add

+

Tools and Examples

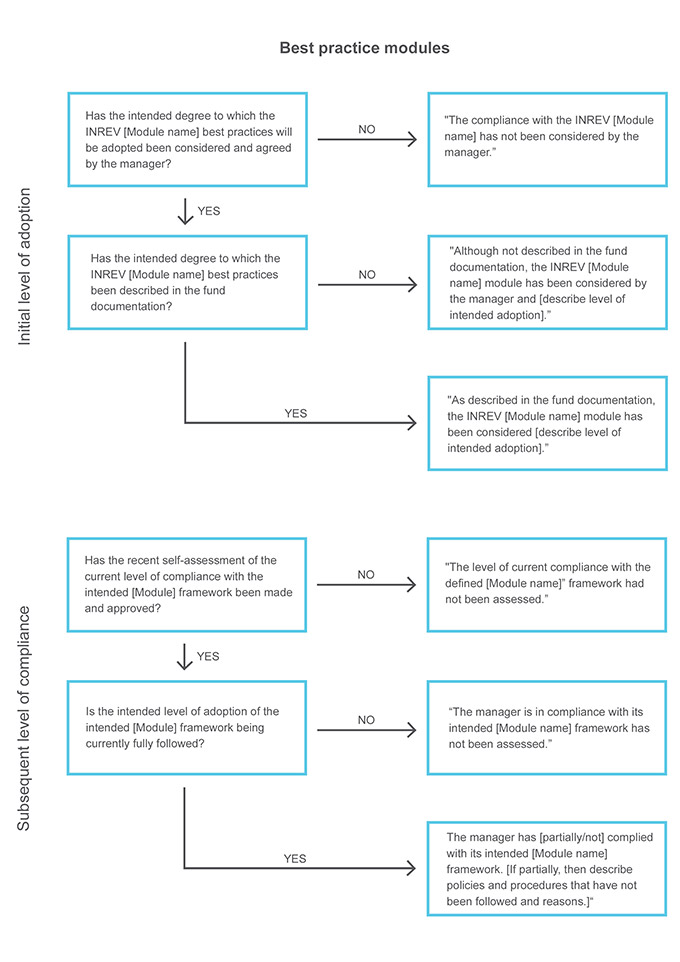

Example - Statement of level of adoption of INREV Guidelines

Management has assessed the degree to which the best practices of INREV’s governance, property valuation, liquidity, tax conduct and sustainability frameworks have been adopted and followed by the vehicle. In addition, Management has assessed the level of compliance with INREV’s reporting, sustainability reporting, performance measurement, INREV NAV and fee and expense metrics frameworks. The results of such assessment are summarised below:

| MODULE | GUIDELINES | LEVEL OF ADOPTION OR COMPLIANCE |

|---|---|---|

| 1 | Governance | Although not described in the vehicle documentation, the INREV Governance module has been considered by the manager. The intended framework partially complies with the INREV governance best practices. All best practices have been adopted except for the fact that investors are not able to terminate the contract of the manager without cause. The vehicle formally assessed at the end of the financial year that it is currently following its intended governance framework. |

| 2 | Reporting | Although not detailed in the vehicle documentation, the INREV reporting module has been considered by the manager. The manager has complied with all the requirements of the INREV reporting module. |

| 2.1 | Sustainability Reporting | Although not detailed in the vehicle documentation, the INREV sustainability reporting requirements have been considered by the manager. The results of the INREV Guidelines assessment show that the manager has complied with all the requirements of the INREV sustainability reporting guidelines. |

| 3 | Property valuation | As described in the vehicle documentation, the INREV property valuation framework module has been considered. The manager has defined a valuation framework which fully adopts INREV valuation best practices. The level of current compliance with the defined valuation framework was last formally assessed during the financial year when it was determined that the vehicle was in compliance with all elements of the intended valuation framework. |

| 4 | Performance Measurement |

The manager has disclosed all relevant INREV performance measures in accordance with the requirements of the INREV Performance Measurement module. |

| 5 | INREV NAV | The manager has complied with all the requirements of the INREV NAV module, except for the fact that assumptions used to determine the fair value of deferred taxes are not fully disclosed for confidentiality reasons. |

| 6 | Fee and expense metrics | As described in the vehicle documentation, the INREV fee and expense metrics framework module has been considered The manager has fully complied with the requirements and recommendations of the INREV fee and expense metrics module. |

| 7 | Liquidity | As described in the vehicle documentation, the INREV liquidity framework module has been considered. The manager has defined a liquidity framework which fully adopts INREV liquidity best practices. The manager formally assessed in at the end of the financial year that it currently follows the defined liquidity framework. |

| 8 | INREV data delivery |

The manager is in compliance with the INREV data delivery module. |

| 9 | Code of Tax Conduct | Although not described in the vehicle documentation, the INREV Code of Tax Conduct module has been considered by the manager. The intended framework complies with the INREV Code of Tax Conduct best practices. All best practices have been adopted. The vehicle formally assessed at the end of the financial year that it is currently following its intended Code of Tax Conduct framework. |

| 10 | Sustainability | Although not detailed in the vehicle documentation, the INREV sustainability framework module has been considered by the manager. The intended framework partially complies with the INREV sustainability best practices. All best practices have been adopted except for the fact that the manager has not built a process to manage ESG impact in its supply chain. The manager formally assessed in at the end of the financial year that it currently follows its intended sustainability framework. |

As described in the vehicle documentation the results of the INREV Guidelines Assessments should be disclosed in investor reporting.

Extract "INREV Guidelines Compliance Statement" from results page of the INREV Guidelines Assessments.

Copy + paste the following example statement into your annual and interim reports

INREV Guidelines Compliance Statement - Example purposes only

The European Association for Investors in Non-Listed Real Estate Vehicles (INREV) published the revised INREV Guidelines incorporating industry standards in the fields of Governance, Reporting, Property Valuation, Performance Measurement, INREV NAV, Fees and Expense Metrics, Liquidity and Sustainability. The Assessments follow these guidelines.

INREV provides an Assessment Tool to determine a vehicle's compliance rate with the INREV Guidelines as a whole and its modules in particular.

THE OVERALL INREV GUIDELINES COMPLIANCE RATE OF THE EXAMPLE VEHICLE IS 92.75%, BASED ON 9 OUT OF 9 ASSESSMENTS

The compliance rate for each completed module is:

- Reporting Guidelines is 92.53%, based on 211 / 252 questions applicable.

- Property Valuation Guidelines is 94.35%, based on 48 / 54 questions applicable.

- INREV NAV Guidelines is 97.5%, based on 30 / 42 questions applicable.

- Liquidity Guidelines is 93.67%, based on 31 / 39 questions applicable.

- Sustainability Guidelines is 88.34%, based on 20 / 22 questions applicable.

- Governance Guidelines is 97.44%, based on 84 / 100 questions applicable.

- Fee and Expense Metrics Guidelines is 96.35%, based on 10 / 15 questions applicable.

- Performance Measurement Guidelines is 88.35%, based on 38 / 42 questions applicable.

- Code of Tax Conduct Guidelines is 89.5%, based on 30 / 41 questions applicable.