosure of quarterly ratios

How should fee and expense metrics be determined in case a fund manager wishes to disclose quarterly ratios?

INREV Guidelines require the computation of the fee and expense metrics on an annual basis. Fund managers may provide investors with quarterly ratios. INREV Guidelines do not propose any methodology to compute quarterly ratios.

Fund managers can indeed disclose quarterly fee and expense metrics to investors. The methodology should be consistent with the methodology used for the fee and expense metrics in the annual reports, particularly on the cost classification and computation methodology.

The quarterly metrics should be presented on a rolling four quarter basis.

The fund manager should be transparent in its reporting to investors and explain the methodology and assumptions used.

In case a fund manager discloses quarterly ratios, the fund manager is still required to disclose the annual metrics in the annual reporting to comply with requirements included in the fee and expense metrics.

add

+

How do you determine if a service is in lieu of or in addition to third party costs?

Generally, when a function and its related services is frequently outsourced to third parties and the vehicle designates the investment manager to perform this function internally, then the services provided by the investment manager are deemed to be in lieu of third-party services. Conversely, when there is already a charge from a third-party for services related to a specific function, and due to task complexity, the investment manager provides oversight or performs other complementary services for the benefit of the vehicle, then these services provided by the investment manager are deemed to be in addition to third party services.

add

+

Can TGER including tax be calculated and presented to investors?

If considered meaningful, a TGER after tax may be also calculated and disclosed by the investment manager to reflect the cost associated with tax structures and taxable income.

The formulae are presented below:

Vehicle taxes included in the TGER after tax comprise:

- Corporation tax;

- Income tax;

- Non-resident landlord tax;

- Other taxes based on gross profit;

- Net wealth tax;

- Deferred tax;

- VAT or other sales tax (only recoverable portion);

- Withholding tax;

- Capital gain taxes;

- (Transfer) taxes on real estate transactions.

add

+

What are the main differences between TGER and TER? Do I need to convert previously reported TERs?

TGER represents a natural progression from the previously reported INREV TER and includes several additional fees. A mapping of TER to TGER is summarised below, including its main components.

Conversion of previously reported TERs is not necessarily. The numerator of TGER bears much similarity to the TER. It is important to note however that historical comparisons depend on the life cycle and activity of the vehicle and should be treated with caution.

| Allocation of main fees and costs from TER to TGER | Workings |

| Asset and fund management fees | |

| Performance fees | |

| Other fees earned by manager | |

| Total vehicle fees for TER | A |

| Audit, valuation, custodian, transfer agent and other admin costs | |

| Vehicle formation costs and dead deal costs | |

| Bank charges and other professional service costs | |

| Total vehicle costs for TER | B |

| Adjustments for TGER | |

| Property acquisition and disposition fees | |

| Project management fees | |

| Debt arrangement fees and costs | |

| Fee and costs adjustments for TGER | C |

| Vehicle taxes (optional, for after-tax TGER calculation) | |

| Vehicle tax adjustments for TGER | D |

| Time-weighted average GAV | E |

| Time-weighted average NAV | F |

| Required ratio: TGER | (A+B+C)/E |

| Recommended ratio: NAV TGER | (A+B+C)/F |

| Optional ratio: (NAV)/TGER after tax | (A+B+C+D)/E or(F) |

add

+

Should TGER be compared against expense metrics of listed structures / public market vehicles?

TGER was designed to consider all relevant elements of a non-listed real estate vehicle load – including both fees and costs. Care should be taken to ensure an “apples to apples” comparison of similar measures disclosed for public markets / listed real estate investments as several adjustments may be required in case of listed structures, e.g. overhead expenses may be structured differently.

add

+

How should Asset Management fees be allocated to TGER?

Certain services under the Asset Management fee are not included in the TGER as they are directly attributable to the building and thus still part of the REER. These may include managing of capex, management of leases, refurbishment design, management of construction progress, etc. The investment manager should use best judgement to split its asset management fee services between what is directly attributable to the building and the vehicle management activities, e.g. strategic input, production of asset level business plan.

add

+

Should TGER be presented for financial reporting periods ending on or after 31 December 2020? Can the INREV TER still be disclosed?

The reporting periods for compliance with TGER are presented in the table below. TGER disclosures will be required for reporting periods ending on or after 31 December 2020. Whilst the TER remains an optional disclosure for investment managers beyond this date, its disclosure will cease to form part of INREV Adoption and Compliance Framework from reporting periods ending on or after 31 December 2020. Nevertheless, next to TGER, managers may choose to continue calculating and disclosing a TER figure on a temporary basis if considered meaningful for historical comparison.

|

INREV expense ratio reporting period |

Period/Year ended 31 Dec 2020 |

Fiscal year ended 31 Mar 2021 |

Fiscal year ended 30 Jun 2021 |

Fiscal year ended 30 Sep 2021 |

Period/Year ended 31 Dec 2021 |

|---|---|---|---|---|---|

| TGER | Required | Required | Required | Required | Required |

| TER | Optional | Optional | Optional | Optional | Optional |

In addition, managers have the option to also compute and disclose TGER on a quarterly basis (annualised), starting with Q4 2020 reporting periods. The approach should be consistent with the fee and cost allocation and computation methodology on an annual basis.

add

+

Treatment of Debt arrangement fees and costs

For the Total Global Expense Ratio (TGER), vehicle expenses are classified into Vehicle Fees and Vehicle Costs. As a result, the Debt Arrangement Fees charged by the investment manager for services rendered in arranging debt financing are allocated to the Vehicle Fees category. The Debt Arrangement Costs paid to a lender, broker, or other third party are allocated to the Vehicle Costs category.

As indicated in the INREV NAV and the INREV GAV Q&As, all debt arrangement fees and costs are accounted for at amortised cost and these costs are then charged via amortisation to Profit and Loss over the term of the loan.

A parallel should also be made to the Property Acquisition Fee and the Property Acquisition Cost, as their amortisation for the period/year is included in the calculation of TGER.

It follows that for both Debt Arrangement Fees and Costs, the amortisation for the period/year should be included in the calculation of TGER.