add

+

Introduction to the Code of Tax Conduct

What does it cover?

The Code of Tax Conduct comprises a set of tax-related best practices designed to be applied across the lifecycle of a real estate investment vehicle. It aims to achieve a shared vision on tax matters for the non-listed real estate investment industry and thereby to help INREV members address tax matters internally within their organisations and externally with regard to others’ expectations and interests.

Effective date

For vehicles to be compliant with these guidelines a transition period was put in place. The module is effective for reporting periods ending on or after 31 December 2022.

How do you comply?

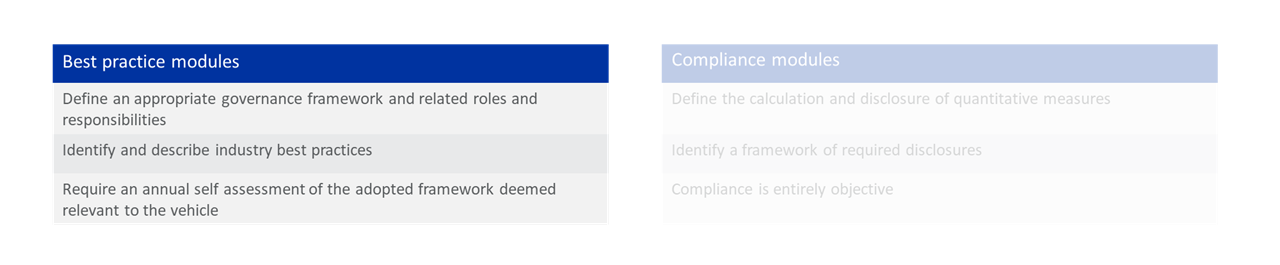

The Code of Tax Conduct module is a best practice module:

Read more at INREV Adoption and Compliance Framework.

The INREV Code of Tax Conduct provides recommendations and best practices regarding tax related matters. This Code of Tax Conduct reflects an effort by INREV, together with industry specialists, to reconcile key tax standards in a set of recommendations and best practices intended to achieve a shared vision on tax matters for the non-listed real estate investment industry.

The Code was developed for the benefit of our members and other interested parties (hereafter referred to as “INREV Members”), including but not limited to non-listed real estate investment funds and vehicles, investment managers, investors and promoters, and is designed to be applied across the lifecycle of a non-listed real estate investment fund strategy.

With its recommendations and best practices, the Code of Tax Conduct aims to help INREV Members address certain tax matters internally within their organisations and externally with regard to others’ expectations and interests. These recommendations are voluntary and in case of inconsistency international, EU and domestic tax laws will necessarily prevail and override these recommendations.

As we enter a new era in international taxation, major changes in the international tax landscape are being (or have already been) implemented around the world. The main drivers for change in the past years are a new global tax environment based on a more coherent harmonisation structure, enhanced co-operation and increased transparency in tax matters. Tax is furthermore being influenced by sustainable development, including the UN Sustainable Development Goals and the EU Sustainable Finance Action Plan .

These changes also affect the non-listed real estate fund industry and have prompted new behaviours and attitudes towards tax matters in general. Contributing to a common framework for a more responsible approach to tax may better align INREV Members with broader objectives of society and support the achievement of the UN Sustainable Development Goals.

To take into account the many changes impacting tax, we recommend INREV Members reevaluate their tax approach in their own organisations and their real estate investment strategies, thereby realigning with changing expectations of stakeholders. The approach to tax can be laid down in a tax policy which takes into account the Guiding Principles of this Code of Tax Conduct. When drafting a tax policy, guidance can among others also be found in the following international guidelines and tax standards:

- The UN Investors' Recommendations on Corporate Tax Disclosure;

- OECD's Guidelines for multinational enterprises;

- OECD's Building Better Tax Control Framework; and

- The sustainability reporting standard on tax, GRI 207: Tax 2019.

The tax governance and risk management responsibility is recommended to support and contribute to the implementation of international and EU standards on AML-CFT.

Consistent with industry standards, INREV has published Guidelines on Sustainability Reporting that aim to provide a coherent framework for ESG reporting in line with annual financial reporting and present a clear picture from the vehicle’s strategy through to environmental key performance indicators. As tax is part of corporate governance, this Code of Tax Conduct is aligned with our Corporate Governance Guidelines as well as Guidelines on Sustainability Reporting.